RUSSIAN OIL FOR CHINA, INDIA

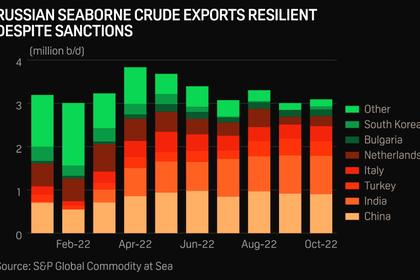

BLOOMBERG - Nov 27 - North American import bans and self-sanctioning by refiners and traders in Europe have barely dented the flow of crude from Russian ports, with volumes successfully diverted east.

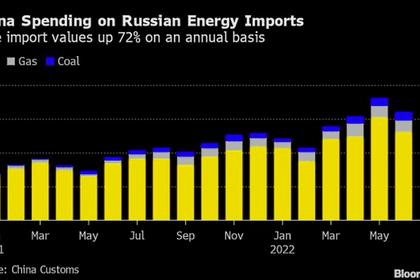

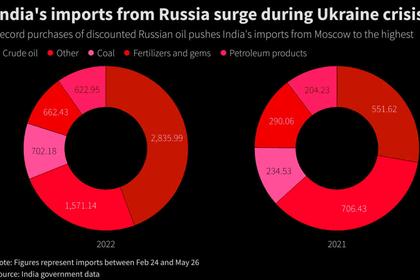

But switching flows to Asia, where India has emerged as Russia’s second-biggest customer, has concentrated Moscow’s dependence on an ever-shrinking pool of buyers. China and India now purchase two-thirds of all the crude exported by sea from Russia; at least half of the crude exported by pipeline from Russia also goes to China.

That gives huge negotiating power to buyers in both countries, and it’s a power they have exercised. Russian crude is trading at a hefty discount to international benchmarks, and that is hitting the Kremlin’s war chest.

The most recent estimate, from the end of last week, is that Russia’s flagship Urals grade was trading at about $52 a barrel at the export terminal. That’s a discount of $33.28, or 39%, to Brent crude. In comparison, the average markdown in 2021 was $2.85. That discount costs Russia's oil exporters about $4 billion a month in lost revenue, while also reducing the Kremlin's tax receipts from overseas sales.

Global crude prices have also fallen since the invasion. Brent was trading at about $100 a barrel when Russian troops went into Ukraine; it’s now about $86. That decline wouldn’t have happened if Russian exports had been severely curtailed, as the International Energy Agency had expected.

It’s easy to see attempts to cut the flow of funds to the Kremlin’s war chest as a failure, particularly while production and export volumes remain strong.

But oil revenue is a product of both volume and price. Hitting volumes seems attractive, partly because it’s so visible. But it would only be effective if the drop in flows far outweighed any consequent rise prices. That’s unlikely. The OPEC+ producers’ group, of which Russia is a key member, has made clear that it won’t step in to replace lost Russian barrels, so any reduction in Russian flows would be felt immediately on the market.

With China, India and Turkey willing to snap up discounted cargoes, any ban on Russian flows could only ever be partial. Unless those countries could also be persuaded to ban imports from Russia, halting its shipments completely, it is very likely that buyers everywhere would end up paying more for their oil, having the opposite effect to the one intended and driving up the Kremlin’s income. This, indeed, is the thinking behind the US-proposed price cap on Moscow’s exports.

Hitting prices, while less easy to see, stands a better chance of actually cutting flows into the Kremlin’s war chest.

-----

Earlier: