OPEC+ RUSSIA: +400 TBD

PLATTS - 31 Jan 2022 - OPEC and its allies are largely expected to affirm another 400,000 b/d hike in crude oil production quotas for March when they meet Feb. 2, but sure to be weighing on the virtual discussions will be the elephant in the room -- potential Western sanctions on Russia.

Should those sanctions come to pass, the oil market could be suddenly cut off from the world's second largest producer behind the US, at a time when global demand is roaring back from the pandemic.

Members with spare output capacity, mainly Saudi Arabia and the UAE, may be asked by their key customers to ease the squeeze with additional production beyond their quotas, which could jeopardize their five-year OPEC+ alliance with Russia.

Loath though they are to insert geopolitics into their meetings, ministers may have no choice but to acknowledge the situation and make contingency plans to avoid a globally destabilizing oil price spike.

"I'm guessing it will probably come up in discussions," one OPEC source told S&P Global Platts on condition of anonymity, while another added that the group was well aware that its relations with Russia could be on thin ice if other members rush in to claim its market share.

"I do not imagine that Russia will accept the principle that countries which have additional spare capacity can increase their production when it cannot do so," the second source said.

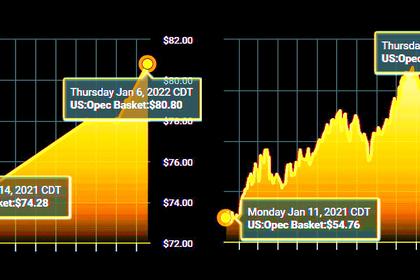

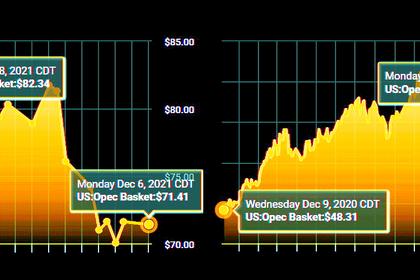

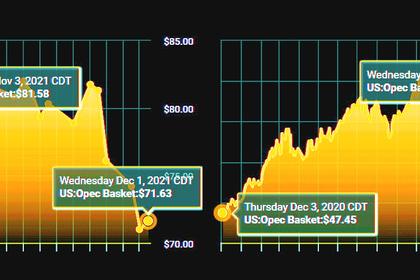

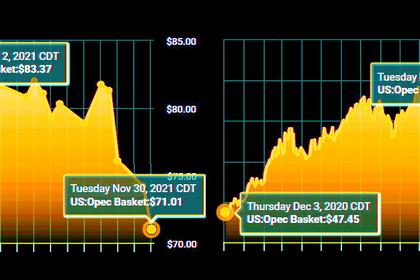

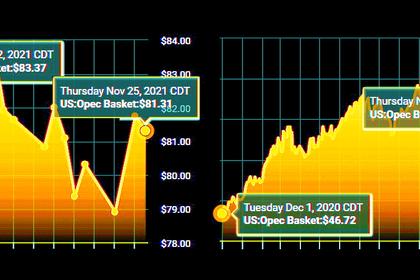

Already, oil prices have hit seven-year highs in recent days over the ratcheting tensions between the West and Russia over Ukraine. Platts assessed Dated Brent at $92.86/b on Jan. 28, up 18% year-to-date, with traders citing a tight market in the Mediterranean and few alternatives to Russian Urals crude available.

OPEC is, of course, no stranger to geopolitics, surviving through wars between members. Iran and Venezuela are currently under US sanctions that have taken a huge bite out of their crude exports.

But a hit to Russia's oil production could be on a different scale entirely.

OPEC changed the entire dynamic of the market when it teamed up with Russia and nine other countries starting in 2017 in a so-called Declaration of Cooperation to control about half of global crude supply.

Russia is regularly the OPEC+ group's largest producer, though sometimes it trades the spot with OPEC kingpin Saudi Arabia. Russia pumped 10.01 million b/d of crude in December, according to the latest Platts survey of the alliance's output, while Saudi Arabia produced 9.95 million b/d.

Unwinding pandemic cuts

The US and European nations have threatened heavy sanctions against Russia if it invades Ukraine.

Most impactful in the near-term to the oil market would be a ban on Russia's access to the SWIFT payments platform and the use of the US dollar in transactions, which would effectively cut of the country from the global financial system.

Analysts say this amounts to a "nuclear option" that the West would likely want to avoid, for fear of causing oil prices to skyrocket and potential retaliatory measures by Russia.

"Russia's purposely ambiguous intentions will keep markets on edge until the uncertainty subsides," Paul Sheldon, Platts Analytics' chief geopolitical adviser, said in a note.

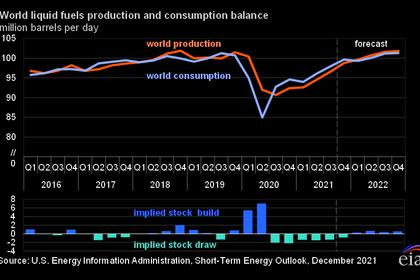

For now, many barrel counters, including OPEC's own analysis arm, see the market in surplus throughout the first quarter, due to seasonal demand weakness.

Balances are likely to tip into deficit sometime in the second or third quarters, making it likely that the OPEC+ alliance will continue on with its monthly 400,000 b/d quota hikes unless clear evidence emerges that it is oversupplying the market and prices retreat, analysts say. The group is on pace to unwind its record 9.7 million b/d pandemic cut, instituted in May 2020, by late 2022.

An advisory delegate-level technical committee will convene Feb. 1 to analyze various market outlooks, followed by a ministerial monitoring committee meeting on Feb. 2 and then the full OPEC+ conference immediately afterwards.

Meeting the market's needs

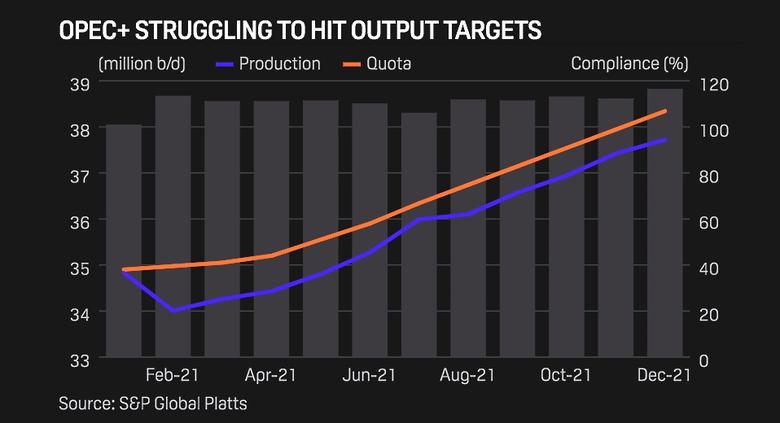

But beyond Russia, shrinking OPEC+ spare capacity is becoming an increasing worry, as several members continue to fall well short of their production quotas, raising doubts about the alliance's ability to meet rising oil demand in the coming months.

The 22 members with quotas under the Declaration of Cooperation pumped a collective 621,000 b/d below their targets, according to Platts estimates.

At some point, if forecasts of supply deficits come true later this year, the alliance may come under increasing pressure from its key customers, including the US, India and Japan, to scrap its quotas and allow Saudi Arabia and the UAE, which hold some 95% of global spare capacity, according to Platts Analytics, to pump at will.

So far, both countries have rejected such suggestions, opting for internal OPEC+ harmony rather than intra-OPEC+ competition.

"As for the capacity constraints, it is so sensitive to discuss this topic at this stage," a delegate told Platts. "The group is able to meet the majority of its commitments. Let's wait and see. This might be a short-lived sentiment."

A loss of Russian barrels to sanctions would only exacerbate the situation.

Delegates can only watch the Ukraine crisis unfold from afar, but a test of loyalty between the keeping alliance's key customers, including the US and Europe, happy and maintaining critical relations with Russia may be coming soon.

-----

Earlier: