OPEC+ WILL UP BY 400 TBD

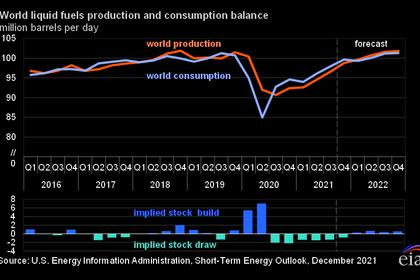

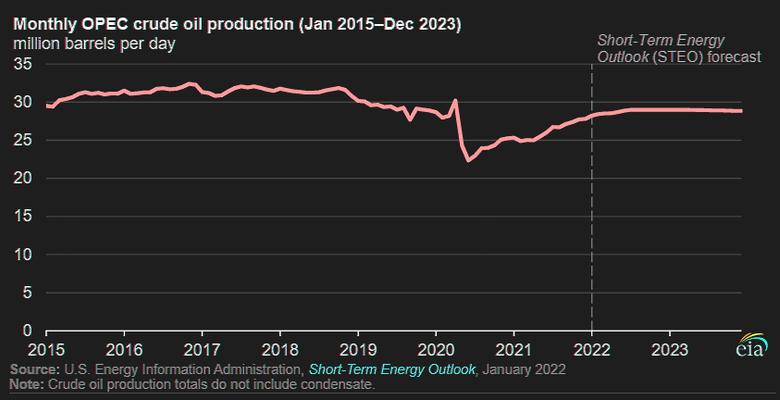

PLATTS - 01 Feb 2022 - The oil market will be oversupplied by 1.3 million b/d in 2022 if OPEC and its allies fully unwind their production cuts as planned, the group's advisory technical committee heard Feb. 1, as ministers appear likely to approve another 400,000 b/d hike in quotas for March.

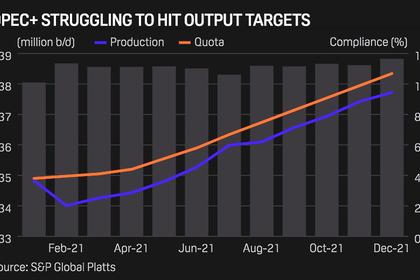

But the inability of several members to hit their quotas over the past several months casts significant doubt on whether the alliance will actually bring on as much supply as it is aiming for.

The 19 OPEC+ countries with quotas underperformed their production targets by 832,000 b/d in December, according to analysis prepared for the committee and seen by S&P Global Platts.

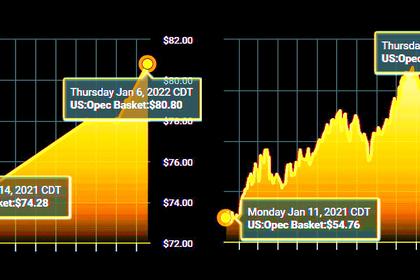

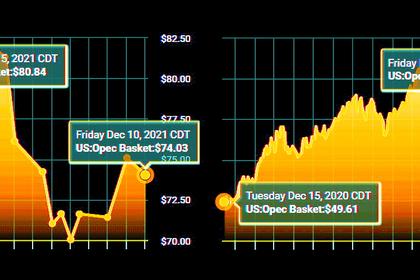

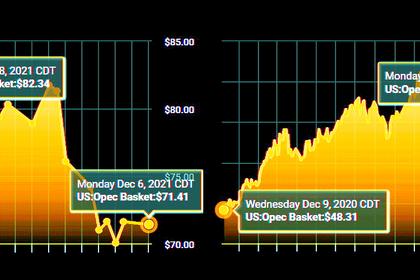

Continued shortfalls, which are likely if the producer bloc keeps raising its quotas to taper its production cuts, could very well tip the market into deficit and put upward pressure on oil prices.

An even worse supply crunch could result if the US and European nations impose sanctions on Russia that impact its oil exports, as they have threatened in the case of an invasion of Ukraine. Russia is the top OPEC+ producer, pumping 10.01 million b/d in December, according to the latest Platts survey of the group's output.

Sources said, however, there was no discussion at the delegate-level committee meeting on the potential sanctions and their impact on the oil market. Nor was there consideration of members with spare output capacity breaching their quotas to make up for other countries' underproduction.

Platts Analytics estimates that Saudi Arabia and the UAE hold some 95% of the group's extra production capacity, but both countries have said they have no intention of risking the harmony within the alliance to infringe on others' market share.

"The consensus is that [the underproduction] is a temporary situation," one delegate said on condition of anonymity. "Countries will recover and meet their quotas."

Eventual US sanctions relief for Iran could ease the possible market tightness, with a Biden administration official saying Jan. 31 that the six-month negotiations over the nuclear deal were entering their "final stretch," though a full agreement that leads to unimpeded Iranian oil exports may not be implemented for months.

A nine-country OPEC+ ministerial committee will meet at 1 pm Vienna time (1300 GMT) on Feb. 2 to review the analysis, before the full conference convenes at 2 pm (1400 GMT) to set March quotas.

Three delegates said the expectation is to affirm another 400,000 b/d rise, as the group has done every month since July.

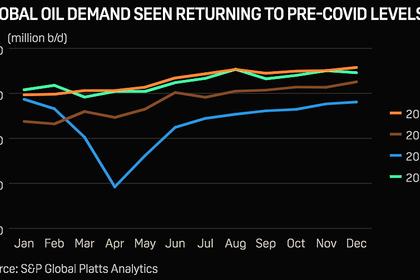

Demand recovery expected

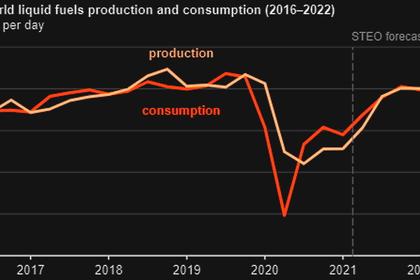

According to the market analysis prepared for the committee, global oil supply will exceed demand by 1.4 million b/d in the first quarter, rising to 1.7 million b/d in the second quarter.

Demand is expected to surpass pre-pandemic levels in the second half of the year "with a healthy recovery trend," the analysis showed, easing the market oversupply to 1.2 million b/d in the third quarter and 1.1 million b/d in the fourth.

The outlook assumes that the OPEC+ alliance will continue raising quotas by 400,000 b/d each month until the record pandemic cuts are eliminated by late 2022, and that Libya, Venezuela and Iran, which are exempt from quotas, maintain their December levels of output.

It also builds in an expected 40 million barrel release from the US Strategic Petroleum Reserve in the first half of 2022, and a return of 13.3 million barrels to the SPR in the third quarter, as the US government has planned.

The technical committee "cautioned against significant uncertainties associated with the potential impact of the omicron variant, ongoing supply chain bottlenecks, recent central bank policy shifts to accommodate upside inflation, volatility in commodity markets, growing capacity strains from underinvestment in the oil industry, the challenge of high sovereign debt levels in many regions and geopolitical risks," it said in a report.

-----

Earlier: