RUSSIA, CHINA ENERGY DEALS

PLATTS - 04 Feb 2022 - Russia and China signed new energy supply deals Feb. 4, as tension with the West over Ukraine underlines the strategic importance of further supply diversification to the East.

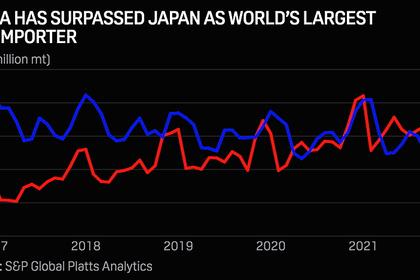

State-run oil giant Rosneft signed a 10-year supply deal with China's CNPC for supplies of 100 million mt, or 200,821 b/d, of crude on the sidelines of a state visit by President Vladimir Putin to China.

The deliveries will be shipped via Kazakhstan for refining at plants in Northwest China, Rosneft said.

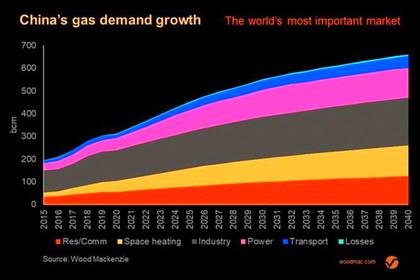

Separately, Russia's Gazprom signed a 10 Bcm/year gas supply deal with CNPC which will see Gazprom's pipeline supplies to China reach 48 Bcm.

Russia has long aimed to capitalize on its vast resources and strategic location to cater to the increasing demand in China. This strategy has picked up pace since 2014, when Western sanctions against Russia limited Western companies' involvement in the Russian energy sector

Geopolitical tension, as well as global demand recovery, has seen prices for Russia's key crude grade Urals rise since the start of the year. S&P Global Platts assessed Urals at $88.165/b Feb. 3, up 14% from the first assessment of the year on Jan. 4 at $77.5/b.

Some analysts see the latest tension around Ukraine as likely to further stimulate Russia-China energy ties.

"Risks of Western sanctions on the Russian energy sector will only reinforce a desire to increase export optionality to Asia, in addition to a desire for Chinese investment in upstream development," Paul Sheldon, chief geopolitical adviser at Platts Analytics said.

Supply deals

The new energy deals are set to increase Russia's existing oil and gas shipments to China.

Rosneft already cooperates with Chinese partners on crude oil production in Russia through Udmurneft and Verkhnechonskneftegaz, and shipbuilding at the Zvezda shipyard.

Russian crude shipments via pipeline to China were flat on the year in 2021 at 40 million mt, or 803,287 b/d, according to Russian pipeline operator Transneft. One quarter of these deliveries were shipped via Kazakhstan.

Local media said that the new deal is worth $80 billion, citing Rosneft.

Russia's key oil export route to China is the 80 million mt/year, or 1.6 million b/d East Siberia-Pacific Ocean pipeline. Designed before sanctions hit the Russian energy sector, the pipeline ships directly to China, as well as via the port of Kozmino.

Premiums for ESPO Blend crude oil surged in January, beating traders' estimates, aided by robust buying interest and tight supplies.

March-loading barrels of ESPO Blend crude were heard to have been sold via several tenders at premiums of around $4.65/b-$5.10/b to Platts front-month Dubai crude assessments.

The premiums surpassed traders' expectations of a $4/b increase to the Dubai benchmark, Platts reported earlier. In comparison, February-loading barrels of the crude traded at $2.80/b-$3.50/b last month.

Russia also plans to significantly increase oil shipment volumes to the East in the next decade through the development of the Northern Sea Route, which runs through Arctic waters.

Russian President Vladimir Putin highlighted the importance of energy in opening remarks at his meeting with his Chinese counterpart Xi Jiping.

"Our oil companies have prepared good, new solutions for hydrocarbons shipments to China. And the gas industry has also taken another step forward - I am talking about the new contract for the supply of gas to China from the Russian Far East at 10 billion cubic meters per year," Putin said, according to a statement posted on the Kremlin website.

Gas cooperation

The latest gas deal follows a 30-year supply contract for 38 Bcm/year between Gazprom and CNPC signed in 2014.

Shipments are carried out via the Power of Siberia pipeline, which was launched in December 2019.

Gazprom is also developing Power of Siberia 2, with shipments via Mongolia, that will increase gas supply capacity to China by a further 50 Bcm/year.

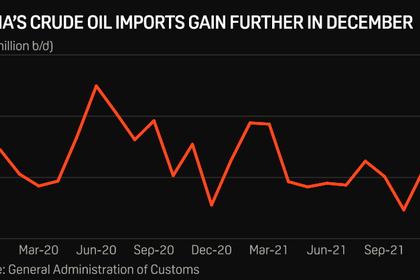

China's gas imports from Russia rose 50.5% year on year in 2021, with pipeline gas volume surging 154.2% year on year to 7.54 million mt while LNG imports fell 9.9% year on year to 4.58 million mt, according to the data released by China's General Administration of Customs on Jan. 20.

Analysts see Russia's ability to redirect gas supplies away from Europe to Asia as limited currently.

"In terms of flows moving East, at this juncture, there seems to be no plausible way to move gas East. The problem being no connection between Yamal and Power of Siberia. As of now, there also isn't enough LNG capacity for Yamal LNG to start exporting more gas from Gazprom. In the longer term, Russia could build a pipeline connecting Yamal to export routes to China," SOVA Capital analyst Mitch Jennings said.

Chinese investors have also increased their investments in Russian projects since 2014 when Russian companies' access to Western financing was restricted due to sanctions.

Novatek has been a major beneficiary. CNPC had bought 20% of shares in Yamal LNG in 2013, and in 2015 the Silk Road Fund took a 9.9% stake in the project. In 2016 Chinese banks also agreed to lend Novatek $12 billion for the project.

Novatek's Arctic LNG 2, currently under development, has also benefitted from Chinese investment, with CNOOC and the CNPC subsidiary CNODC each holding a 10% stake in the project. Novatek has since signed supply contracts with Chinese companies including Shenergy Group and Zheijang Energy.

-----

Earlier: