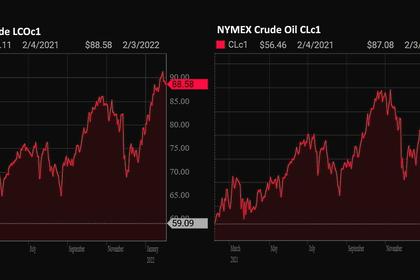

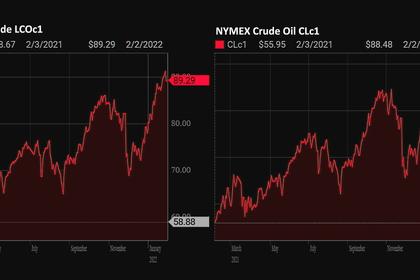

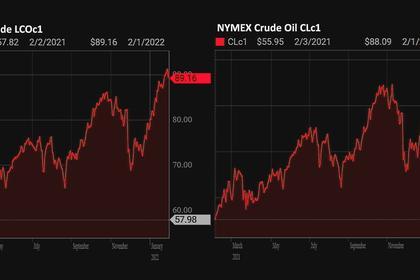

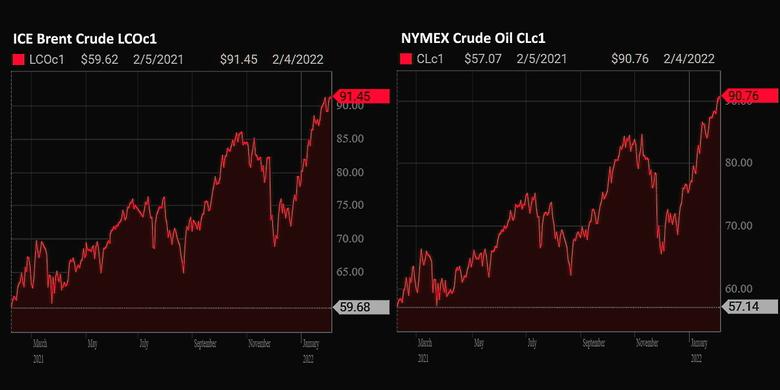

OIL PRICE: ABOVE $91

PLATTS - 04 Feb 2022 - Crude oil futures were higher in mid-morning Asian trade Feb. 4, extending strong overnight gains and sending both benchmarks further above the $90/b handle as a deep freeze sweeps across the US and shuts in production.

At 10:53 am Singapore time (0253 GMT), the ICE April Brent futures contract was up 47 cents/b (0.52%) from the previous close at $91.58/b, while the NYMEX March light sweet crude contract rose 63 cents/b (0.7%) at $90.90/b.

Oil prices had pushed to fresh highs overnight on the heels of media reports that some Permian basin producers had shut in production Feb. 3 because of freezing temperatures and ice disrupting trucking operations.

"WTI crude surged over the $90[/b] level after an arctic blast made its way to Texas and disrupted some oil production in the Permian Basin," OANDA's senior market analyst Ed Moya said in a Feb. 4 note. "The oil market is too tight and vulnerable to any shock. Even as thousands of flights are canceled, the energy market is fixated [on] production and not so much short-term demand shocks."

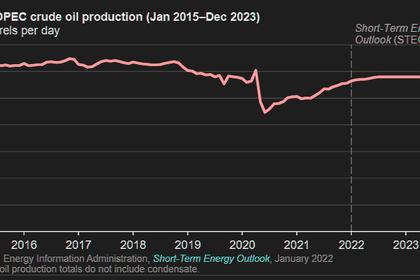

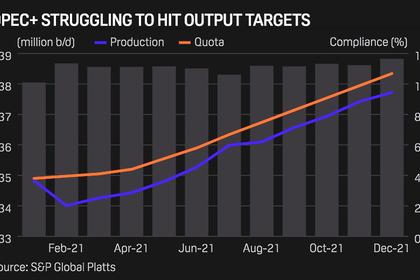

The latest disruption will further compound fears of a widening supply deficit as demand continues to recover globally and OPEC producers struggle to raise output to adequate levels.

The backwardation in prompt time spreads for ICE Brent has widened in a sign of the growing call on prompt oil barrels. The M1-M2 spread was trading around $1.45/b as of 0230 GMT, up from a $1.39/b settlement at the start of February.

The Q1-Q2 spread was trading around $3.40/b, up from $3.26/b as of the Asian close at 4.30pm in Singapore Feb. 3, a record high according to S&P Global Platts data of Asia's closing prices going back to Oct. 2014.

"$100/b oil now looks in sight and the possibility of oil trading in triple-digit prices is growing," OCBC Treasury Research analysts said in a note.

Nonetheless, oil executives said US oil production will ramp up soon, potentially easing the supply crunch. US oil producer ConocoPhillips' CEO Ryan Lance said Feb. 3 that the US' crude production may grow as much as 900,000 b/d this year and could be cause for worry.

"[It's] right at the front of our mind," he said. "I am absolutely concerned about it. If you're not worried about it, you should be."

S&P Global Platts Analytics forecasts similar growth in US output. "We expect exit-to-entry growth of 880,000 b/d and average 12.05 million b/d in 2022," Platts Analytics' manager for North American Supply Rene Santos said.

-----

Earlier: