JAPAN'S LNG INVESTMENT

PLATTS - 15 Mar 2022 - Japan aims to reduce its dependency on Russian energy supply by taking steps, including LNG investments outside Russia, as it mulls its response to the Sakhalin and Arctic LNG 2 projects following the recent G7 leaders' commitment, Minister of Economy, Trade and Industry Koichi Hagiuda said March 15.

"We aim to reduce our dependency on Russian energy by securing alternative supply sources outside Russia by LNG investments among other steps," Hagiuda told a press conference.

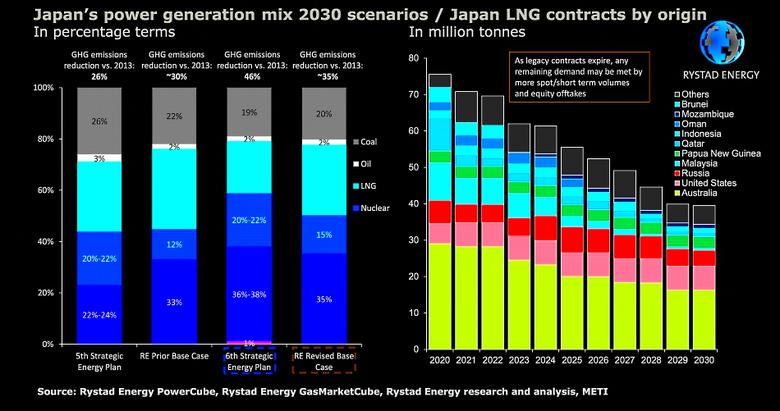

Japan also intends to work on renewables and nuclear power in a bid to further diversify its energy sources, as part of its response to the G7 joint statement, which calls for reducing Russian energy dependency in phases, Hagiuda said.

The G7 -- the UK, US, Canada, Japan, Germany, France and Italy -- pledged March 11 to continue to cut their reliance on Russian energy, in response to Russia's invasion of Ukraine, "while ensuring that we do so in an orderly fashion and in ways that provide time for the world to secure alternative and sustainable supplies," the leaders said in a joint statement.

"Based on the G7 leaders statement, we will consider our response to the Sakhalin 1, 2 and Arctic LNG 2 projects from a standpoint of energy security in the entire energy portfolio," Hagiuda said.

Russia accounted for 9% of Japan's total LNG imports of 74.32 million mt in 2021 and 4% of total crude oil imports of 2.48 million b/d, according to the finance ministry data.

The G7 statement came after the US already said it would ban all Russian energy imports while the UK is set to phase out Russian oil imports by the end of the year and reduce Russian gas supplies.

More than half of the 9.6 million mt/year LNG production capacity at the Sakhalin 2 project is committed to Japanese offtakers, and Sakhalin 2 LNG accounts for almost all of Japan's LNG imports from Russia.

Japan's Sakhalin Oil and Gas Development Co., or SODECO, has a 30% stake in the Sakhalin 1 project. METI has a 50% stake in SODECO, while Japan Petroleum Exploration holds a 15.285% interest, Itochu 14.456%, Marubeni 12.349%, INPEX 6.08% and Itochu Oil Exploration 1.83%.

Japan's Mitsui (12.5%) and Mitsubishi (10%) also hold stakes in the Sakhalin 2 project. State-owned Japan Oil, Gas and Metals National Corp. provides an equity financing and loan guarantee to Japan Arctic LNG, a subsidiary of Mitsui, which has a 10% stake in the Arctic LNG 2 project.

-----

Earlier: