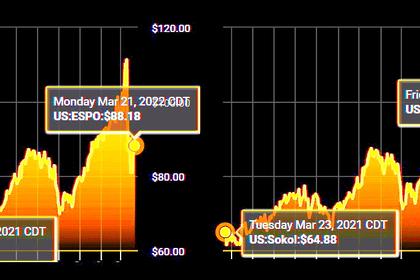

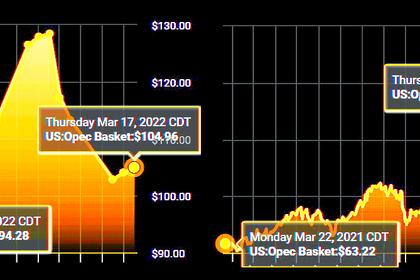

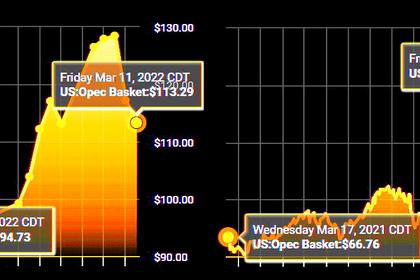

OIL PRICE: BRENT ABOVE $116, WTI ABOVE $110

REUTERS - March 23 - Oil prices rose on Wednesday amid volatile trading on increasing concerns of global supply tightness from sanctions imposed on Russia, the world's second-largest oil exporter, and on signs that exports from Kazakhstan may be disrupted.

Brent crude futures were up 95 cents, or 0.82%, to $116.43 a barrel at 0816 GMT. Prices earlier rose to as high as $117.70 and at one point fell to a low of $114.45. The contract fell 14 cents in the previous session.

U.S. West Texas Intermediate (WTI) crude futures rose 73 cents, or 0.67%, to $110 a barrel. The contract surged to a high of $111.35 and slipped to a low of $108.38. Prices fell 36 cents on Tuesday.

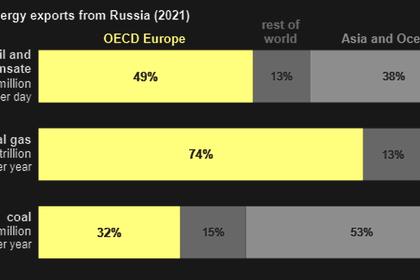

The market remains on edge over the prospect of further sanctions on Russia, the world's second-largest crude exporter, after its invasion of Ukraine, actions that Moscow calls a "special operation".

U.S. President Joe Biden is set to announce more Russian sanctions when he meets with European leaders on Thursday in Brussels, including an emergency meeting of NATO.

Adding to concerns about supply, Russian and Kazakhstan oil exports via the Caspian Pipeline Consortium (CPC) from the Black Sea may fall by up to 1 million barrels per day (bpd), or 1% of global oil production, because of storm-damaged berths, a Russian official said on Tuesday.

"Oil markets are a mess of volatility at the moment," said Jeffrey Halley, an analyst at brokerage OANDA. "You don't have to be a genius to know what Russia reducing its flows, or closing it, will do to an already tight market."

Plunging crude stockpiles in the United States, the world's biggest oil consumer, also added to the apprehensions around supply.

The latest data from the American Petroleum Institute industry group showed U.S. crude stocks fell by 4.3 million barrels for the week ended March 18, according to market sources, counter to analysts' forecasts for an increase.

Nine analysts polled by Reuters on average had estimated crude inventories rose by 100,000 barrels in the week to March 18.

Official U.S. inventory data is due from the Energy Information Administration on Wednesday.

-----

Earlier: