GLOBAL ENERGY, COMMODITY CRISIS

By GERARD REID Leader Alexa Capital

ENERGYCENTRAL - Mar 22, 2022 - We live in dangerous times, no more so if you are in Ukraine today. But these are also dangerous times for the wider world. I was thus not surprised some days ago when the German Economics and Energy Minister, Robert Harbeck, warned that ‘Germany’s people may face mass unemployment and poverty if there was an immediate boycott of Russian gas and oil.’ There was much criticism of his comments as there are calls across the world for a ban on Russian fossil fuel imports but note that Europe is currently paying circa $1bn per day to Russia for those fuels. However, we need to be careful in dangerous times as unforeseen things can happen and it is critical to ensure financial stability, whatever happens.

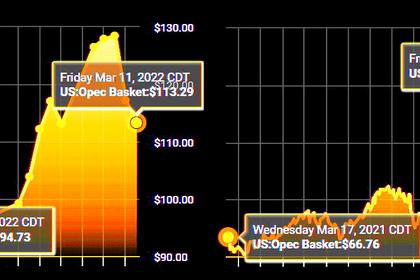

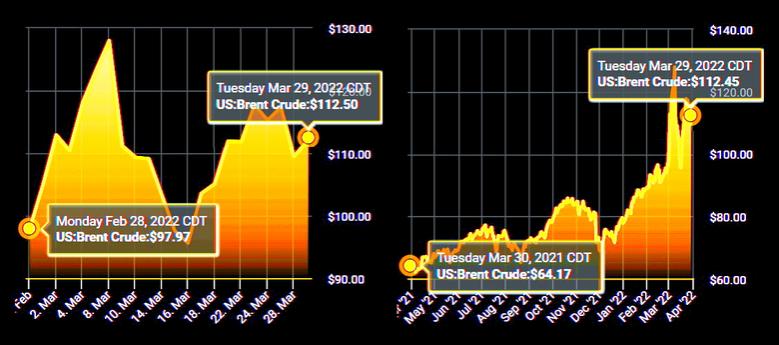

The sanctions against Russia are the hardest we have seen against any country to date and in particular the decision to freeze $600bn of Russian foreign reserves is a first, which will have huge consequences in the long-term. In the short term, a funding crisis is unfolding for anyone involved in the commodities that Russia produces. Russia is the largest producer and exporter of commodities in the world, starting with oil and gas representing 10% and 24% of global production respectively. Then add in 30% of sunflower oil exports, 16% of global wheat exports and 13% of barley exports. In the global metals sector, Russia accounts for 30% of nickel exports, 24% of palladium, 16% of platinum, 10% of aluminum and 5% of steel. And if one includes the Ukraine the numbers are even higher.

We are already seeing massive stress and volatility in all these markets. The most notable is nickel where nickel prices rocketed up by 250% in less than two days obliging the London Metals Exchange to close the exchange, cancelling $4bn in trades and when it did finally reopen the exchange’s trading system it malfunctioned repeatedly. Good luck to you if you have not already secured nickel for stainless steel production or lithium-ion batteries this year.

In energy, particularly in Europe, we are already seeing enormous stress thanks to all-time highs in gas prices which are in turn causing volatility and stress in power markets. Already, we have seen the German development bank, the KFW give emergency loans to three energy companies: Leag, VNG and Uniper, and in the UK over thirty retail utilities have gone bankrupt over the last 6 months. And there is more to come.

The fact is that the sanctions are taking Russian commodities out of the market (incl. oil and coal despite them not being sanctioned) which, together with inadequate stock inventories means that there is not enough supply globally which is pushing energy prices up for everyone. This means the companies need to borrow more money to buy, move and sell these commodities. Secondly, market participants need to lock in prices for future deliveries. They do so by selling a financial derivative such as a future. On the other side, buyers often buy futures to lock in their price. These hedging mechanisms require cash guarantees to be paid so that if one side cannot deliver on their commitments, the other side is not financially disadvantaged. These so called ‘margin calls’ are usually funded by credit lines from banks but in the current extremely volatile markets, banks are shying away from this type of business. To fill that gap, the German KFW had to jump in to prevent what otherwise could have been the bankruptcy of a system relevant energy company.

Going forward, we need governments to allow the European Central Bank, the Bank of England, and the US Federal Reserve to step in to ensure the necessary liquidity is available for trades to happen. The bottom line is that global trading markets were not designed to withstands shocks like this. The good news is that this liquidity is a loan so when the commodity is delivered that loan can be repaid with interest on top. The difficulty is that providing liquidity to so many market players is against the interests of Europe and the US who are both driving for sanctions. It is also difficult because you do not want to be in the business of bailing out ‘free riders’ and speculators.

To further complicate the situation, commodity price rises must be passed onto consumers across the world in the form of higher heating bills at the same time they are facing rising bread prices. In addition, supply shortages of raw materials cause production to falter and place stresses on businesses that cannot make payments or secure resources at necessary prices which exacerbates the situation. Recession is the outcome. Finally, what the German Economics and Energy Minister Robert Harbeck should have warned about is that ‘People across the world may face mass unemployment and poverty if there is not a quick end to the Ukrainian crisis.’ Let us hope for a peaceful outcome soon as we are not in a good situation otherwise.

-----

This thought leadership article was originally shared with Energy Central's Energy Collective Group. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join the Energy Collective Group today and learn from others who work in the industry.

-----

Earlier: