SAUDI'S HYDROGEN WILL UP

PLATTS - 15 Nov 2022 - Saudi Arabia has set its sights on becoming a global supplier of renewable and low-carbon hydrogen, configuring production standards to meet market requirements in both Europe and the Asia-Pacific region, the energy ministry's head of hydrogen, Zeid al-Ghareeb, said at the UN Climate Change Conference in Egypt Nov. 15.

Hydrogen would be a key part of the future energy mix, al-Ghareeb said, with Saudi ambitions to produce 4 million mt/year of "clean" hydrogen by 2030.

This amount could be exceeded as demand scaled up, he said.

The country did not want to differentiate between "green" and "blue" hydrogen (both of which it is developing), instead preferring a focus on carbon intensity.

"We should not focus on the source of energy," al-Ghareeb said. "We should be agnostic."

Instead, he urged a focus on emissions, in line with net-zero objectives to reduce greenhouse gas production.

Platts assessed the price of hydrogen (Saudi Arabia, SMR with CCS, including capex) at $4.18/kg Nov. 15. Electrolytic hydrogen (Saudi Arabia, alkaline, including capex) was assessed at $3.20/kg, among the cheapest sources of hydrogen in the world, according to S&P Global Commodity Insights data.

Blue hydrogen stepping stone

Air Products' Chief Operating Officer Samir Serhan said it was not realistic to switch overnight from unabated fossil fuel-derived hydrogen to electrolytic production powered by renewables.

Instead, carbon capture-enabled blue hydrogen derived from natural gas was a vital stepping stone, given the scaling of technology and amount of power needed.

Saudi Arabia has plans to produce 650 mt/d of renewable hydrogen at its Neom project from 2026, with construction underway, Serhan said.

Air Products is a partner in the project.

The Neom facility will be backed by 4 GW of wind and solar power.

The company is also developing a "world-scale" hydrogen plant at Jubail reforming natural gas with carbon capture technology, to produce 420 mt/d of hydrogen.

Serhan said the energy crisis in Europe was "definitely" making renewable hydrogen more competitive on cost, but questioned how long that would last.

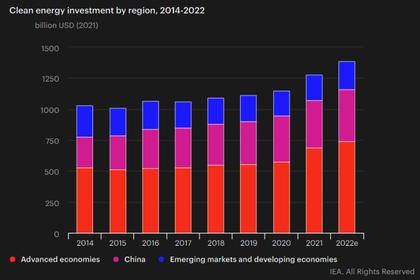

He also said there was "no doubt" that the US Inflation Reduction Act meant there would be more clean hydrogen projects there.

Global standards

Regulation was needed to drive uptake of clean hydrogen, Saudi Aramco vice president for chemicals and hydrogen Olivier Thorel said.

"It is a very expensive fuel," translating to a carbon price in the hundreds of dollars per ton, he said. "No carbon price in the world gives that."

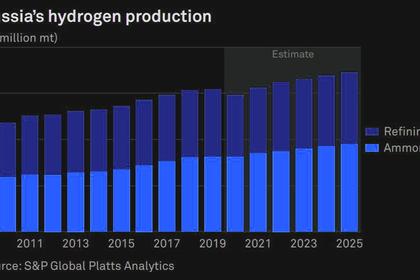

Aramco would initially focus on exports, targeting 11 million mt/year of low-carbon hydrogen by 2030. First-use cases would be the existing markets of refining and fertilizer production, he said.

Al-Ghareeb said the difficulty of building the sector was simultaneously developing the supply and demand sides of the market.

"The government's business is to stay out of business," he said, but added that states could provide frameworks and incentives to encourage private investment.

He said Saudi Arabia was well placed to supply consumers in both Europe and the Asian markets of Japan and South Korea.

Saudi standards of production and carbon intensity would be determined by what consumers in those markets wanted, he added.

Thorel said Aramco was being transparent about the carbon intensity it could achieve in its products, and it was then up to customers to commission them.

The company would then have a notion of what to build and what standards to adopt, he said.

A carbon capture rate of 97% was technically achievable, but it was "quite expensive," he said.

Long game

In the short term, aggregating demand centers around clusters would be key, with ammonia a ready end-market and transport mode for hydrogen, al-Ghareeb said.

Saudi Arabia was carrying out pilot projects to collect data for hydrogen mobility, including testing hydrogen buses at Mecca to cater for the 2 million to 3 million visitors making the pilgrimage each year.

If they prove themselves to be valuable, that would be a major step, he said.

Pipelines would be the cheapest supply solution in the medium term, subject to clusters of demand to justify the infrastructure investment.

And in the longer term, green products such as steel produced using renewable hydrogen could become the key end-market, solving the problem of hydrogen conversion losses and costs.

Aramco has pledged to decarbonize its own operations by 2050. Thorel said the company would also offer low-carbon products to the market.

Then "customers will choose and vote with their feet," he said.

-----

Earlier: