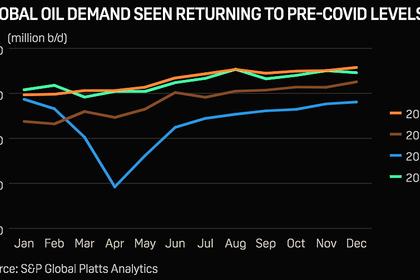

GLOBAL OIL DEMAND 2022: +4.2 MBD

OPEC - 10 February 2022 - OPEC Monthly Oil Market Report

Oil Market Highlights

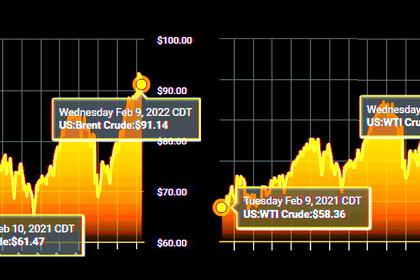

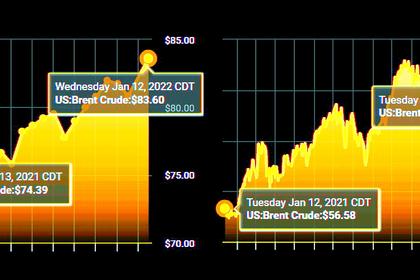

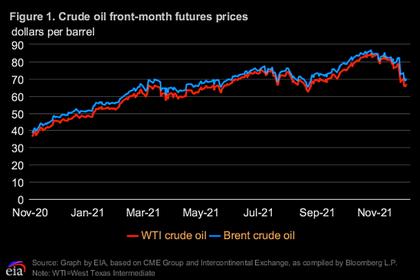

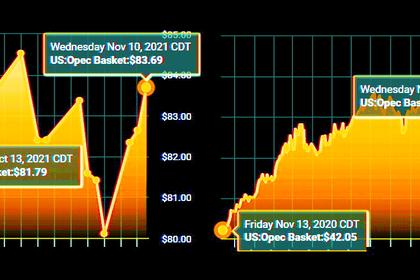

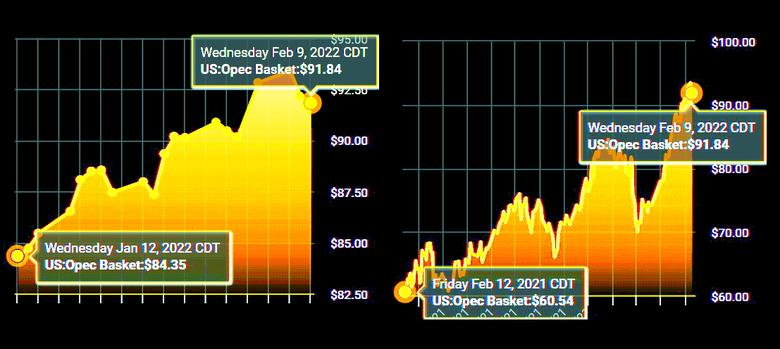

Crude Oil Price Movements

Crude oil spot prices rebounded in January, compared to the previous month, as oil futures markets surged. Crude prices were supported by strong global oil market fundamentals amid dissipating fears about the impact of the COVID-19 Omicron variant and geopolitical risks, which raised concerns about near-term oil supply. The OPEC Reference Basket increased $11.03, or 14.8%, to settle at $85.41/b in January, its highest monthly value since September 2014. Similarly, crude oil futures prices increased on both sides of the Atlantic with the ICE Brent front month up $10.77, or 14.4%, in January to average $85.57/b and NYMEX WTI rising by $11.29, or 15.7%, to average $82.98/b. As a result, the Brent/WTI futures spread narrowed by 52¢ to an average of $2.59/b. The market structure of all three crude benchmarks – ICE Brent, NYMEX WTI and DME Oman – strengthened significantly in January over the previous month as market perception of the outlook for the supply-demand balance improved. Hedge funds and other money managers turned more positive about oil prices, increasing net long positions to their highest level since last November.

World Economy

Results for 4Q21 have been reported for major economies, with particularly better-than-expected growth levels in the US and China. Consequently, the world GDP growth estimate for 2021 is revised up to 5.6% from 5.5% in the previous assessment. Global growth for 2022, however, remains unchanged at 4.2%. US GDP was reported at 5.7% for 2021, while the growth forecast for 2022 remains unchanged at 4%. Euro-zone economic growth for 2021 and 2022 remains at 5.2% and 3.9%, respectively. Japan’s economic growth forecast for 2021 and 2022 is unchanged at 1.8% for 2021 and 2.2% for 2022. China’s 2021 growth was reported at 8.1% and the forecast for 2022 remains at 5.6%. India’s forecast for 2021 is unchanged at 8.8%, while the 2022 forecast was revised up to 7.2% from 7% previously, taking into account the acceleration in growth levels in 2H21 and an expected carry-over into 1H22. Russia’s GDP growth forecast remains at 4% for 2021 and 2.7% for 2022. Brazil’s economic growth forecast for 2021 is unchanged at 4.7% and remains at 1.5% for 2022. Key uncertainties remain the spread of COVID-19 variants and the effectiveness of vaccines, as well as the pace of vaccine rollouts worldwide. Moreover, supply chain bottlenecks and sovereign debt levels in many regions, together with rising inflationary pressures and the responses of central banks, also require close monitoring.

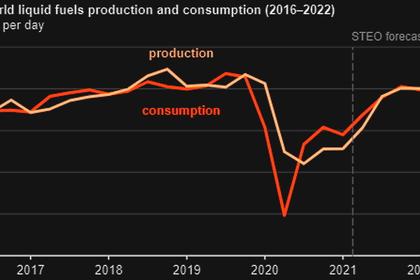

World Oil Demand

World oil demand growth in 2021 is revised up slightly by 17 tb/d, reflecting the latest data trends across the regions, to now stand at 5.7 mb/d. Both 3Q21 and 4Q21 figures for OECD Americas are revised higher, mainly as a result of the better performance in the US, confirming the upward revisions taken last month. Overall, non-OECD growth in 2021 increased by 3.1 mb/d while the OECD recorded growth of 2.6 mb/d. In the OECD, the US continued to be the major driver of oil demand, recording growth of 1.6 mb/d. In 2022, oil demand growth is expected at 4.2 mb/d unchanged from last month, with OECD and non-OECD projected to grow by 1.8 mb/d and 2.3 mb/d, respectively. In the OECD, optimism arises from economic growth with the supportive effects of fiscal and monetary policies expected to more than offset the negative effects from Omicron on oil demand. Industrial activities are also anticipated to accelerate, boosting diesel demand. Meanwhile, mobility has recovered substantially with domestic, regional and international flights already showings signs of recovery.

World Oil Supply

Non-OPEC liquids supply growth in 2021 is revised down by 0.06 mb/d to around 0.6 mb/d y-o-y, to average 63.6 mb/d. An upward revision, mainly to the US, was offset by downward revisions in the supply forecasts of other countries such as Brazil, China, Canada, Ecuador and the UK due to unexpected lower output in 4Q21. The 2021 oil supply forecast primarily sees growth in Canada, Russia, the US, China, Guyana, Argentina, Qatar and Norway, while output is projected to decline in the UK, Brazil, Colombia and Indonesia. For 2022, non-OPEC supply growth remained unchanged at 3.0 mb/d y-o-y, to average 66.6 mb/d. The main drivers of liquids supply growth are expected to be the US and Russia, followed by Brazil, Canada, Kazakhstan, Norway and Guyana. OPEC NGLs are forecast to grow by 0.1 mb/d both in 2021 and 2022 to average 5.1 mb/d and 5.3 mb/d, respectively. In January, OPEC crude oil production increased by 0.06 mb/d m-o-m, to average 27.98 mb/d, according to available secondary sources.

Product Markets and Refining Operations

Refinery margins on the US Gulf Coast versus WTI and in Singapore versus Oman showed strong performance in January, gaining $1.42/b and 50¢/b, respectively, m-o-m, as global product inventory levels reached multi-year lows. However, in Europe refinery margins lost $1.20/b versus Brent, as they were affected not only by higher crude prices, but also record-high natural gas prices, as nearly 80% of all European refineries depend on natural gas to power their plants. In all regions, the strongest positive margin contributor was gasoil, as inventories for that product continued to fall, leading to a higher premium relative to crude oil. At the same time, preliminary data shows global refinery runs rose only slightly, limited by a winter storm that affected operations in parts of the US, hampering a higher upturn in total refinery intakes.

Tanker Market

Coming off a year that saw multi-decade lows, dirty tanker spot freight rates began 2022 close to the bottom end of the five-year range, even as rising bunker fuel prices weighed on earnings. VLCC rates in particular continued to languish in the doldrums while Suezmax and Aframax rates came down from an improved performance at the end of last year. Clean spot freight rates also experienced a similar decline from a slight lift seen at the end 2021 driven by heating demand and weather-related delays that reduced tanker availability.

Crude and Refined Products Trade

Preliminary data shows US crude imports rose 3% m-o-m in January to average 6.5 mb/d, the highest since June 2021. US crude exports fell to the lowest since December 2018, averaging 2.4 mb/d in January. US product imports and exports fell to the lowest since May 2020, the month hit hardest by the pandemic. Meanwhile, the latest data for China shows the country’s crude imports continued to recover from lows seen in October to reach a nine-month high of 10.9 mb/d in December. China’s product exports contracted 24%, m-o-m, in December to the lowest since January 2017, amid government directives to limit the outflow of clean products. India’s crude imports averaged 4.6 mb/d in December, the highest for the year, as refiners looked toward higher runs in 1Q22. India’s product exports reached levels last seen in April 2020, with increases across all major products, except jet fuel, which remained at the still-high level seen in the previous month. Japan’s crude imports have seen a 26% increase over the last two months to average 3.0 mb/d, the highest since December 2019, amid higher refinery runs to meet winter demand and increased use of crude for direct burning.

Commercial Stock Movements

Preliminary December data shows total OECD commercial oil stocks down by 31.2 mb m-o-m. At 2,725 mb, inventories were 311 mb lower than the same time a year earlier, 210 mb lower than the latest five-year average, and 202 mb below the 2015-2019 average. Within components, crude and products stocks fell m-o-m by 18.3 mb and 12.9 mb, respectively. At 1,330 mb, crude stocks in the OECD were 99 mb less than the latest five-year average and 100 mb below the 2015-2019 average. OECD product stocks stood at 1,395 mb, representing a deficit of 111 mb compared with the latest five-year average and 102 mb below the 2015-2019 average. In days of forward cover, OECD commercial stocks in December rose by 0.1 day m-o-m to stand at 61.1 days. This is 10.6 days below December 2020 levels, 2.9 days less than the latest five-year average and 1.3 days lower than the 2015-2019 average.

Balance of Supply and Demand

Demand for OPEC crude in 2021 is revised up by 0.1 mb/d from the last month’s assessment to stand at 27.9 mb/d, around 5.0 mb/d higher than in 2020. Demand for OPEC crude in 2022 was also revised up by 0.1 mb/d from the last month’s report at 28.9 mb/d, around 1.0 mb/d higher than in 2021.

-----

Earlier: