EUROPEAN GAS PRICES DOWN

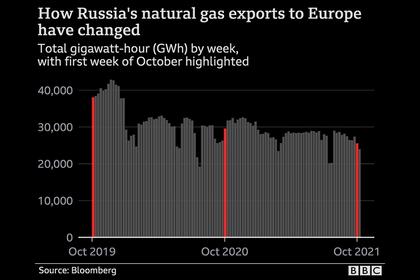

PLATTS - 01 Feb 2022 - European gas prices were markedly lower in intraday trading Feb. 1 amid news of a substantial supply boost via Ukraine to Slovakia and the apparent return of the Nord Stream 1 pipeline to full capacity.

"With more flows at the moment and the weather forecast still mild, risk premium is taken off the market," a German-based gas trader, adding that the strengthened gas flows could be expected to continue.

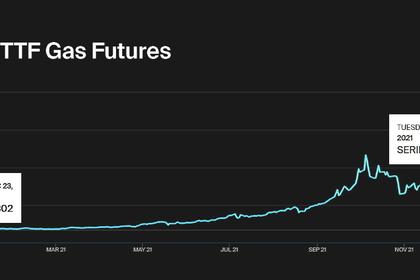

March Dutch TTF futures, which hit a low of Eur74.5/MWh (483.3/MWh) early on, were trading at Eur76/MWh at 1317 GMT, having fallen 7.4% on Jan. 31 to Eur84.025/MWh, as assessed by S&P Global Platts.

Entry gas flow nominations at the Slovakian-Ukrainian interconnection point Velke Kapusany jumped day on day, with Slovakian TSO Eustream's data showing 848 GWh/d (80 million cu m/d) of flows for the Feb. 1 gas day, up from 514 GWh/d on Jan. 31.

Velke Kapusany nominations in January averaged close to 315 GWh/d until Jan. 24, when flows strengthened to average 490 GWh/d for the rest of the month.

At the same time, Nord Stream 1 appeared to be returning to full capacity, according to the operator's data, with hourly gas flow nominations reaching 73 GWh since the start of Feb. 1 gas day, compared with 69 GWh/h for Jan. 31.

Nord stream 1 flows remained below capacity for the whole of January, trending at 1.64 TWh/d compared with the normal 1.75 TWh/d level.

Meanwhile, March UK NBP gas futures, which touched a low of 178.06 pence/therm early on, were trading at 182 p/th by 1315 GMT, having fallen 7.7% on Jan. 31 to 201.5 p/th.

Daily gas flow nominations at the Mallnow compression station in Germany continued to suggest reverse flows on the Yamal pipeline, according to operator Gascade, with no entry flows nominated for Feb. 1 but with exit nominations appearing to decline to 36 GWh/d, compared to 142 GWh for Jan. 31.

-----

Earlier: