OIL PRICES FOR INDIA

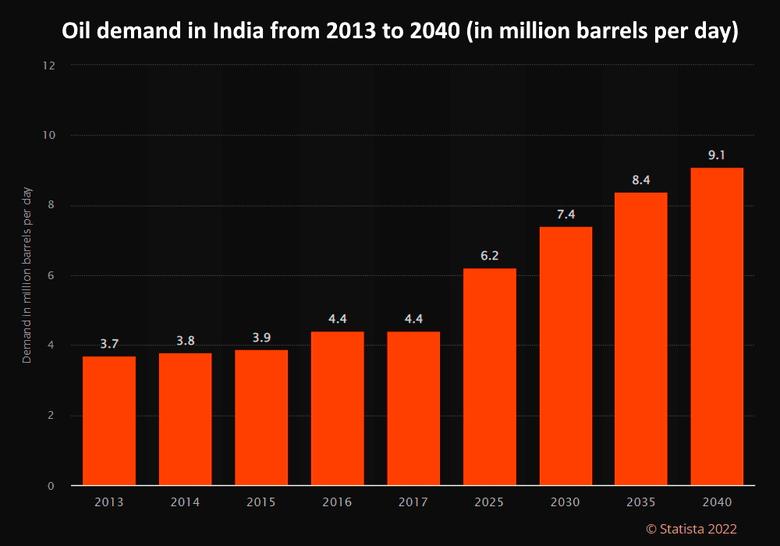

PLATTS - 02 Mar 2022 - India's minimal dependence on Russian crude means that the South Asian oil buyer can weather any potential supply disruption from Russia, but surging oil prices are starting to put a huge amount of upward pressure on import bills and inflation.

However, analysts said Indian buyers are increasingly becoming cautious about shipment logistics and delays of cargoes from the Black Sea region, which may prompt them to temporarily look for replacement cargoes from the Middle East.

"The effect on India will not be significant from a crude sourcing perspective since the share of Russian crudes is quite small in the Indian crude basket, which majorly consists of Middle Eastern crudes. But high flat prices of crude will create inflationary pressure on economic recovery since India is mostly dependent on imported crudes," said Shreyans Baid, analyst for South Asian oil markets at S&P Global Commodity Insights.

"And the wide Brent-Dubai EFS has the potential to further increase the share of Middle Eastern crudes in the Indian crude basket," he added.

The Platts Brent-Dubai exchange of futures for swaps hit a record high of $11.80/b in early Asian trade March 2, according to S&P Global Commodity Insights.

In a country that imports nearly 85% of its crude requirements, Russian crude accounted for less than 3% of the around 4.3 million b/d crude that India imported in 2021, according to S&P Global Commodity Insights' Platts Analytics.

However, Russia has been increasing its energy links with India in recent years. Russia's biggest crude producer Rosneft owns a significant stake in Indian refiner Nayara Energy, and is looking to increase cooperation on LNG at a time when South Asia is a key development priority for Russia.

Indian companies have also recently joined Russian upstream projects, including Rosneft's Vankor and Taas-Yuryakh.

George Voloshin, head of the Paris branch of Aperio Intelligence, said India is unlikely to exit Russian upstream projects as a result of the conflict in Ukraine.

Port, shipment logistics

Analysts see the conflict as a greater risk to port and shipment logistics.

"For India, the only concern is whether some shipments, such as Urals, will face some logistics issues, but I don't see any major disruption as yet," an Indian crude oil trader said.

Some traders are trying to find answers to whether SWIFT would still work for legitimate Russian oil and gas trades, which are still outside the purview of sanctions.

"Otherwise it will be difficult to keep oil and gas flows out of the sanctions and flows will be disrupted even without direct sanctions on that sector," one refining source said.

For India, the implications of high prices are a bigger concern than Russian crude supplies.

"India's direct dependence on Russia for oil is quite low. But it will be hit by the change in global price level," said Priyanka Kishore, head of India and South East Asia Economics at Oxford Economics.

"From a policy perspective, higher inflation and deteriorating deficits will increase the pressure on the Reserve Bank of India to act more aggressively, even as growth slows," she added.

The trickle-down effect

Sumit Pokharna, vice president at Kotak Securities, said rising international crude oil prices amid ongoing geopolitical tensions pose a major risk for India, not just for the energy market but for the economy as a whole.

"Elevated oil prices may result in a jump in inflation and higher raw material costs will put pressure on corporate margins," Pokharna said.

"Naturally, oil marketing companies will increase retail auto fuel prices in the short term to partly pass on the burden. Part of the burden may be borne by government through duty cuts. Higher crude oil prices may impact trade deficit and weaken Indian currency, and a weaker currency brings higher imported inflation," he added.

Traders at Kandla port on India's west coast said a range of sectors, including petrochemicals, cotton yarn and pharmaceuticals, would be impacted due to high crude prices.

"International crude prices may go up 20%-25% next week as a fallout of the Ukraine-Russia war," said Sanjay Shrepuriya, a Kandla-based industry official.

To tide over the situation, India is open to the release of crude oil either on its own or in coordination with other oil global consumers from strategic reserves if the Russia-Ukraine conflict pushes prices higher, although supply disruption is expected to be minimal, the CEO of Indian Strategic Petroleum Reserves told S&P Global Commodity Insights in an interview earlier this week.

Russia and India in December signed new energy cooperation agreements, including a contract for Rosneft to ship almost 15 million barrels of crude to India in 2022, according to government and company statements.

Russia's largest crude producer said then it had agreed to a contract to ship up to 2 million mt, or around 14.66 million barrels, of crude by the end of 2022. Deliveries would be shipped through the Russian Black Sea port of Novorossiisk, the company said at the time.

-----

Earlier: