RUSSIA SANCTIONS: CONTINUATION

PLATTS - 21 Feb 2022 - The US and EU are for now holding off imposing broad economic sanctions that could impact energy and commodity markets after Russian President Vladimir Putin claimed breakaway regions of Ukraine.

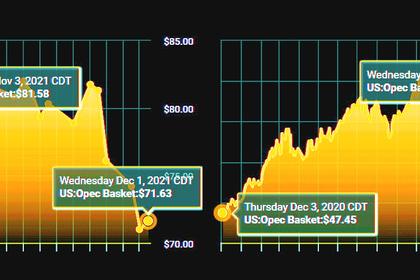

Crude oil futures rose sharply Feb. 21 as risks of a conflict between Russia and Ukraine escalated, undermining earlier hopes for a fresh diplomatic solution.

At 1810 GMT, the ICE April Brent futures contract was up $1.91/b (2.04%) from the previous close at $95.45/b, while the NYMEX April light sweet crude contract was $1.91/b (2.12%) higher at $92.12/b

US President Joe Biden plans to issue an executive order sanctioning individuals in the so-called DNR and LNR regions of Ukraine, White House press secretary Jen Psaki said in a statement.

"To be clear: these measures are separate from and would be in addition to the swift and severe economic measures we have been preparing in coordination with Allies and partners should Russia further invade Ukraine," Psaki said.

'Just the start'

The targeted sanctions are "just the start" as the crisis escalates, according to Suzanne Maloney, Brookings Institution vice president.

Specific sanctions will depend on what happens next in the standoff, said Paul Sheldon, chief geopolitical adviser for S&P Global Platts Analytics. "Anything less than an overt military incursion would depend on the circumstances," he said.

The "swift and severe" measures that have been threatened for months are expected to target Russia's major banks and the 55 Bcm/year Nord Stream 2 gas pipeline to Germany.

Analysts do not yet expect Western governments to impose energy sector sanctions, ban Russia from dollar trades or block access to the international financial messaging service SWIFT, both of which would have massive consequences for energy markets and the global economy.

Risks to energy markets

Energy flows and prices will be hard to shield from a major conflict, according to some analysts.

Eddie Fishman, who advised on sanctions issues in the Obama administration's State Department, predicted that it would be impossible to keep energy "off the table long term if Russia were to invade Ukraine."

Platts Analytics does not expect the US to impose secondary sanctions on Russian oil customers, given Europe's heavy dependence on the flows and oil prices already in the mid-$90s/b.

"The West is unlikely to jeopardize such large volumes," Platts Analytics said.

Russia was the No. 3 oil supplier to the US in November after Canada and Mexico, US Energy Information Administration data showed Jan. 31, as the Ukraine crisis threatens to disrupt the flows.

Platts Analytics expects any disruption in the Russian crude to have a minor effect, as US refiners could backfill by easing exports of US Gulf Coast sour crudes, such as Mars. Lower US imports of Russian oil feedstocks would have a bigger impact, but Gulf Coast refiners could run Canadian or Latin American heavy grades at the cost of margins.

-----

Earlier: