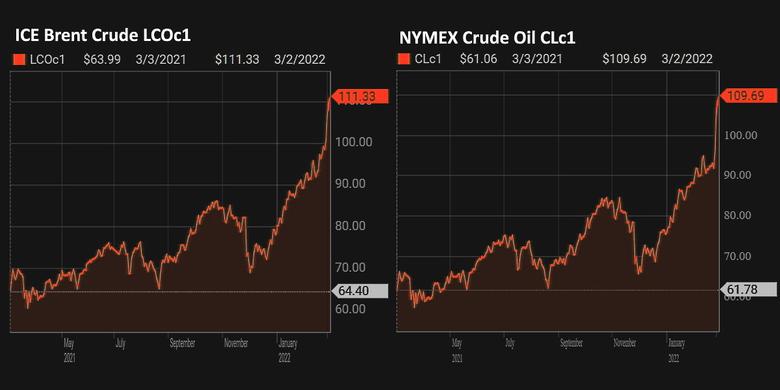

OIL PRICE: ABOVE $111

REUTERS - March 2 - Oil prices surged on Wednesday as supply disruption fears mounted following hefty sanctions on Russian banks amid the intensifying Ukraine conflict, while traders scrambled to seek alternative oil sources in an already tight market.

Brent crude futures rose by as much as $8 and touched as high as $113.02 a barrel, the highest since June 2014, before easing to $111.75 at 0804 GMT.

U.S. West Texas Intermediate (WTI) crude futures were up $7.24, or 7%, to $110.67 a barrel, after earlier hitting the highest since August 2013.

The backwardation in the Brent futures contract, when prompt prices exceed later dated supply, surged to the highest ever according to data going back to 2004. The premium of the first-month Brent future to the sixth-month contract rose to as much as $18.55 a barrel.

"Trade disruptions are starting to get people's attention," said Westpac economist Justin Smirk.

"Issues around trade finance and insurance - that's all impacting exports from the Black Sea. The supply shocks are unfolding," he said.

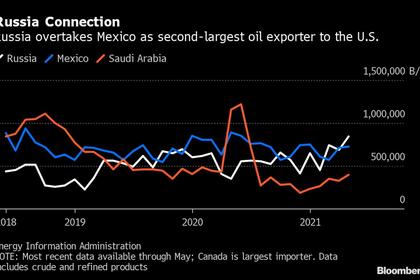

Russian oil exports account for around 8% of global supply.

Exxon Mobil on Tuesday said it would exit Russia oil and gas operations as a result of Moscow's invasion of Ukraine. The decision will see the firm pull out of managing large production facilities on Sakhalin Island in Russia's Far East.

At the same time, while Western powers have not imposed sanctions on energy exports directly, U.S. traders at hubs in New York and the U.S. Gulf are shunning Russian crude.

U.S. President Joe Biden warned Vladimir Putin that the Russian leader "has no idea what's coming" in a State of the Union speech dominated by Russia’s invasion of Ukraine.

"People are not touching Russian barrels. You may see some on the water right now, but they were bought prior to the invasion. There won't be much after that," one New York Harbor trader told Reuters.

State-run Indian refiner Bharat Petroleum Corp (BPCL.NS) is seeking extra oil from Middle Eastern producers for April, fearing Western sanctions against Russia could hit deliveries of Urals crude.

Top oil exporter Saudi Arabia may sharply hike prices of crude for Asia in April, trade sources said, with differentials for most grades hitting all-time highs as global supplies tighten over financing and shipping issues from sanctions on Russia.

A coordinated release of 60 million barrels of oil by International Energy Agency member countries agreed on Tuesday put a lid on market gains, but analysts said that would only provide temporary relief on the supply front.

"They helped to cap the rise, but if you want to turn prices around, you need something more sustainable," Smirk said.

Commercial oil stockpiles are at their lowest since 2014, the IEA said.

Against that backdrop, the Organization of the Petroleum Exporting Countries, Russia and allies, together known as OPEC+, are due to meet on Wednesday, where they are expected to stick to plans to add 400,000 barrels per day of supply each month.

Underscoring tightness in the market, the latest data from the American Petroleum Institute industry group showed U.S. crude inventories fell by 6.1 million barrels for the week ended Feb. 25.

The U.S. Energy Information Administration is due to release weekly data on Wednesday, with analysts polled by Reuters expecting a crude inventory build of 2.7 million barrels.

-----

Earlier: