RUSSIAN OIL FOR INDIA UP

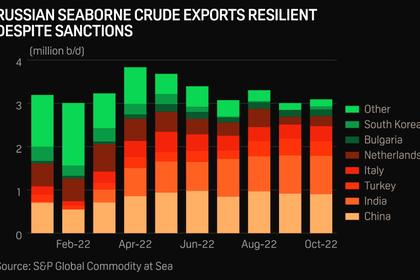

PLATTS - 05 Dec 2022 - Russia's seaborne crude exports were little changed in November at just over 3 million b/d after flows to India surged to a record high, absorbing barrels displaced from Europe where imports sank to all-time lows ahead of the EU's Dec. 5 import ban and G7 price cap, according to tanker tracking data.

Seaborne exports of Russian crude averaged 3.07 million b/d in November, according to S&P Global Commodities at Sea data, down from 3.09 million b/d in October and just below the pre-war average of 3.1 million b/d in January and February.

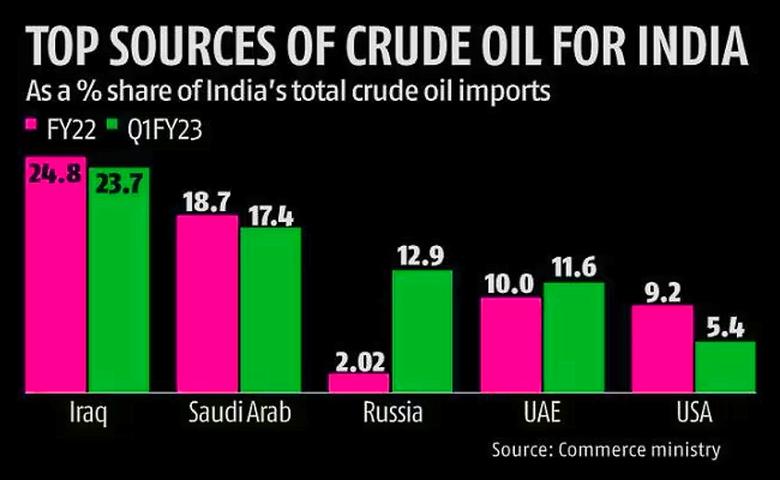

While Russian crude flows to the EU slumped 308,000 b/d to average a record low of 464,000 b/d in the month, Indian refiners stepped up their buying of Russian oil by 272,000 b/d to a record 1.17 million b/d.

With Russian crude flows to China little changed from recent levels at 918,000 b/d, together with India, the two energy-hungry Asian importers accounted for 68% of seaborne Russian crude exports in November, the data showed, up from 58% in the previous month.

Turkey, now Russia's third-biggest crude buyer as local refiners switch to cheap Russian crude, saw imports from Russia slip 35% on the month to 224,000 b/d, the data showed. Before Russia's invasion of Ukraine, Turkey's five refineries were importing around 130,000 b/d of Russian crude.

The data came days after the G7 set its price cap on Russian crude at $60/b and the EU's own embargo on seaborne Russian crude came into effect early Dec. 5. The price cap and EU embargo will extend to Russian product exports from Feb. 5.

The November data also showed Russian crude exports headed for South Korea jumped to 144,000 b/d, the highest since May. South Korea, which imported 275,000 b/d of Russian crude in 2021, has backed Western oil sanctions on Russia but its offshore waters are often used for ship-to-ship transfers of Russian crude with onward transport to Southeast Asia.

Crude discounts

The G7's price cap mechanism, which controls access to shipping insurance and services for Russian oil, allows a transition period of 45 days for vessels carrying Russian-origin crude loaded before Dec. 5 and unloaded at the final port of destination by Jan 19.

But the G7's price cap may do little to initially further curb Russian oil export flows as its main export grade is currently trading below $60/b.

Russia's medium sour Urals crude, once viewed as the key indicator for medium sour crudes trading in Europe, was assessed by Platts, part of S&P Global Commodity Insights, at $53.47/b on Dec. 2. In the East, Russia's ESPO export grade was assessed by Platts at $72.86/b on Dec. 5, however.

As the Dec. 5 deadline approached, discounts for the Urals to benchmark Dated Brent widened again after retracing ground from the record highs of above $40/b reached in June.

On Dec. 2, the discount for Urals crude loading at the Russian Baltic Sea port of Primorsk stood at $33.45/b below Dated Brent, according to data from S&P Global. In Asia, the discount for Russia's ESPO crude export stream versus Dubai has also widened in recent weeks to stand at $7.94/b on Dec. 5, S&P Global data showed.

While Russia has said it has no plans to sell its crude or oil products under the price cap mechanism, US officials have said the price cap is intended to cheapen the value of Moscow's key revenue source outside the G7 by giving refiners in China and India more leverage to negotiate steeper discounts.

Flows to EU

Tanker data showed Russian seaborne crude flows into Europe have been drying up fast with flows to Italy, home to Lukoil's 320,000 b/d ISAB refinery in Sicily, more than halving on the month to average 141,000 b/d, in line with pre-war levels.

Forced to process Russian crude after its banks revoked credit lines used by the refinery to purchase oil from alternative suppliers, ISAB's Russian crude imports had seen Italian imports of Russian oil peak at 472,000 b/d in May, according to CAS.

The Netherlands and Bulgaria -- which has an exemption from Brussels -- continue to receive Russian crude in November, the data shows, with small shipments also to Croatia and Denmark.

Analysts at S&P Global estimate that some 2 million b/d of Russian crude and products to Europe will ultimately need to find new buyers when the EU's full oil sanctions on Moscow take effect Feb. 5, 2023.

S&P Global estimates that about half of the 2 million b/d displaced from Europe will likely find new buyers in Asia although uncertainty over the available "shadow" tanker fleet able and willing to sidestep the G7's price cap measures made forecasts difficult.

"Concurrent restrictions on G7 insurance and financing, a delayed rollout of the price cap, and Russia's aversion to selling into Western policy constraints will combine to create an initial shortage of ships and buyers required to re-route roughly half of the 2 million b/d," S&P Global's chief geopolitical risk advisor said in a note.

Overall, S&P Global analysts forecast that initial dislocations will lower Russian crude and condensate output by 1 million b/d between November and March, to 1.5 million b/d below pre-conflict levels.

-----

Earlier: