OIL PRICE WILL UP TO $300

PLATTS - 08 Mar 2022 - Russia has threatened to retaliate against international sanctions with an embargo on gas exports and warned restricting imports of its oil would see prices surge to $300/b.

"It is absolutely obvious that refusing Russian oil would lead to catastrophic consequences for the global market. The price surge would be unpredictable – to more than $300 per barrel, if not more," said Russian Deputy Prime Minister Alexander Novak.

Novak -- Russia's senior representative at the OPEC+ oil producer cartel -- also threatened gas export to Europe in response to the EU steps to reduce dependence on the Kremlin for energy supplies.

Russia "has the right" to halt flows of gas through the Nord Stream 1 pipeline feeding Europe, Novak warned.

"So far we are not making this decision. No one will benefit from this. Although European politicians are pushing us to this with their statements and accusations against Russia," Novak said.

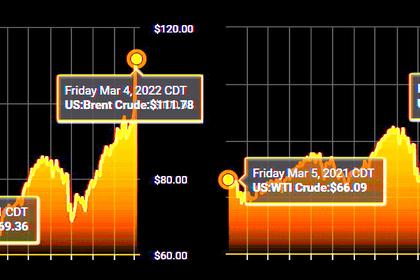

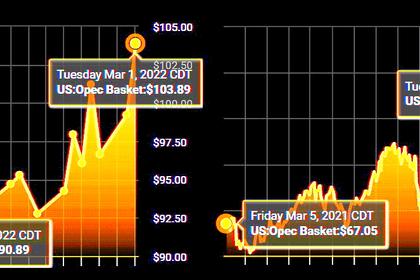

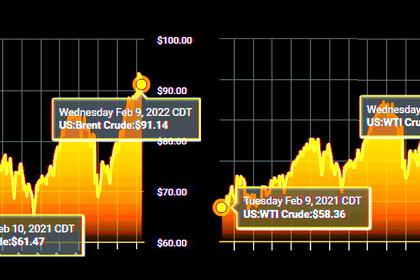

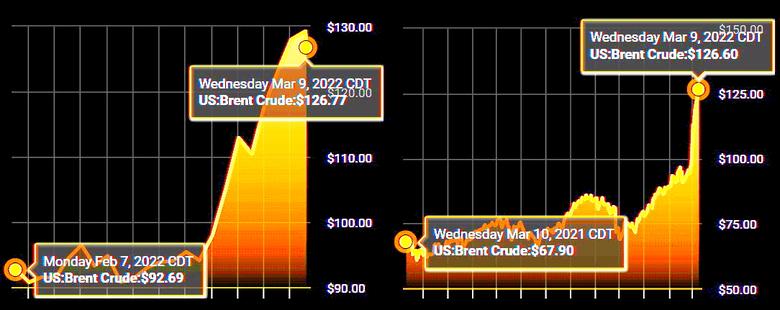

S&P Global Commodity Insights assessed Dated Brent at $130.045/b March 7, up from $100.485/b on Feb. 23, the day before Russia invaded Ukraine. The Dutch TTF Day Ahead gas price was assessed at Eur212/MWh March 7, up from Eur88.85/MWh on Feb. 23.

"Replacing the volume of Russian oil on the European market quickly is impossible, it will take more than one year, and it will be much more expensive for European consumers," Novak said.

Europe is the biggest export market for Russian oil, consuming 2.7 million b/d of crude and a further 1 million b/d of oil feedstocks/products, according to S&P Global Commodity Insights.

"There are not sufficient sources of incremental supply to cover a substantial prolonged loss of Russian oil, particularly the 4 million b/d Russian oil imports into Europe," said Shin Kim, head of oil supply and production analytics, S&P Global Commodity Insights. "Saudi Arabia and the UAE could potentially add 1.5-2 million b/d combined if they ramp up to full capacity, but even these volumes likely cannot be sustained for an extended amount of time."

'Ramifications'

Novak added that Russia continues to meet all of its obligations for oil and oil products supplies to Europe.

The Russian official's comments came after a day of mixed messages from European leaders on the threat of imposing oil and gas import bans on Russia. Dutch Prime Minister Mark Rutte said March 7 sanctions on Russian energy supplies for Europe would have "enormous ramifications" and that countries in the region should "ensure energy supplies are not hindered."

"You can't simply close down [the] use of oil and gas overnight, even from Russia," UK Prime Minister Boris Johnson said. "That's obviously not something every country around the world can do. We can go fast in the UK, other countries can go fast, but there are different dependencies."

Their comments followed pressure from the US over the weekend to consider bans on Russian oil imports in response to the war in Ukraine.

Meanwhile, the EU is expected to launch a new drive within the economic block to phase out dependency on Russian oil and gas. The UK is expected to follow with a new energy strategy to focus on diversification of supply this week.

-----

Earlier: