OIL PRICE FOR INDIA: $100

PLATTS - 21 Feb 2022 - Oil's climb towards $100/b may prompt Indian refiners to diversify their crude import basket as fears grow that a Russia-Ukraine conflict could disrupt flows and squeeze supplies in a market that is already feeling the pinch due to lower availability, the head of the Federation of Indian Petroleum Industry told S&P Global Platts.

As geopolitical tensions rise, leading oil importers are hoping for a favorable US-Iran nuclear agreement which would open up flows from the OPEC producer and ease the tight supply situation and global oil prices, FIPI's director general Gurmeet Singh said in an interview.

"In the current scenario, [the] demand for oil has outpaced production growth as economies slowly rebound from the worst of the pandemic, leaving the market with a small buffer to mitigate an oil supply shock," Singh said.

"A Russian invasion of Ukraine could drive up the already-high oil and natural gas prices, prolonging elevated inflation around the world. As such, the threat of a Russian invasion of Ukraine would shake up a fragile global oil market, pushing prices closer to $100/b," he added.

US officials, including President Joe Biden, have said in recent days that they believe Russian President Vladimir Putin has made the decision to invade Ukraine.

Iran's return to the market

Singh added that Washington was working towards reviving a nuclear deal with Iran that would release as much as a million barrels a day to the world market. The current round of nuclear talks between Iran and the United States is in the final stage of negotiations.

"If a deal is reached, Iran would ramp up crude and condensate production within four to six months and its oil exports could rebound to the pre-sanctions level of 2.5 million b/d. A favorable US-Iran nuclear agreement will allow more oil exports from the OPEC producer, and reduce the pressure on the international oil prices," he added.

High crude prices impact the Indian economy in a significant way since India imports almost 83%-84% of its total crude oil requirements. Higher crude oil and petroleum product prices lead to higher inflation rates in the economy.

For every 10% increase in crude oil prices, the wholesale price index increases by 0.9%-1% and the consumer price index by 0.4%–0.6 %. A 10% rise in oil prices leads to an increase of nearly $15 billion in India's current account deficit, or 0.4% of its GDP, leading to a depreciation in the Rupee, Singh said, quoting financial institutions.

"For oil marketing companies, higher crude prices lead to higher borrowings for working capital and higher interest rates. This impacts the profit margins of oil marketing companies," Singh said.

He added that as prices remain elevated, Indian refiners have the option to diversify their crude procurement by securing various grades of crude, from sour to sweet, that are available at competitive rates.

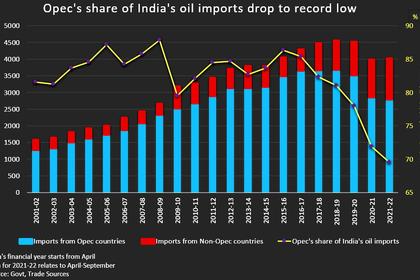

Indian refiners have been diversifying their crude mix. In 2021, OPEC's share in the Indian crude mix shrunk to 70% from as high as 87% in 2008. India has been increasing crude oil imports from the US and Canada. In 2021, US and Canadian oil accounted for a record 7.3% and 2.7% of India's imports, respectively, compared with 5.5% and 0.7% a year earlier, Singh added.

Surging oil, energy transition

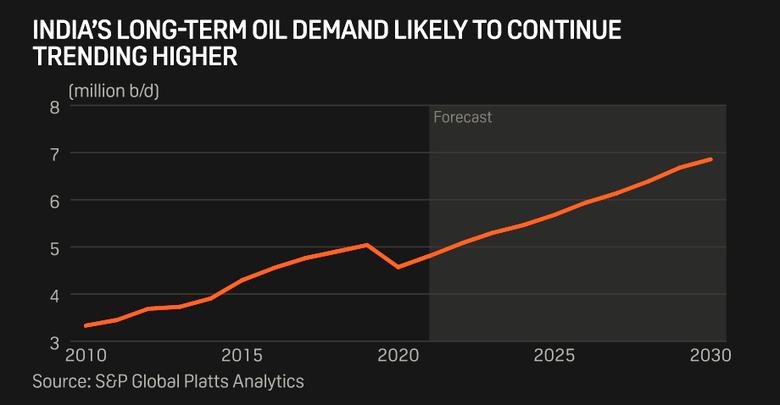

According to Platts Analytics, India's oil demand is expected to grow by 260,000 b/d in 2022, up from a growth of 240,000 b/d in 2021.

Singh said refiners in the country were increasingly pursuing strategies that would help them stay relevant even if the energy landscape changes drastically, while at the same time help to absorb the shock from volatile oil prices.

"Indian refiners, which are traditionally geared to maximize output of gasoil and gasoline, are widening their product slate by improving efficiency and installing petrochemical production units," Singh said.

The wide variety of end uses for petrochemical products -- durable and non-durable -- in technology, medical, packaging, automotive, construction, and so many other applications support robust growth in different scenarios, he added.

Hit hard by the soaring oil prices, refiners have also been aggressively looking for diversification towards clean energy projects, Singh said.

"Energy players are looking to retain their profitable core while also capturing some of the clean sources of opportunities emerging in low-carbon markets, including renewable power, bioenergy, next-generation mobility, energy services, and hydrogen," he added.

India's announcement that it aims to reach net zero emissions by 2070, as well as the target to meet 50% of its electricity requirements from renewable energy sources by 2030 would have a big impact on the country's energy basket and its fight against climate change, Singh said.

"With a rising energy consumption base and progress towards energy transition, the oil and gas industry will remain a vital part of the global energy mix by adapting and positioning itself to provide lower-carbon energy products to consumers around the world," Singh said.

-----

Earlier: