RUSSIAN OIL FOR CHINA UP

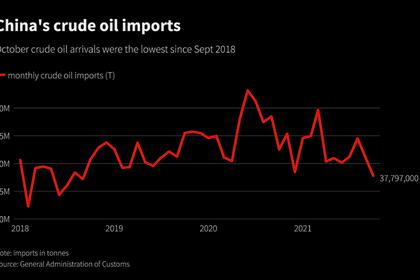

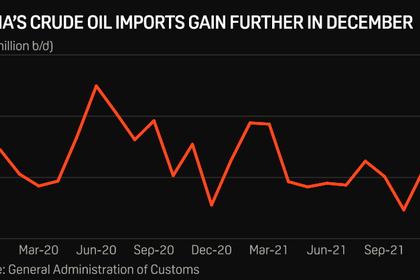

PLATTS - 14 Feb 2022 - China's independent refiners snapped up record volumes of ESPO crude in January to meet the country's robust winter demand for low-vapor gasoil, helping Russia to become the biggest supplier of feedstock to the Shandong-based refiners.

But as crude oil markets inch closer to $100 a barrel and remain on tenterhooks amid fears of a potential Russian invasion into Ukraine, China's independent refiners will be keeping a close eye on geopolitical developments to see if there would be a need to alter their buying plans.

According to the S&P Global Platts data on Feb. 14, Russia returned as the top supplier to China's independent refineries in January -- overtaking Malaysia -- with arrivals amounting to 2.77 million mt, up 45.7% from the previous month.

Taking the lion's share, Russian ESPO arrivals into Shandong -- home to the country's small-sized independent refineries -- amounted to 2.55 million mt, up by a robust 34.1% on the month. A few cargoes of Sokol and some fuel oil from Russia also contributed to the final numbers.

Imports of ESPO in January was also 3.1% higher from the last record level of 2.473 million mt in July 2021.

Normally, about 26 to 30 cargoes of ESPO crude gets loaded from Russia's Far East ports on a monthly basis, and around 60%-70% of the Russian ESPO exports end up at Shandong ports.

The price impact

As demand remains strong, premiums for April-loading ESPO has inched higher, with independent refineries expecting premiums to be at least $6-$6.5/b higher against the ICE Brent Futures on a DES Shandong basis by Feb. 14, they said. This would be higher than their expectations of $5.5-$6/b late-last week on a similar basis.

In addition, Middle Eastern crude suppliers continued to send more barrels to China's independent refineries in January, a trend that will likely continue in 2022.

Five suppliers from the Middle East figured among the top 10 suppliers to independent refiners in January, supplying a total of 7.81 million mt of crude oil, up 3.8% from December 2021 levels.

The combined imports from those five countries -- Saudi Arabia, Iraq, Oman, UAE and Kuwait -- accounted for 47.7% of the total feedstock imports in January. This compared with a share of 44% in the previous month and 37.4% in the same month a year earlier.

In 2021, China's independent refineries had increased imports by 10% to 70.4 million mt from those five countries, up from 64 million mt a year earlier, boosting their market share from 34% in 2020 to 39% in 2021.

The private refining complex, which are designed to crack medium-sour crudes, have been on a buying spree for the Middle Eastern barrels.

And this is likely to increase further with the potential startup of the new 16 million mt/year Shenghong refining complex sometime from March onwards. Shenghong is designed to process crudes from Saudi Arabia, with a ratio of 50:50 for Arab Light and Arab Heavy.

Appetite for blended crudes

Some more Middle Eastern crudes also made its way into China's independent refineries as blended crudes with Malaysian grades.

In January, at least 2.275 million mt of Iranian crudes have been discharged, mainly into Shandong ports. These grades reported include Mal Blend, Oman, Upper Zakum, and a few others. Out of these, around 856,000 mt of Mal Blend imports originated from Iran last month, according to Kpler shipping data and market sources.

Shandong-based small sized independent refineries have been increasing their imports for blended crudes due to better economics.

Besides Mal Blend, bitumen blend, which also comes from Malaysia, continued to flow into Shandong and accounted for 1.04 million mt of the volumes in January, up 119% on the month.

Bitumen blend, which doesn't require crude import quotas, continued to be a major supplement feedstock for plants short of crude import quotas.

Platts collects information covering feedstocks imported by independent refineries in Shandong province, Tianjin, Zhoushan and Dalian, Lianyungang, including 32 crude import quota holders, and other non-quota holders.

These 32 refiners have been awarded a combined 99.7 million mt of crude quotas in the first batch of 2022, accounting for 93% of the total allocations to the independent refining sector in 2022.

-----

Earlier: