GLOBAL OIL DEMAND UP BY 2.3 MBD

PLATTS - 14 Dec 2022 - Tentative signs of a "soft landing" in the global economy and resilient demand data in China and the Middle East have prompted the International Energy Agency to upgrade its demand outlook, warning "another price rally cannot be ruled out" due to potential tighter oil balances in the second quarter of 2023.

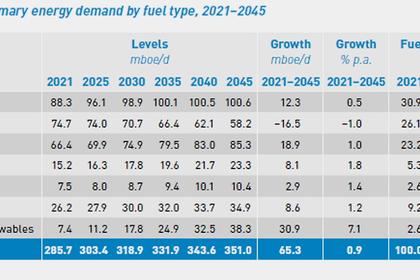

The IEA predicts oil demand will rise by 2.3 million b/d in 2022 and by a further 1.7 million b/d in 2023, noting the contrast between strong gasoil and diesel use, especially in non-OECD economies, and weak petrochemical consumption in Europe and Asia.

"Despite the seasonal slowdown in world oil demand and continued macroeconomic headwinds, recent oil consumption data have surprised to the upside... This was especially apparent in non-OECD regions, including China, India and the Middle East," the IEA report said.

"Buoyant gasoil demand echoes incipient optimism about the state of the global economy and prospects for China's reopening," the IEA pointed out.

Industrial users in Europe continue to switch from natural gas to gasoil, which is considerably cheaper now on an energy equivalent basis, the IEA said, adding that this would help offset fears of a gas supply crunch over the winter and into 2023 and 2024.

Employment and consumer spending data in OECD regions were solid, while inflation numbers indicated that price pressures eased a little, boosting hopes of a soft landing, the IEA said.

"While the US and Europe are likely to enter recession in 2023, these downturns are likely to be mild, aided by less hawkish central banks," the energy watchdog said, as signs emerge that the pace of interest rate rises may start to slow down.

Supply cuts emerge

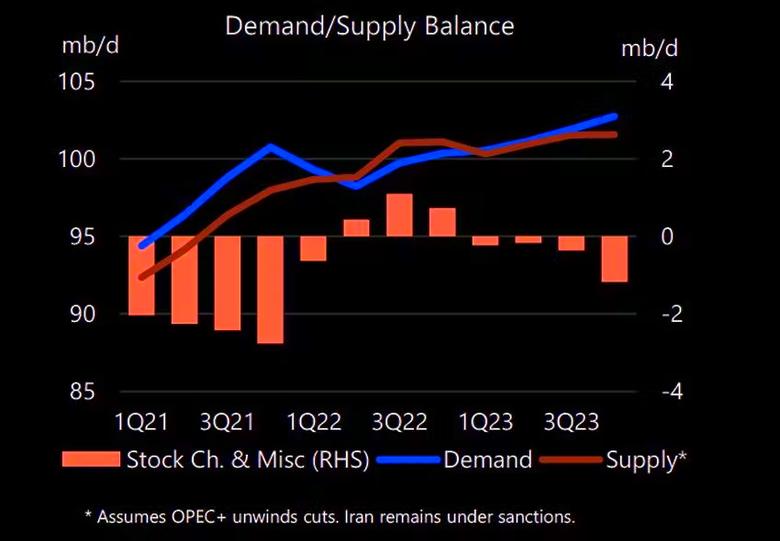

World oil supply fell in November for the first time in five months after Saudi Arabia and other Gulf countries curbed supply in line with lower OPEC+ production targets, the IEA said.

At 101.7 million b/d, global production for the month was down 190,000 b/d from October's post-COVID high, the IEA said.

It noted a bigger fall is expected in December after the EU ban on Russian crude imports along with a G7 price cap took effect Dec. 5.

Although OPEC+ had sharply reduced its nominal supply ceiling from November through to the end of 2023, the IEA noted that "in reality, only Saudi Arabia and its Gulf neighbors will continue to pump at or around significantly lower quotas as most of the bloc have undershot targets for some time."

In non-OPEC+ countries, output rose for a third consecutive month and was up by 3.1 million b/d since the start of the year, largely due to strong production in the US, Brazil and the North Sea, the agency added.

For 2023, world oil supply is forecast to rise by just 770,000 b/d on the year to 100.8 million b/d after 4.7 million b/d growth in 2022, the IEA said

Market balances

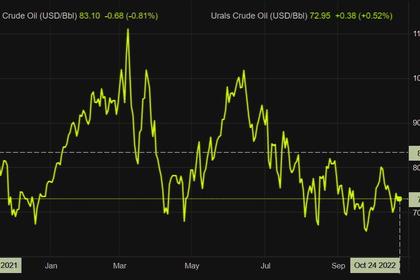

The IEA's warning of upside oil price risk comes as the Dated Brent physical benchmark trades around the $80/b mark, having flirted with $100/b just over a month ago as global demand risks amid recessions and China's lockdowns took over the narrative from OPEC+ cuts and potential Russian supply losses.

The oil market is closely watching oil market balances as global stocks remain low going into a period of extreme uncertainty over how the G7 sanctions will impact Russian oil flows. Observed global inventories have remained largely flat for several months at around five-year lows, the IEA pointed out.

The IEA highlighted that global observed inventories fell by 23.2 million barrels in October as product stocks fell for the first time since March and crude oil saw a smaller build. OECD industry stocks increased by 17.3 million barrels, to 2,765 million barrels, narrowing the deficit versus the five-year average to 150.2 million barrels, but OECD government stocks fell by 19.9 million barrels. Preliminary data for the US, Europe and Japan show industry stocks increased by 3.1 million barrels in November, the IEA noted.

Over the next year, S&P Global Commodity Insights expects "oil markets will be on an extended pathway of recalibration as supply and demand fundamentals adjust to elevated prices and supply uncertainty." The S&P Global analysts believe it will take several years of stronger supply growth than demand growth for inventory cushions to return to more comfortable levels.

But whether the bearish narrative holds -- and for how long -- will depend on China and OECD economic recovery on one hand and supply losses from OPEC+ and sanctions on the other.

Indeed, in the near-term oil prices may stay capped should the energy agency's oil balances play out and fundamentals drive oil markets.

Despite the OPEC+ curbs and further anticipated declines, mainly from Russia, the IEA forecasts world production to overtake demand through the rest of 2022 and the first quarter of next year.

-----

Earlier: