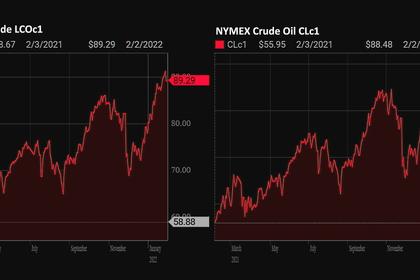

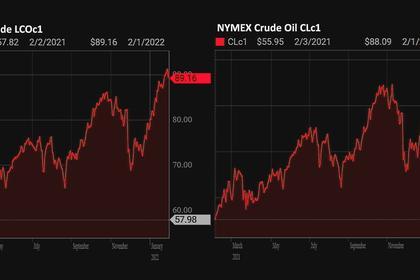

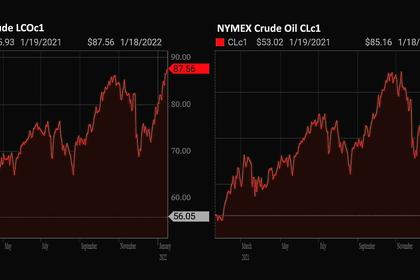

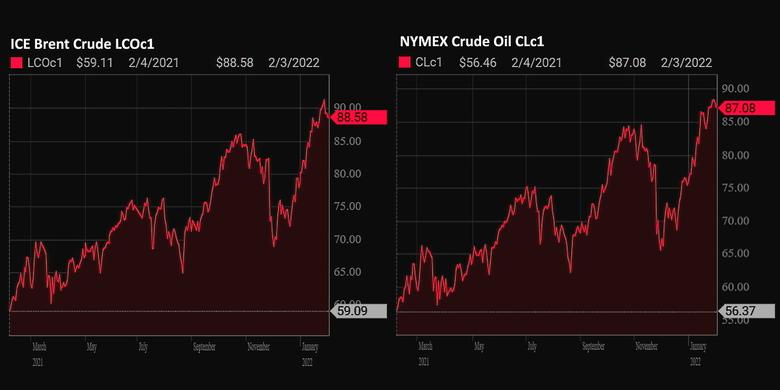

OIL PRICE: NOT ABOVE $89

PLATTS - 03 Feb 2022 - Crude oil futures were lower in mid-morning trade in Asia Feb. 3 after the OPEC+ producer group agreed to raise output as expected, while thin trading volumes were expected to linger for the remainder of the week.

At 9:47 am Singapore time (0147 GMT), the ICE April Brent futures contract was down 43 cents/b (0.48%) from the previous close to $89.04/b, while the NYMEX March light sweet crude contract fell 60 cents/b (0.68%) at $87.66/b.

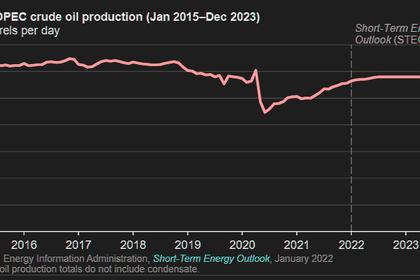

OPEC and its allies Feb. 2 proceeded as planned with another modest hike in crude production quotas for March, in the face of surging oil prices and rising geopolitical market risks.

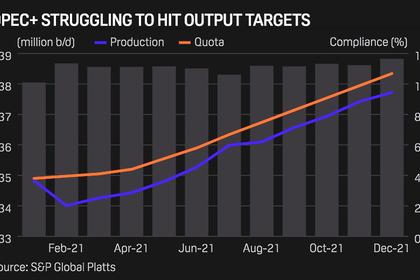

In a meeting that wrapped up at a record low 16 minutes, the OPEC+ alliance arrived at the same conclusion as it had in the previous seven months -- no additional supplies beyond the previously agreed 400,000 b/d monthly tapering of its pandemic output cuts were needed.

The decision came as no surprise to market watchers, who noted that it makes little difference to oil markets as OPEC producers continue to face issues in raising output to adequate levels due to aging equipment.

"Energy traders were not surprised and sold the OPEC+ announcement," said OANDA senior market analyst Edward Moya in a Feb. 3 note. "The oil market is not really any closer to seeing additional barrels of crude, but today we are not seeing any fresh catalysts to send prices to fresh highs."

Trading volumes are expected to remain thin for the remainder of the week with several Northeast Asian markets still closed for the Lunar New Year holidays.

Crude prices also saw some selling pressure overnight after Iran's oil minister Javad Owji said Feb. 2 that the country was ready to supply more oil to global markets as quickly as possible.

In the US, crude oil inventories were seen declining 1.05 million barrels in the week ended Jan. 28 to 415.14 million barrels, snapping two weeks of builds and pushing stocks 8.6% behind the five-year average, Energy Information Administration data showed Feb. 2.

Nationwide distillate inventories fell 2.41 million barrels over the same period to 122.74 million barrels, while total gasoline inventories climbed for a fifth straight week, building 2.12 million barrels to 250.04 million barrels, the EIA said.

"The holiday-shortened week for many markets in the region will continue to draw thin trading volume, with China and Hong Kong markets still closed for holiday [Feb. 3]," said IG market strategist Yeap Jun Rong.

-----

Earlier: