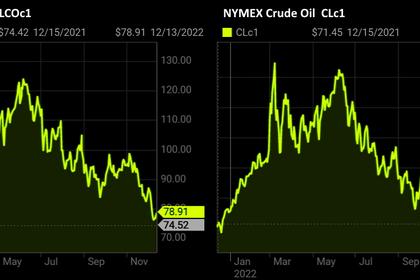

OIL PRICE: BRENT ABOVE $80, WTI ABOVE $75

REUTERS - Dec 14, 2022 - Oil prices were broadly stable on Wednesday as bearish signals from data indicating a surprise build in U.S. crude inventories met forecasts of oil demand rebounding over 2023 from OPEC and the International Energy Agency (IEA).

Brent crude futures dropped 17 cents, or 0.2%, to $80.51 per barrel by 0926 GMT, while U.S. West Texas Intermediate (WTI) crude futures fell 3 cents to $75.36.

U.S. crude inventories rose 7.8 million barrels in the week to Dec. 9, according to market sources citing data from the American Petroleum Institute, while analysts polled by Reuters had expected a 3.6 million barrel drop.

Government data is due at 1530 GMT.

The inventory data dampened the previous session's bullish sentiment based on hopes for a revival in Chinese demand with the easing of COVID-19 restrictions and for a weakening dollar after data showed U.S. inflation subsiding.

Road and air traffic in China has rebounded sharply, data suggests.

But PVM analyst Stephen Brennock cautioned that while "Beijing’s recent decision to loosen the strict COVID-19 policies is a positive step (it) is only expected to pave the way for an uptick in China’s oil demand from 2Q23 onwards."

Looking into 2023, OPEC said it is expecting oil demand to grow 2.25 million barrels per day (bpd) over next year to 101.8 million bpd, with potential upside from China.

The IEA on Wednesday raised its 2023 oil demand estimate to 1.7 million bpd for a total of 101.6 million bpd.

Oil prices have been supported by a leak and outage of TC Energy Corp's (TRP.TO) Keystone Pipeline, which ships 620,000 barrels per day of Canadian crude to the United States.

Officials said the cleanup will take at least several weeks.

The U.S. consumer price index rose 0.1% in November after 0.4% the previous month, fuelling hopes for a slowdown in interest rate hikes, which in turn could support oil prices.

U.S. Federal Reserve policymakers are expected to raise rates by 50 basis points on Wednesday, slowing from the 75-basis-point pace they had stuck to since June.

-----

Earlier: