RUSSIAN OIL FOR INDIA UP

PLATTS- 14 Nov 2022 - India's appetite for Russian crudes in October rose to levels not seen in recent years and surpassed volumes shipped by leading Middle Eastern suppliers, as refiners rushed to snap up plentiful cargoes ahead of any potential shipping or policy hurdles once the EU's sanctions kick in, analysts told S&P Global Commodity Insights.

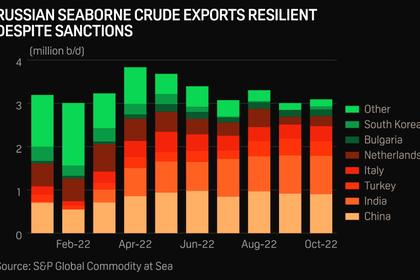

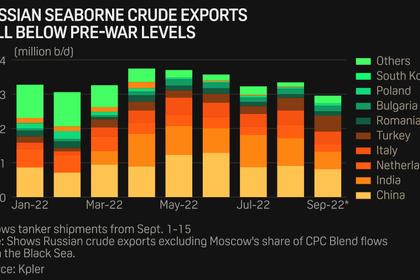

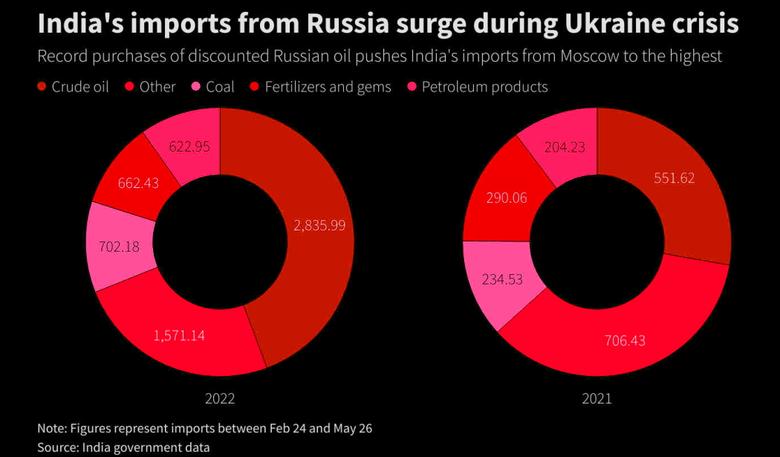

From a market share of less than 1% in India's import basket before the start of the Russia-Ukraine conflict, Russia's share of India's imports rose to 4.24 million mt, or nearly 1 million b/d, in October, taking a 21% share comparable to that of Iraq and higher than Saudi Arabia's share of around 15% in the country's import basket in the same month, S&P Global data showed.

"Since the voyage time to India from Russian ports ranges from 2-5 weeks, the crude that arrived in October must have been purchased months in advance," said Shreyans Baid, senior oil analyst for South Asia at S&P Global Commodity Insights.

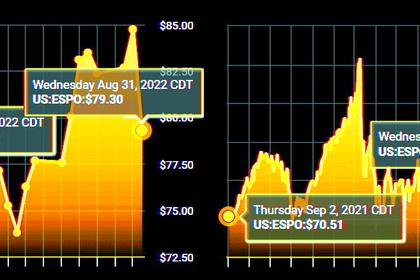

"But future purchases of Russian crudes by Indian refiners will depend on how the EU ban shapes up the seaborne trade and whether Russian crudes make economic sense given high freight rates and the market structure," he added.

Vibhuti Garg, director for South Asia at the Institute for Energy Economics and Financial Analysis, said: "India is scouting for cheaper oil as the country is witnessing high inflation and currency devaluation. It comes as no surprise that with the discounted price, Russia is becoming the top oil supplier."

"If Brent crude oil continues to remain high, then India will look for cheaper options to control inflation and to protect its dwindling foreign exchange reserves," Garg added.

"As the refineries start up from planned maintenance schedules, Indian crude imports have seen a jump in October and are likely to stay healthy in upcoming months," Baid said. "Despite the jump in Russian crude inflows, overall, the Middle East as a region still remains the largest supplier of crudes to India, with a combined share of close to about 55%."

Displacing African, US crudes

The rising share of Russian crude sales to India has also taken a toll on the country's appetite for African crudes. This, combined with a tighter market structure, as well as increased volatility in freight markets have led to the share of West African crudes dropping from 12.5% in January-September 2021 to 8.4% in the same 2022 period.

India's External Affairs Minister S. Jaishankar during a recent visit to Moscow said that as the world's third-largest consumer of oil and gas, where the consumer's level of income is not very high, it was the duty of the government to ensure that Indian consumers had the best access to crudes that can be brought in the most advantageous terms from the international market.

"In that respect, quite honestly, we have seen that the India-Russia relationship has worked to our advantage. So, what works to my advantage, I would like to keep that going," he added.

Not just African crudes, but even the share of North American crudes in India's import basket had fallen to about 10% in the first eight months of 2022, compared with about 15% for the same period last year.

Janet Yellen, US treasury secretary said last week during her visit to New Delhi that Washington was proactively taking steps to deepen economic integration with trusted trading partners like India.

"For too long, countries around the world have been overly dependent on risky countries or a single source for critical inputs. We are proactively deepening economic integration with trusted trading partners like India," she said.

Catering to reviving demand

India's oil products consumption picked up 3.4% on the year to 18.37 million mt, or 4.6 million b/d, in October, the latest provisional PPAC data showed, reflecting the highest fuel demand in four months in Asia's third-largest economy. In October, overall oil product demand rose 6.7% on the month.

For the January-October period, demand for oil products rose 8.8% to 180.75 million mt, or 4.7 million b/d, reflecting improved economic activity after the third wave of COVID-19.

India's petroleum minister Hardeep Singh Puri said that as demand showed a rising trend, the government was taking all possible steps to limit the blow from high global oil prices.

"We have been able to navigate this reasonably well. Prices were held at the bunk. When petrol prices went up by 43% and 46% in North America, our prices went only 2%. I am not comparing with the countries where prices have shot up through the roof," Singh said.

"With confidence, we can say that we would be able to navigate both in terms of availability of energy and affordability," he added.

-----

Earlier: