U.S. OIL PRODUCTION WILL RISE

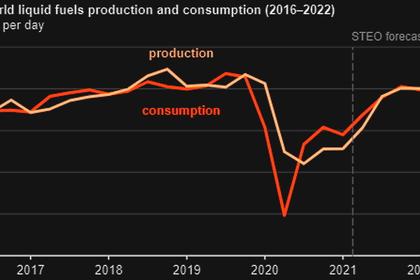

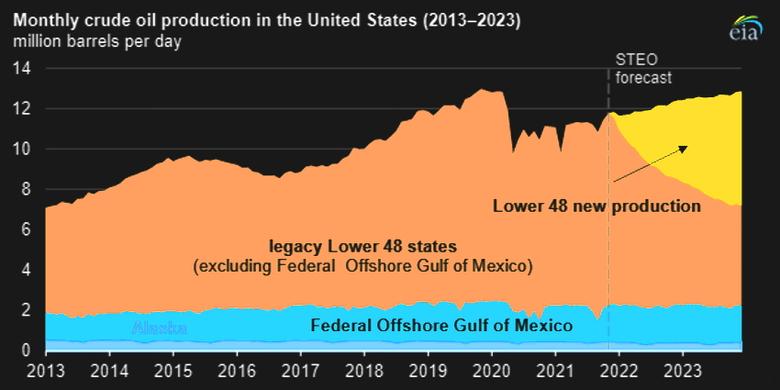

U.S. EIA - FEBRUARY 16, 2022 - In our February 2022 Short-Term Energy Outlook (STEO), we forecast that crude oil prices will remain high enough to drive U.S. crude oil production to record-high levels in 2023, reaching a forecast 12.6 million barrels per day (b/d). We expect new production in the Permian Basin to drive overall U.S. crude oil production growth.

In the February STEO, we forecast that U.S. crude oil production will increase to 12.0 million b/d in 2022, up 760,000 b/d from 2021. We forecast that crude oil production in the United States will rise by 630,000 b/d in 2023 to average 12.6 million b/d. We expect more than 80% of that crude oil production growth to come from the Lower 48 states (L48), which does not include production from Alaska and the Federal Offshore Gulf of Mexico.

Production from new L48 wells, particularly in the Permian region, drive our forecast of U.S. crude oil production growth. Legacy production, or crude oil production from existing wells, typically declines relatively quickly in tight oil formations, and we expect that production from new wells will offset these legacy production declines.

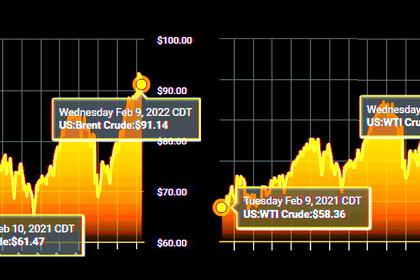

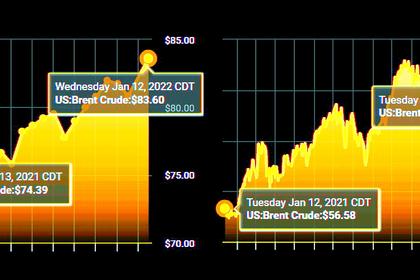

Crude oil prices have generally increased since April 2020, resulting in increased crude oil production. The Brent spot price for crude oil (the international benchmark) reached $97 per barrel (b) on February 7, 2022, the highest nominal price (not adjusted for inflation) since September 17, 2014.

From January 8, 2021, to February 7, 2022, the L48 added 220 oil-directed rigs, 114 of which were in the Permian region. We forecast that production in the Permian region will average 5.3 million b/d in 2022 and 5.7 million b/d in 2023.

Our crude oil production forecast assumes the West Texas Intermediate crude oil price averages $79/b in 2022 and $64/b in 2023, which we expect will lead to continued increases in drilling activity and crude oil production in the United States. The price forecast is highly uncertain, however, and a number of factors could push prices higher or lower than our forecast.

-----

Earlier: