GLOBAL OIL DEMAND 2022: +4.2 MBD

OPEC - 15 March 2022 - OPEC Monthly Oil Market Report

Oil Market Highlights

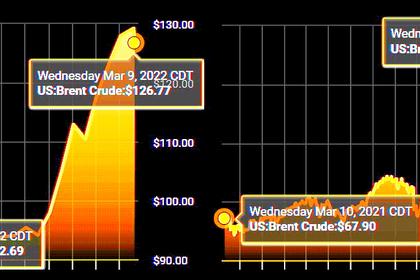

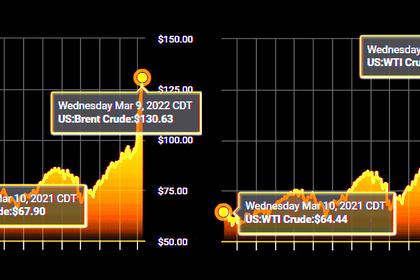

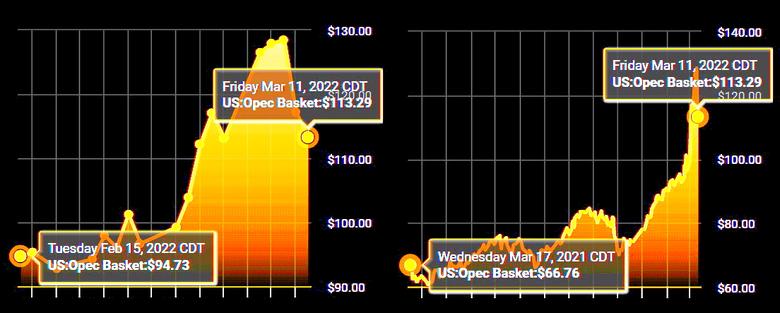

Crude Oil Price Movements

Crude oil spot prices increased strongly in February compared to the previous month, supported by strong physical crude market fundamentals, dissipating fears about COVID-19, and an escalating geopolitical conflict in Eastern Europe that raised concerns about a near-term oil supply disruption resulting in a rally in oil futures markets. The OPEC Reference Basket rose by $8.81, or 10.3%, to settle at $94.22/b. Crude oil futures prices rose on both sides of the Atlantic with the ICE Brent front month up $8.53, or 10.0%, to average $94.10/b and NYMEX WTI rising by $8.65, or 10.4%, to average $91.63/b. Consequently, the Brent-WTI futures spread narrowed by 12¢ to an average of $2.47/b. The market structure of all three crude benchmarks – ICE Brent, NYMEX WTI and DME Oman – moved into deeper backwardation as investors were anticipating a potential supply disruption. Strong demand in the spot market added support to the market structure. Hedge funds and other money managers raised their net long positions in anticipation of higher oil prices.

World Economy

The conflict in Eastern Europe has added more downside risk to the performance of world economy in 2022. So far, and in addition to the ongoing pandemic, the conflict has led to a number of key issues including rising commodity prices, which are further escalating global inflation. The effects of the conflict, especially the impact of rising inflation, if sustained, will lead to a decline in consumption and investments to varying degrees. Moreover, financial conditions of the various asset classes, such as in currency markets, equities and an ongoing repricing of debt are being impacted. Clearly, this will impact economic activities in 2022, though to what exactly extent remains to be seen. Given the complexity of the situation, the speed of developments, and fluidity of the market, with so far limited data to understand the far-reaching consequences of this conflict, projections are changing almost on a daily basis, making it challenging to pin down numbers, with reasonable degree of certainty. However, with more data and hence a deeper understanding of the unravelling events, over the next few weeks, the global GDP growth forecast for 2022 remains under assessment at 4.2%, and will be reviewed and adjusted, when there is more clarity on the far-reaching impact of the geopolitical turmoil. Similarly, all headline economic forecast numbers for 2022 remain under assessment.

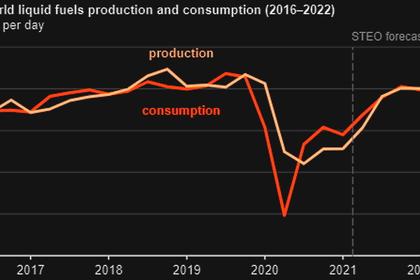

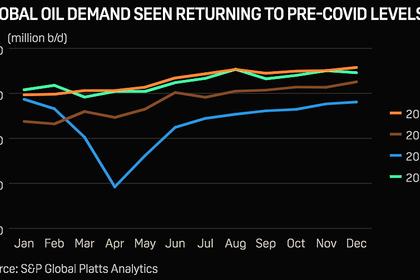

World Oil Demand

World oil demand growth in 2021 is revised up by 0.05 mb/d, reflecting the actual data across the regions, to now stand at 5.7 mb/d. The 4Q21 figure for all OECD region is revised higher, as a result of the better performance. The OECD in 2021 increased by 2.7 mb/d, while the non-OECD showed growth of 3.1 mb/d. Given the above mentioned developments and the extremely high uncertainty surrounding global macroeconomic performance, the 2022 forecast for global oil demand growth remains under assessment at 4.2 mb/d, with OECD forecast at 1.9 mb/d and non-OECD at 2.3 mb/d. However, this forecast is subject to change in the coming weeks, when there is more clarity on the far-reaching impact of the geopolitical turmoil.

World Oil Supply

Non-OPEC liquids supply growth in 2021 remained broadly unchanged from last month’s assessment at around 0.6 mb/d y-o-y. Total US liquid output increased by 0.15 mb/d, y-o-y. Oil supply in 4Q21 is estimated to have declined in Canada and Australia, while there have been some minor upward revisions in other countries. The 2021 oil supply estimation primarily sees growth in Canada, Russia, the US and China, while output is projected to decline in the UK, Brazil, Colombia and Indonesia. The forecast for non-OPEC supply for 2022 remains at 3.0 mb/d, y-o-y. This forecast is under assessment, and will be reviewed and adjusted in the coming weeks, if deemed necessary. The main drivers of liquids supply growth are expected to be the US and Russia, followed by Canada, Brazil, Kazakhstan, Guyana and Norway. OPEC NGLs are forecast to grow by 0.1 mb/d both in 2021 and 2022 to average 5.1 mb/d and 5.3 mb/d, respectively. In February, OPEC crude oil production increased by 0.44 mb/d m-o-m, to average 28.47 mb/d, according to available secondary sources.

Product Markets and Refining Operations

In February, refinery margins on all main trading hubs improved, mainly reflecting fuel supply-side dynamics over an already increasingly tight global product balance. Most product prices in all regions soared, which in turn helped lift product crack spreads, in response to a contraction in product outputs due to maintenance, concerns about dislocations due to geopolitical developments, and stronger crude prices. In the immediate near term, refinery intakes are expected to decline further, which could exacerbate the global product shortage, and drive product prices upwards.

Tanker Market

The dirty tanker market remained at muted levels for much of February, although volatility accelerated at the end of the month as geopolitical developments intervened. In monthly terms, VLCCs continued to be anchored at historically weak levels, as has been the case since mid-2020. Suezmax and Aframax rates have performed better and were slightly higher than in the previous year, registering an improvement m-o-m. Clean rates were flat to the east but picked up in the Atlantic Basin. The volatility seen at the end of the month will become more evident in March data, with upward pressure particularly concentrated in the Aframax and Suezmax classes.

Crude and Refined Products Trade

Preliminary data shows US crude imports declined 5% in February, m-o-m, following three months of gains. US crude exports picked up from the low levels of the previous month, rising 16%, m-o-m. China’s crude imports averaged 10.5 mb/d in January, as flows were supported by new import quotas but capped by limited refinery runs during the Beijing Olympics and the Lunar New Year holidays. India’s crude imports averaged 4.5 mb/d in January, down around 3% from the strong level the month before. Crude imports were expected to rise in February, as the economy gains momentum and refiners boost runs. Japan’s crude imports declined in January from the multi-year high seen the month before. Japan’s product exports in January were the highest since March 2020, with gasoline outflows at a multi-year high and gasoil at the highest since March 2020. Recent developments in Eastern Europe have created considerable dislocations, which is likely to be visible in March data, adding considerable uncertainty to crude and product trade flows.

Commercial Stock Movements

Preliminary data for January sees total OECD commercial oil stocks down, m-o-m, by 3.1 mb. At 2,677 mb, OECD commercial oil stocks were 359 mb less than the same time one year ago, 280 mb lower than the latest five-year average and 250 mb below the 2015-2019 average. Within the components, OECD commercial crude stocks fell, m-o-m, by 8.7 mb, while OECD commercial product stocks rose, m-o-m, by 5.5 mb. At 1,294 mb, OECD commercial crude stocks were 158 mb less than the latest five-year average and 139 mb below the 2015-2019 average. OECD commercial product stocks stood at 1,383 mb, representing a deficit of 142 mb compared with the latest five-year average and were 112 mb below the 2015-2019 average. In terms of days of forward cover, OECD commercial stocks fell, m-o-m, by 0.7 days in January, to stand at 59.3 days. This is 11.6 days below January 2021 levels, 6.2 days less than the latest five-year average, and 2.8 days lower than the 2015-2019 average.

Balance of Supply and Demand

Demand for OPEC crude in 2021 was revised up by 0.1 mb/d from the previous month’s assessment to stand at 28.0 mb/d, which is around 5.0 mb/d higher than in 2020. In contrast, demand for OPEC crude in 2022 was also revised up by 0.1 mb/d from the previous month’s assessment to stand at 29.0 mb/d, which is around 1.0 mb/d higher than in 2021.

-----

Earlier: