SAUDI'S OIL FOR EUROPE

PLATTS - 14 Nov 2022 - Saudi Arabia is positioning itself to supply more oil to Europe as traditional buyers of Russian barrels look to diversify ahead of looming sanctions in early December and analysis suggests the trend could become more pronounced in 2023.

Russian crude has historically made up about a fifth of Europe's crude diet.

Since the EU moved to impose sanctions on Russian barrels, key consumers have been looking to wean themselves off medium sour Russian Urals in favor of comparable grades in the Middle East. Regular suppliers to the European market such as the US and West Africa have also been stepping up with lighter and sweeter grades.

But Middle East producers — and Saudi Arabia in particular — which have a greater focus on Asian markets, have also been looking west as key Gulf crude buyers China and India gobble up cheaper Russian exports.

"Our assumption has always been that Middle East, West African and US barrels will back-fill lost Russian supply into Europe, with the volumes of lost Russian supply hinging on policy and/or other exceptions," said Tony Starkey, an analyst at S&P Global Commodity Insights.

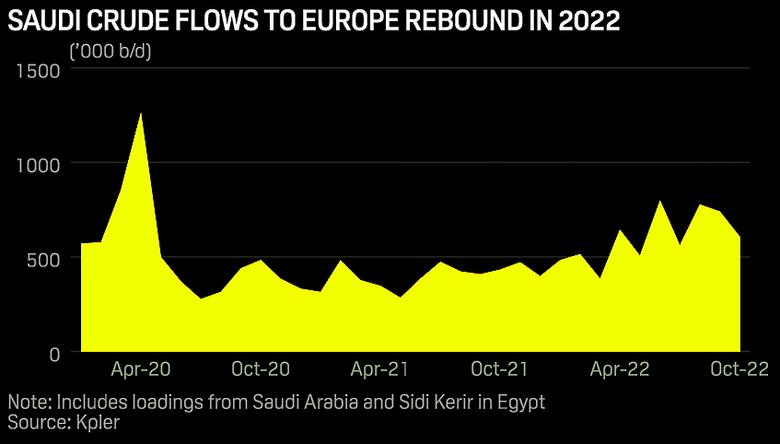

Saudi crude exports to Europe have increased steadily in 2022, with flows rising to recent highs, according to data from both S&P Global ship-tracking analysis and Kpler shipping data.

Saudi shipments to Europe jumped to two-year highs of 777,000 b/d in August, according to Kpler, and the flow has averaged 600,000 b/d so far in 2022, the highest since 2019.

Saudi crude normally travels to Europe via two routes — directly on tanker from the kingdom's main export terminals — Ras Tanura and Yanbu, and also from Sidi Kerir in Egypt via the SUMED pipeline.

The Netherlands, Poland, Spain, France and Italy have been the top five destinations for Saudi oil in the region this year, all of which have also been regular buyers of Russian crude. Croatia, Germany, Greece, Lithuania, Turkey and the UK have also purchased Saudi crude this year.

The European market may still represent only around a tenth of Saudi crude supply, but it will likely to be a bigger outlet in 2023 for the kingdom, whose energy minister has recently signaled that the world's crude large exporter was looking to supply more to Europe.

"We are engaged with so many governments. Just to give you example, Germany, Poland, the Czech Republic, Croatia, Romania and other," Prince Abdulaziz bin Salman said at a recent industry event.

"They are going through a phase of debottlenecking their supply chains and supply systems to ensure that we can come in."

Competitive pricing

Saudi Arabia has been raising its prices to reflect new-found demand in Europe and cutting prices as it looks to compete with Russia in Asia.

National oil company Saudi Aramco announced its pricing for December 2022 barrels on Nov. 4 with a cut for most of its crude grades into Asian markets but ratcheted up is official selling price for grades into Northwest Europe.

The Arab Light benchmark was increased by 80 cents/b, setting it at a premium of $1.70/b against the ICE Brent benchmark.

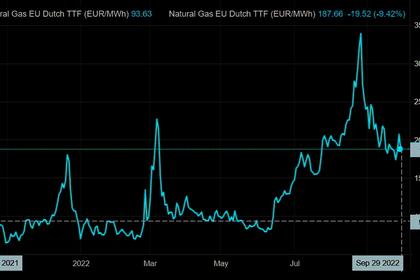

Meanwhile, Urals is at a $23.6/b discount to Dated Brent due to the market shunning Russian barrels and saw a further widening by 60 cents/b month on month.

"The price increase to Northwest Europe market seeks to capture pricing upside from the upcoming EU ban on seaborne Russian crude imports from Dec. 5, which could further boost demand for Saudi grades in Europe," S&P Global analysts said in a research note.

So, while Saudi Aramco cut prices to Asia to defend its position against heavily discounted Russian barrels which have flooded into key consumers such as India and China, it has also seized the opportunity in a market likely to be vacated by Russia in recent months.

"Gulf states will export more oil and products to Europe and the US," said independent oil consultant Anas Al-Hajji, noting the changing global crude flows and the importance of crude quality.

Russia's Urals is classified as a medium sour grade, with a specific gravity of around 31.7 API and sulfur content of 1.7%, according to the Platts Periodic Table of Oil.

That makes it very similar in quality to other medium sour crudes such as Iraq's Basrah Medium, Saudi Arabia's Arab Light, Arab Medium, Arab Heavy, Iranian Heavy, Brazil's Mero and Oman Crude Export Blend.

Saudi's flagship crude Arab Light has a gravity slightly lighter at 33.3 API while Arab Medium and Arab Heavy have a gravity of 30.9 API and 27.8 API, respectively. However, these three are more sulfurous than the Russian grade.

Meanwhile, heavier crudes such as Iraq's Basrah Heavy, key Latin American crudes as well as Norway's Johan Sverdrup can all be blended with lighter sweeter offerings to produce something similar to Urals, said lead crude analyst at Refinitiv Ehsan Ul-Haq.

"Europe has so far coped well but if demand increases significantly especially due to below normal temperatures, supply may not be adequate," Ul-Haq said.

With European demand being hit by economic weakness and higher interest rates, faltering supply may not be such a challenge in the immediate term, but should it quickly recover Saudi Arabia is well positioned to take advantage with most of its competitors have been hit by output constraints and capital discipline.

Saudi Arabia says it has the capacity to pump as high as 12 million b/d but has been producing around 1 million b/d shy of that and was expected to cut output further as OPEC+ undertakes steep cuts this month.

The OPEC kingpin pumped 10.90 million b/d in October from 11.02 million b/d in September, Platts monthly survey found.

Europe's oil refiners may need to tweak their slates and blend a little more, but Saudi crude supply will make a stable long-term replacement for Russian Urals.

-----

Earlier: