OPEC+ 0.4 MBD

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

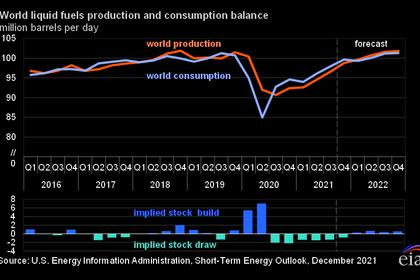

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

OPEC+ 0.4 MBD

OPEC - 02 Mar 2022 - 26th OPEC and non-OPEC Ministerial Meeting concludes

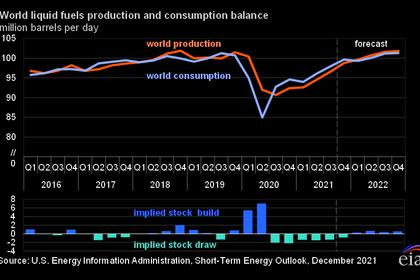

Following the conclusion of the 26th OPEC and non-OPEC Ministerial Meeting, held via videoconference on 2 March 2022, and based on internal consultation held exclusively by the OPEC and participating non-OPEC oil-producing countries in the Declaration of Cooperation of (DoC), it was noted that current oil market fundamentals and the consensus on its outlook pointed to a well-balanced market, and that current volatility is not caused by changes in market fundamentals but by current geopolitical developments.

The OPEC and participating non-OPEC oil-producing countries decided to:

Reaffirm the decision of the 10th Ministerial Meeting on 12 April 2020 and further endorsed in subsequent meetings including the 19th Ministerial Meeting on 18 July 2021.

Reconfirm the production adjustment plan and the monthly production adjustment mechanism approved at the 19th Ministerial Meeting and the decision to adjust upward the monthly overall production by 0.4 mb/d for the month of April 2022, as per the attached schedule.

Reiterate the critical importance of adhering to full conformity and to the compensation mechanism taking advantage of the extension of the compensation period until the end of June 2022. Compensation plans should be submitted in accordance with the statement of the 15th Ministerial Meeting.

Hold the 27th OPEC and non-OPEC Ministerial Meeting on 31 March 2022.

Production table PDF version

Earlier:

2022, March, 2, 11:45:00

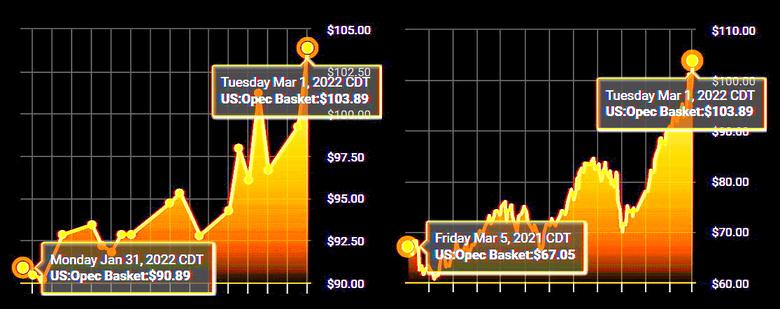

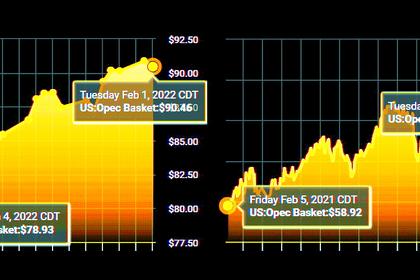

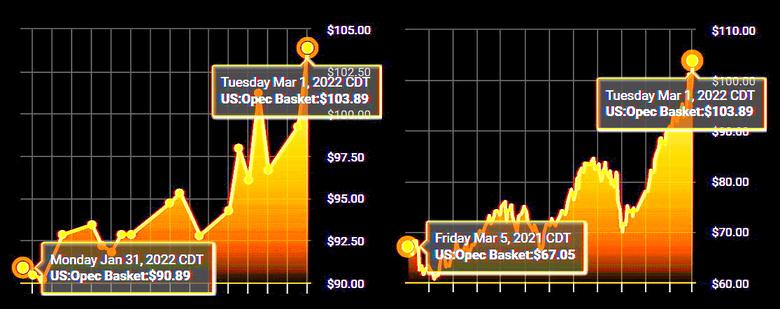

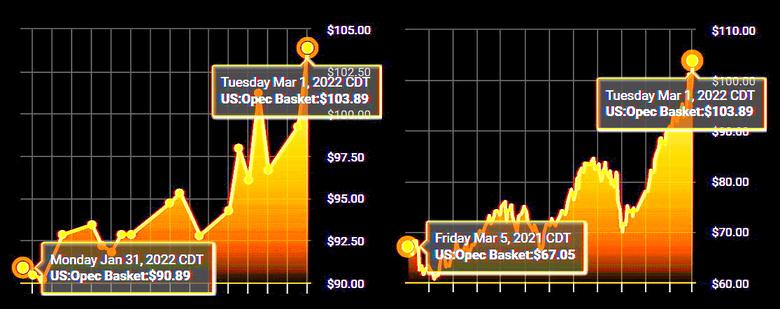

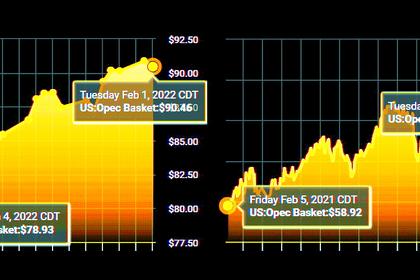

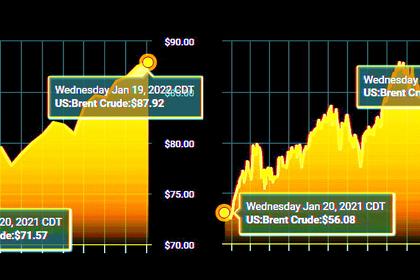

OIL PRICE: ABOVE $111

Brent rose by as much as $8 and touched as high as $113.02 a barrel, before easing to $111.75, WTI were up $7.24, or 7%, to $110.67 a barrel.

2022, March, 2, 11:40:00

OPEC+ OIL PRODUCTION: +0.4 MBD

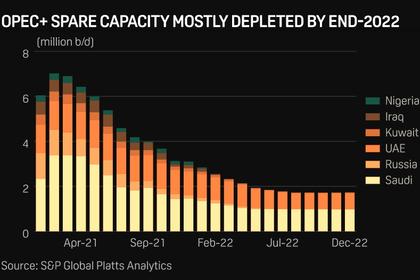

OPEC+ members are attempting to regain pre-pandemic output levels by late 2022 through their monthly easing of quotas, but potential disruptions to Russian oil flows put that plan at risk.

2022, March, 1, 12:20:00

OIL PRICE: NEAR $100

Brent advanced 1.8% to $99.7, WTI rose 1.6% to $97.28.

2022, February, 21, 11:50:00

GLOBAL ENERGY CRISIS & STABILISATION

In the situation that has obtained in recent months on energy markets, it has become clear that one of the foundations of stability of the modern global world is, in the first instance, reliable energy supply, which cannot be provided without observing a reasonable balance of energy sources and an absence of discrimination against traditional sectors of the fuel and energy complex.

2022, February, 3, 13:45:00

OPEC+ RUSSIA: GROWTH BY 0.4 MBD

Reconfirm the production adjustment plan and the monthly production adjustment mechanism approved at the 19th ONOMM and the decision to adjust upward the monthly overall production by 0.4 mb/d for the month of March 2022.

2022, January, 19, 10:50:00

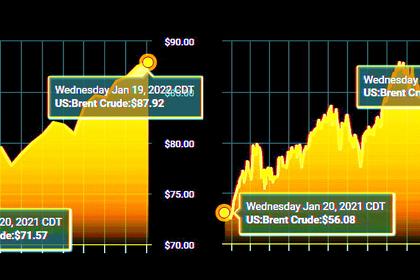

OIL PRICE WILL BE $100

Global oil demand is seen rising 3.5 million barrels per day (bpd) year-on-year in 2022, with fourth-quarter demand reaching 101.6 million bpd.

2021, December, 27, 11:55:00

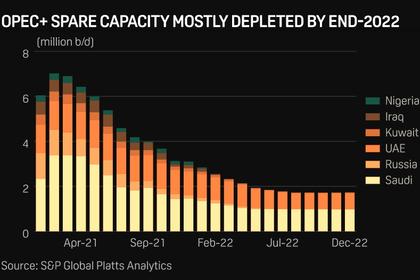

OPEC+ SUCCESSFUL BALANCE

With Russia nearing its maximum capacity and Nigeria, Angola and several other countries struggling to maintain output, OPEC+ sustainable spare capacity will shrink to just 1.2 million b/d by June, lessening the group's ability to offset disruptions.

All Publications »

Tags:

OPEC,

RUSSIA,

OIL,

PRICE,

PRODUCTION