GLOBAL COAL INVESTMENT $1.5 TLN

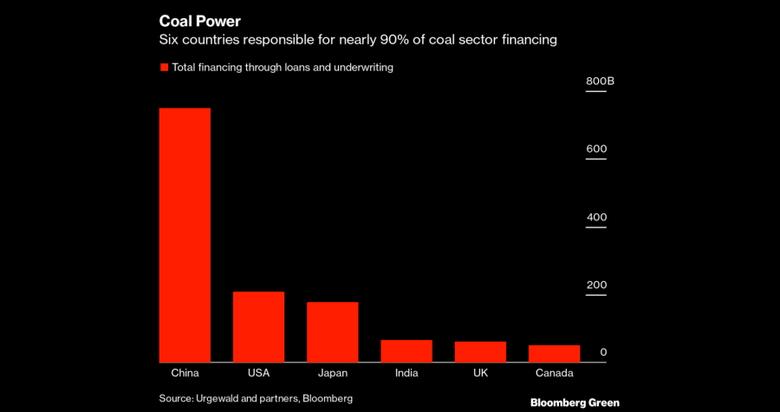

GLOBAL ENERGY - February 17, 2022 - The world coal industry has secured $363 billion in bank credits in the period from January 2019 to November 2021, according to research conducted by the German NGO Urgewald.

And banks continued to support transactions on the sale of securities of companies in the industry, with their combined sum totalling $1.2 trillion.

The research took account of credits and capital investments for 1,032 companies working in all parts of the coal industry, ranging from production, processing and transport of coal to management of coal-fired power stations and production of equipment for pits and stocks.

The sector’s five largest creditors — U.S. Citigroup. Britain’s Barclays, Japan’s Mizuho Financial, Mitsubishi UFJ Financial and Sumitomo Mitsui Banking Corporation, part of Sumitomo Mitsui Financial Group – are members of the international Net Zero bank alliance holding more than 40 % of banking assets world-wide.

According to the alliance’s official objectives, the credit portfolios of banks making up its membership by 2050 must reflect the principles of carbon neutrality. And to achieve that, the alliance plans to set down a list of priority industries with which the desired effect can be achieved already in 2030.

The industry’s leading investors are U.S. investment giants BlackRock and Vanguard – their portfolios as of November 2021 included shares and bonds of coal companies, totalling $109 billion and $101 billion respectively.

Restrictions on credits in the coal sector are gradually becoming a more popular measure. The HSBC bank has become a pioneer of sorts – I n 2021, it announced its intention to halt financing coal-producing companies in OECD countries by 2030 and world-wide by 2040. And the bank plans to reduce by 2025 credits for coal-fire power stations by 25 %, with that figure to rise to 50 % by 2030.

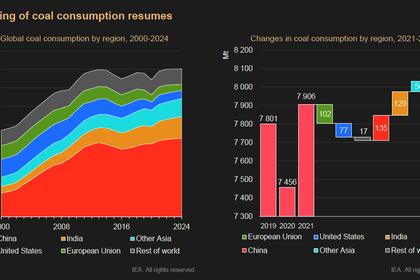

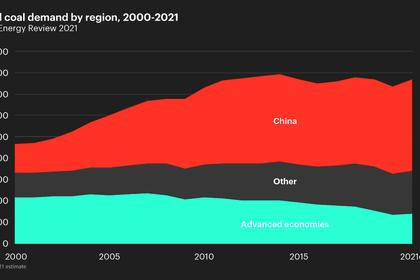

However, coal remains in demand in power generation. According to the International Energy Agency (IEA), worldwide coal-fired generation grew by 9% in 2021, hitting a new all-time high of 10,350 terawatt-hours (TWh). The record growth was driven by the post-COVID recovery of the world economy, as well as unprecedented increases in gas prices, making it less affordable for the power industry. Thus, in 2021, the amount of electricity generated from gas in the EU fell by 5% (to 524 TWh, according to Ember).

In the coming years, coal demand will continue to grow in China and India. In 2020, the share of these two countries in the commissioning of new coal generating capacity reached 78% (43 GW out of 54.9 GW), while in the first half of 2021 this figure was 71% (12 GW out of 16.9 GW, according to Global energy monitor).

-----

Earlier: