SAUDI ARAMCO NET INCOME UP TO $42.4 BLN

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

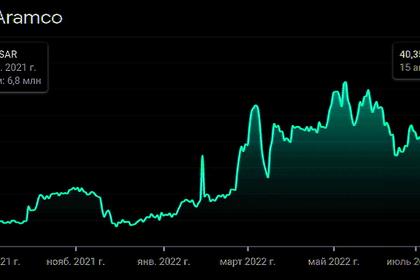

SAUDI ARAMCO NET INCOME UP TO $42.4 BLN

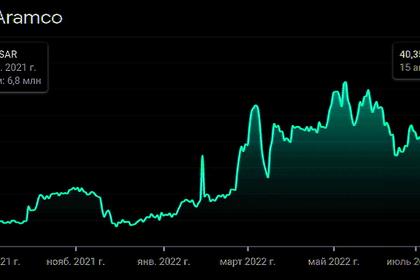

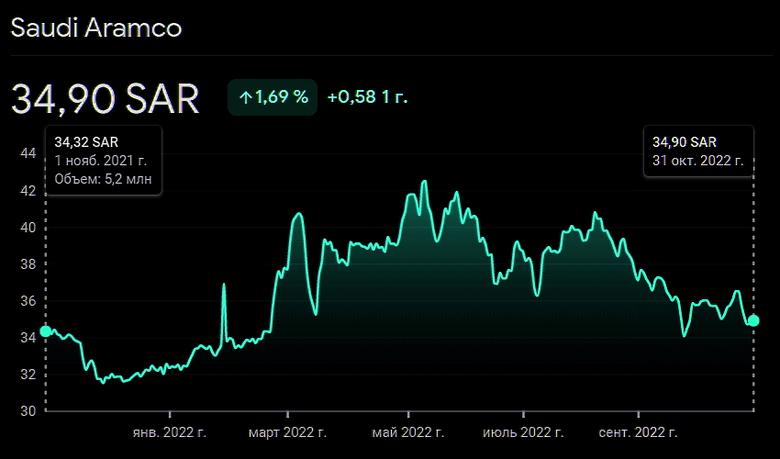

ARAMCO - Dhahran, Saudi Arabia, November 01, 2022 - Aramco announces third quarter 2022 results Q3

net income rises 39% YoY to $42.4 billion; free cash flow increases to a record $45.0 billion

• Q3 earnings reflect Aramco’s ability to generate significant value

• Net income: $42.4 billion (Q3 2021: $30.4 billion)

• Cash flow from operating activities: $54.0 billion (Q3 2021: $36.3 billion)

• Free cash flow1: $45.0 billion (Q3 2021: $28.7 billion)

• Gearing ratio1, 2: -4.1% as at September 30, 2022, compared to 12.0% at end of 2021

• Q2 dividend of $18.8 billion paid in the third quarter; Q3 dividend of $18.8 billion to be paid in the fourth quarter

• Partnership with F2 and F3 highlights work on advanced low-carbon transport solutions

• World’s first independent certifications of blue ammonia and hydrogen production

Full report PDF version

Earlier:

2022, October, 26, 10:30:00

SAUDI'S OIL INVESTMENT FOR PAKISTAN $12 BLN

Saudi Arabia previously signed in February 2019 several memorandums of understanding for an investment of US$21bn in various sectors of the Pakistani economy, including for the project of a deep conversion refinery and petrochemical complex with an investment of US$12bn.

2022, August, 15, 12:10:00

SAUDI ARAMCO NET INCOME UP TO $87.9 BLN

The Saudi Arabian Oil Company (“Aramco” or “the Company”) announced its financial results for the second quarter of 2022, posting a 90% year-on-year (YoY) increase in net income

2022, August, 8, 12:10:00

SAUDI, CHINA COOPERATION

The areas of potential cooperation include upstream and downstream businesses, engineering and construction, oilfield services, carbon capture and hydrogen.

2022, August, 3, 12:15:00

SAUDI'S INVESTMENT MARKETING $3.2 TLN

Saudi Arabia would be looking to secure investments in untapped business sectors, including green hydrogen, renewable energy, and information technology.

All Publications »

Tags:

SAUDI,

ARAMCO