BRITAIN NEED OIL

PLATTS - 15 Mar 2022 - UK Prime Minister Boris Johnson will meet with the crown princes of Saudi Arabia and the UAE March 16, his office said, seeking more oil supplies from the OPEC members as western powers continue to scramble for alternatives to Russian energy.

Sanctions imposed on Russia's financial sector have effectively cordoned off a significant chunk of the country's more than 7 million b/d of crude and refined product exports from European and American customers, as prices have soared, fueling record inflation in major economies.

But getting Saudi Arabia and the UAE to agree to pump more crude would require them to break a more-than-five-year partnership with Russia that has forged strong ties beyond oil — an uncertain prospect as they increasingly look eastward for political allies.

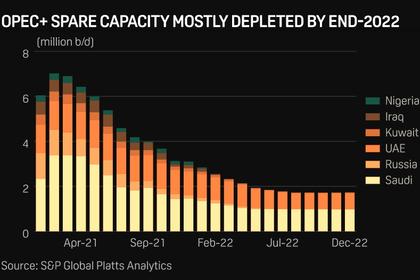

The two countries are essentially OPEC's only members with spare production capacity available to help ease the supply crunch the sanctions caused.

S&P Global Commodity Insights' Platts Analytics estimates that by May, Saudi Arabia will hold just under 1 million b/d of additional production upside, while the UAE will hold about 755,000 b/d. Every other OPEC member will be effectively maxed out, and several are plagued by severe instability in their oil production.

Downing Street said Johnson's one-day trip would begin in Abu Dhabi to meet Crown Prince Mohammed bin Zayed before the prime minister then flies to Riyadh for an audience with Crown Prince Mohammed bin Salman. Both princes are the de facto leaders of their countries.

"The world must wean itself off Russian hydrocarbons and starve [Russian President Vladimir] Putin's addiction to oil and gas," Johnson said in a statement. "Saudi Arabia and the United Arab Emirates are key international partners in that effort. We will work with them to ensure regional security, support the humanitarian relief effort and stabilize global energy markets for the longer term."

The UK itself has said it will ban imports of Russian oil by the end of 2022.

Protecting the alliance

What kind of reception Johnson will get in Riyadh remains unclear.

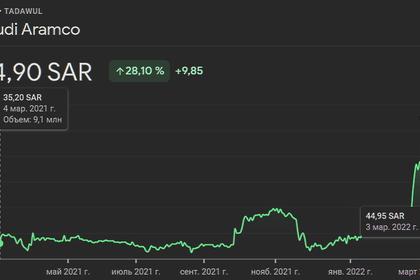

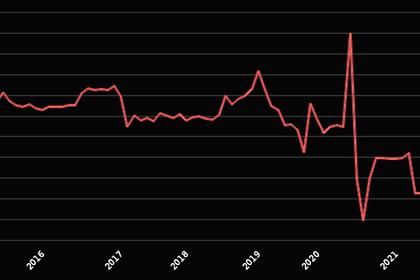

Even before Russia's invasion of Ukraine, Saudi Arabia had steadfastly rebuffed appeals to more aggressively raise production to cool off rising prices, preferring to remain cautious in the face of the pandemic and protect hard-earned revenue gains after the market crash of 2020.

Saudi officials have also been very careful not to be seen infringing on other OPEC+ members' market share, in particular Russia, to keep them in the producer bloc's fold. The Saudi energy ministry had no immediate comment on Johnson's visit.

The UAE may be more receptive. The country's ambassador to the US, Yousef al-Otaiba, said March 9 it "will be encouraging OPEC to consider higher production levels," following a high-level call between Emirati and American diplomats.

UAE energy minister Suhail al-Mazrouei later tempered expectations, saying the country was still supportive of the OPEC's alliance with Russia, indicating it would not unilaterally raise output.

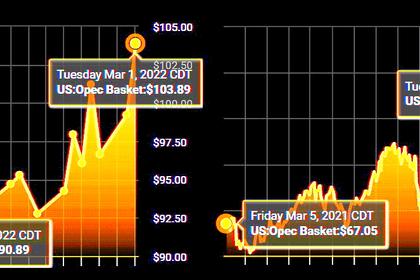

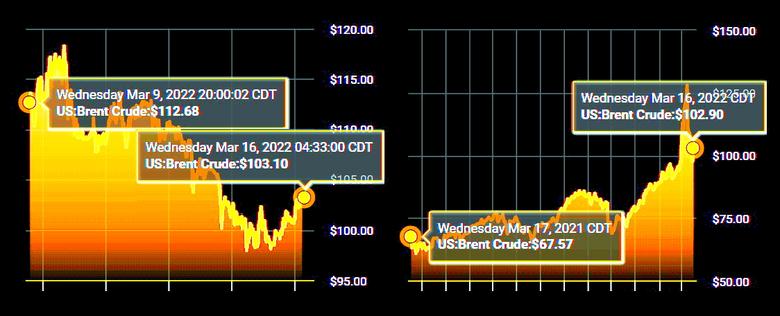

But Otaiba's comments sent crude prices tumbling, bringing a measure of relief to consumers after they had surged past $137/b — their highest since 2008 — earlier in the week on the escalating Ukraine crisis.

Resurgent coronavirus cases in China have since further taken the air out of crude prices, with the Platts Dated Brent benchmark assessed at $107.96/b March 15, but they remain well above levels that importing countries would like to see.

Iran concerns

The OPEC+ alliance has been gradually easing the record production cuts it instituted during the worst of the pandemic in 400,000 b/d monthly increments — a pace criticized by the US, India, and other key customers as too slow to keep pace with rising demand, let alone the Russia sanctions.

Johnson's visit to Abu Dhabi and Riyadh comes two weeks ahead of the next OPEC+ meeting, scheduled for March 31, where the group will be deciding on May output levels.

Downing Street said Johnson would also be discussing the situation in Iran and Yemen with the princes, as well as increased security cooperation, trade, investment, and human rights — the last item a sore point between Saudi Arabia and western countries, with US President Joe Biden refusing to deal with Prince Mohammed directly.

Saudi Arabia and the UAE have voiced their concerns about their longstanding geopolitical rival Iran, as talks over a nuclear deal that would relieve sanctions on Iranian oil exports have stalled.

The nuclear deal would also bring major supply relief to the market, but Gulf Arab countries are seeking security assurances against Iranian aggression.

Both the UAE and Saudi Arabia have been hit by missile and drone strikes from Iranian-backed Yemeni Houthi rebels, including on key oil facilities and ports. Other attacks have targeted shipping in the region.

Downing Street said Johnson's visit to Riyadh would also confirm a £1 billion investment by Saudi Arabia's Alfanar Group in the Lighthouse Green Fuels Project in Teeside, which aims to be the first to produce sustainable aviation fuel from waste at scale in the UK.

"The prime minister is focused on diversifying the UK's energy supply and working with international partners to ramp up renewables," Johnson's office said.

-----

Earlier: