RUSSIAN GAS FOR EUROPE DOWN ANEW

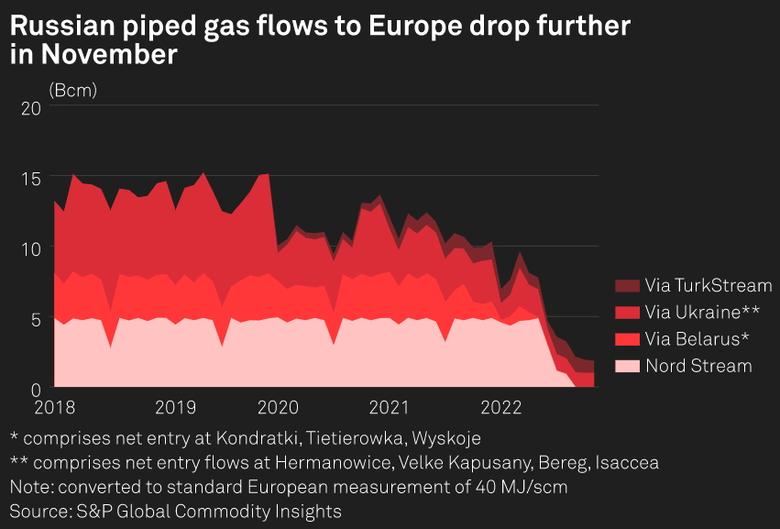

PLATTS - 06 Dec 2022 - Russian gas flows to Europe slipped further in November, staying below 2 Bcm for the second consecutive month, an analysis of data from S&P Global Commodity Insights showed Dec. 6.

Total Russian pipeline exports to Europe in November via the remaining major supply routes -- TurkStream and the Ukrainian network -- totaled just 1.86 Bcm, down 5% compared the October total.

Russia gradually choked its gas supply to Europe through 2022, ending deliveries via Yamal-Europe and Nord Stream, and sharply cutting exports via Ukraine.

The November total of 1.86 Bcm compares with deliveries of 10.09 Bcm in November last year, laying bare the extent of Russian supply curtailments.

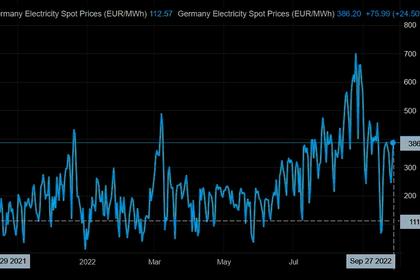

Lower Russian deliveries to Europe drove European gas prices to record levels in 2022.

Platts, part of S&P Global Commodity Insights, assessed the Dutch TTF month-ahead price at an all-time high of Eur319.98/MWh in late August.

Prices have weakened since then on the back of healthy storage and demand curtailments, though prices remain historically high with Platts assessing the TTF month-ahead price on Dec. 5 at Eur135.48/MWh.

TurkStream flows

With Nord Stream flows halted and the suspension of deliveries via Belarus in the Yamal-Europe system earlier this year, Russian gas is only reaching non-CIS countries in Europe via TurkStream and Ukraine.

Deliveries via TurkStream into southeast Europe dropped below 1 Bcm in October and fell further in November to just 0.84 Bcm -- or an average of 28 million cu m/d.

Supplies via TurkStream had averaged more than 40 million cu m/d at times this summer, though offtake in Bulgaria was ended in April after Sofia refused to comply with the terms of Gazprom's new ruble-based payment mechanism.

Deliveries via TurkStream have, however, picked up in December, with flows back up at as high as 44 million cu m/d, S&P Global data showed.

Two of the main beneficiaries of gas via TurkStream are Serbia and Hungary, which both still have relatively close ties with Moscow.

Gas via TurkStream is also delivered to Romania, Greece, North Macedonia, and Bosnia and Herzegovina.

The two-string TurkStream pipeline was commissioned in January 2020, with the 15.75 Bcm/year Turkish string carrying Russian gas to Turkey and the second string sending gas to Europe via Bulgaria.

Russia and Turkey are also looking to develop a new gas hub for Russian gas supplies that could see an expansion of the 31.5 Bcm/year TurkStream system.

Ukraine transit

Meanwhile, Russian gas continues to transit Ukraine en route to Europe despite Moscow escalating its attacks on Ukrainian energy infrastructure in recent weeks.

Flows via Ukraine remained above 1 Bcm in November, though some gas remained in Ukraine as it took imports from Slovakia at Velke Kapusany.

There were fears last month that some of the remaining transit of Russian gas via Ukraine at the only operational entry point, Sudzha, could be halted due to a dispute between Gazprom and Moldova.

Gazprom said some gas meant for delivery to Moldova was being retained in Ukraine and threatened to reduce the supply accordingly. However, it opted not to curtail deliveries after Moldovagaz paid in full for all Russian gas in November.

Risk to Ukrainian transit remains.

Gazprom said in late-September that Moscow could impose sanctions on Ukraine's Naftogaz Ukrayiny in retaliation for a recent arbitration claim that -- if carried out -- would mean a ban on all financial transactions with the Ukrainian company.

Naftogaz said Sept. 9 it had filed a request for a new arbitration case in a bid to force Gazprom to pay in full for gas transit services, but the Russian company refuted all the claims.

Naftogaz and Gazprom signed in December 2019 a gas transit agreement under ship-or-pay terms, meaning Gazprom is obliged to pay for transit whether it uses it or not.

However, Naftogaz has claimed that since May Gazprom has been flowing less gas than agreed in the contract and paying less than the agreement provides.

-----

Earlier: