QATAR LNG FOR GERMANY

PLATTS - 29 Nov 2022 - QatarEnergy signed Nov. 29 two long-term agreements with the US' ConocoPhillips for the supply of LNG into the planned German terminal at Brunsbuttel, with the first shipment expected in 2026.

Under the new deals, Germany will be supplied with up to 2 million mt of LNG for a period of at least 15 years, QatarEnergy said in a statement.

The LNG will be supplied on a DES basis from Qatar's major North Field East and North Field South expansion projects in which ConocoPhillips is a partner.

Qatar's energy minister Saad al-Kaabi said the agreements were "momentous" for a number of reasons.

"They mark the first ever long-term LNG supply to Germany with a supply period that extends for at least 15 years, thus contributing to Germany's long-term energy security," he said.

He added that the agreements represented the culmination of efforts between QatarEnergy and ConocoPhillips to provide "reliable and credible LNG supply solutions."

ConocoPhillips holds a 3.125% share in the North Field East project and a 6.25% share in the North Field South project, which are planned to start up in 2026 and 2027, respectively.

ConocoPhillips CEO Ryan Lance said the agreements provided an "attractive LNG offtake solution for our new joint ventures with QatarEnergy and position the joint ventures as reliable sources of LNG supply into Europe."

Qatar, one of the world's largest LNG exporters, has been courted by European countries, including Germany and the UK, in recent months as they seek improved gas supply security amid stubbornly high prices.

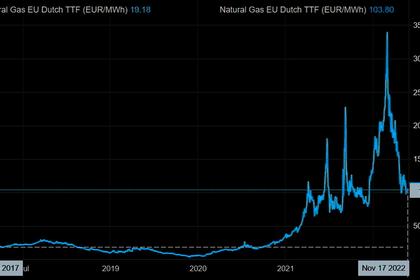

Platts, part of S&P Global Commodity Insights, assessed the Dutch TTF month-ahead price at Eur123.30/MWh on Nov. 28, down from an all-time high of Eur319.98/MWh on Aug. 24, but still well above the Eur65/MWh seen at the end of 2021.

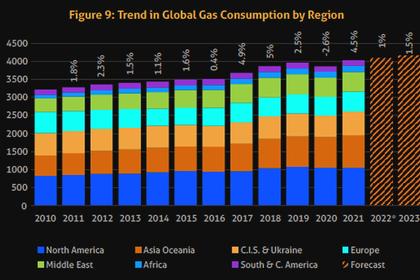

Qatar's biggest market for LNG has traditionally been Asia, which takes about 80% of the Gulf country's total exports, but Europe has been looking for more LNG supply after Russia sharply reduced pipeline deliveries through 2022.

Kaabi said previously he expected Qatar to supply 15 million mt of LNG to Europe this year and 12 million-15 million mt/year consistently in the coming years.

Qatar's LNG exports are set to increase 64% via the two-phase North Field expansion project, raising capacity from 77 million mt/year to 126 million mt/year through 2027.

German LNG

Germany has been looking to lock in an LNG supply deal with Qatar after Russia's invasion of Ukraine with Berlin and Doha agreeing in May to develop bilateral LNG trade relations as part of a joint declaration of intent on energy cooperation.

However, the declaration did not lead to any immediate long-term supply deal, with the duration of any contract seen as a stumbling block.

With a deal of at least 15 years, however, there is a commitment from ConocoPhillips to import LNG into Germany until at least 2041 despite Berlin having set a net-zero target of 2045.

Qatar had also reportedly sought guarantees that any LNG supply would not be diverted to other markets.

ConocoPhillips was one of three companies that have agreed to take long-term capacity at the planned 8 Bcm/year Brunsbuttel LNG terminal alongside chemicals giant Ineos and German utility RWE.

The operator of the planned facility, German LNG Terminal GmbH (GLNG), said last month that the three companies would be foundation customers of the terminal, but did not detail the capacities booked by each company.

The permanent Brunsbuttel terminal is expected to begin operations in 2026 -- although efforts are underway to accelerate the start-up -- and its capacity could be expanded to at least 10 Bcm/year.

Ahead of the startup of the permanent facility, an FSRU is set to be commissioned at Brunsbuttel by the end of 2022.

Planned terminals

Germany has no LNG import infrastructure at present, but since the Russian invasion of Ukraine in February, Berlin has accelerated work to deploy FSRUs alongside the existing plans to build onshore facilities.

It is developing a total of five state-backed FSRUs, with an initial focus on bringing the Brunsbuttel and Wilhelmshaven FSRUs online by the turn of the year.

A sixth, privately backed FSRU project is also under development by Deutsche ReGas, which is expected to be technically ready next month.

QatarEnergy signed Nov. 29 two long-term agreements with the US' ConocoPhillips for the supply of LNG into the planned German terminal at Brunsbuttel, with the first shipment expected in 2026.

Under the new deals, Germany will be supplied with up to 2 million mt of LNG for a period of at least 15 years, QatarEnergy said in a statement.

The LNG will be supplied on a DES basis from Qatar's major North Field East and North Field South expansion projects in which ConocoPhillips is a partner.

Qatar's energy minister Saad al-Kaabi said the agreements were "momentous" for a number of reasons.

"They mark the first ever long-term LNG supply to Germany with a supply period that extends for at least 15 years, thus contributing to Germany's long-term energy security," he said.

He added that the agreements represented the culmination of efforts between QatarEnergy and ConocoPhillips to provide "reliable and credible LNG supply solutions."

ConocoPhillips holds a 3.125% share in the North Field East project and a 6.25% share in the North Field South project, which are planned to start up in 2026 and 2027, respectively.

ConocoPhillips CEO Ryan Lance said the agreements provided an "attractive LNG offtake solution for our new joint ventures with QatarEnergy and position the joint ventures as reliable sources of LNG supply into Europe."

Qatar, one of the world's largest LNG exporters, has been courted by European countries, including Germany and the UK, in recent months as they seek improved gas supply security amid stubbornly high prices.

Platts, part of S&P Global Commodity Insights, assessed the Dutch TTF month-ahead price at Eur123.30/MWh on Nov. 28, down from an all-time high of Eur319.98/MWh on Aug. 24, but still well above the Eur65/MWh seen at the end of 2021.

Qatar's biggest market for LNG has traditionally been Asia, which takes about 80% of the Gulf country's total exports, but Europe has been looking for more LNG supply after Russia sharply reduced pipeline deliveries through 2022.

Kaabi said previously he expected Qatar to supply 15 million mt of LNG to Europe this year and 12 million-15 million mt/year consistently in the coming years.

Qatar's LNG exports are set to increase 64% via the two-phase North Field expansion project, raising capacity from 77 million mt/year to 126 million mt/year through 2027.

German LNG

Germany has been looking to lock in an LNG supply deal with Qatar after Russia's invasion of Ukraine with Berlin and Doha agreeing in May to develop bilateral LNG trade relations as part of a joint declaration of intent on energy cooperation.

However, the declaration did not lead to any immediate long-term supply deal, with the duration of any contract seen as a stumbling block.

With a deal of at least 15 years, however, there is a commitment from ConocoPhillips to import LNG into Germany until at least 2041 despite Berlin having set a net-zero target of 2045.

Qatar had also reportedly sought guarantees that any LNG supply would not be diverted to other markets.

ConocoPhillips was one of three companies that have agreed to take long-term capacity at the planned 8 Bcm/year Brunsbuttel LNG terminal alongside chemicals giant Ineos and German utility RWE.

The operator of the planned facility, German LNG Terminal GmbH (GLNG), said last month that the three companies would be foundation customers of the terminal, but did not detail the capacities booked by each company.

The permanent Brunsbuttel terminal is expected to begin operations in 2026 -- although efforts are underway to accelerate the start-up -- and its capacity could be expanded to at least 10 Bcm/year.

Ahead of the startup of the permanent facility, an FSRU is set to be commissioned at Brunsbuttel by the end of 2022.

Planned terminals

Germany has no LNG import infrastructure at present, but since the Russian invasion of Ukraine in February, Berlin has accelerated work to deploy FSRUs alongside the existing plans to build onshore facilities.

It is developing a total of five state-backed FSRUs, with an initial focus on bringing the Brunsbuttel and Wilhelmshaven FSRUs online by the turn of the year.

A sixth, privately backed FSRU project is also under development by Deutsche ReGas, which is expected to be technically ready next month.

-----

Earlier: