OPEC+ RUSSIA SUPPLY THE MARKET

PLATTS - 29 Mar 2022 - OPEC and its allies remain in firm control of the oil market, key members Saudi Arabia and the UAE said March 29, as the group prepares to meet to decide on May production levels amid an outcry from crude importing countries over tight supplies and rising fuel prices.

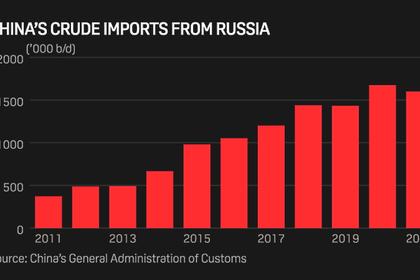

Market balances have been thrown into flux by the Ukraine war, as sanctions on Russia's financial sector have led to widespread shunning of Urals and other Russian crude grades. Furthermore supply from non-OPEC's second biggest producer Kazakhstan has been affected by storm damage at the Novorossiisk terminal, its key export route.

Even so, ahead of the meeting March 31, OPEC+ officials have strongly signaled that the coalition is not prepared to go beyond the steady monthly increases that have been implemented since August.

"We are experts in our field and we have being doing it for a long time," UAE energy minister Suhail al-Mazrouei said at the Atlantic Council's Global Energy Forum in Dubai. "We're trying to balance the market and it's not an easy job. When we say this is the right way to do it, we know from experience, so trust us."

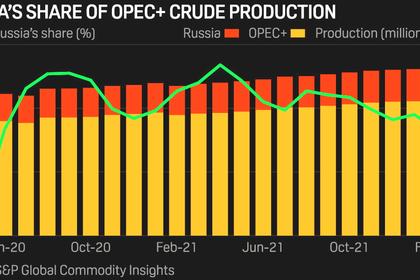

The monthly production quota rises have been 400,000 b/d but are set to go up slightly with upward revisions of baseline production levels for Saudi Arabia, Russia, Iraq, the UAE and Kuwait set to go into effect from May. Quotas are determined from the baseline levels and have yet to be finalized, OPEC+ officials have said.

Helima Croft, RBC's head of global commodity strategy, said Saudi Arabia and the UAE, who hold the vast majority of OPEC+ spare capacity, are wary of accelerating their production increases and losing an output buffer to deal with potential additional sanctions on Russia or some other disruption to global supplies.

"If you're down to 2 million or 2.5 million b/d [of spare capacity] and you start accelerating [the production increases], and let's say we move to Russian crude moving to not just being unpopular but becoming totally unavailable because of secondary sanctions, what do you have in reserve? If you spend this now, what if the [Russian outage] goes to 5 million b/d? The risk is, you lose control of the market," Croft said.

Russian deputy prime minister Alexander Novak said March 23 that it was too early to talk about an adjustment to Russia's quota under the agreement, as Russia continues to supply the market.

This is despite urgent calls from energy consumers for producers to release more oil onto the market. IEA executive director Fatih Birol said the market was "really disappointed" by the alliance's lack of urgency to ease the market tightness and that OPEC+ countries were underproducing their production targets. The global market is facing an estimated 2.5 million b/d supply shortfall as a result of the war, the IEA has estimated.

OPEC+ countries have contributed to the market tightness, with several members underproducing their quotas. Collectively, the group fell 1.053 million b/d short of its targets in February, according to analysis prepared for ministers ahead of their meeting and seen by S&P Global Commodity Insights.

A delegate-level advisory committee will meet March 30 to assess market conditions and member quota compliance.

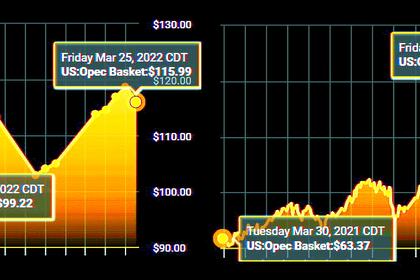

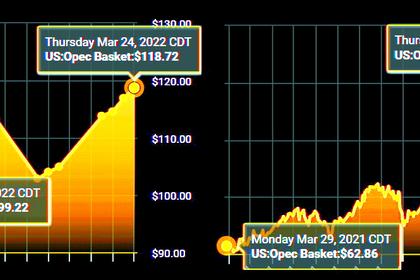

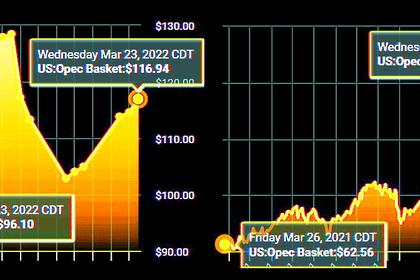

Prices have seen significant volatility in recent weeks. Dated Brent was assessed at $100.49/b on Feb. 23, the day before the invasion began, peaked at $137.64/b on March 8, and had fallen back to $117.56/b March 28.

Baseline revisions

A revision of the production baselines for Saudi Arabia, Russia, Iraq, the UAE and Kuwait set to go into effect for May should add some additional barrels of production from OPEC+ into the market.

S&P Global analysts expects this to result in a one-time 400,000 b/d combined quota increase for Saudi Arabia and the UAE in May.

"As the only two countries holding notable volumes of spare capacity, this should directly trigger a commensurate supply increase," S&P Global analysts said.

The changes to the baselines, from which quotas are determined, were agreed in mid-2021 after the UAE insisted on having its upstream capacity additions since the OPEC+ agreement came into effect factored in.

Delegates said the alliance had yet to sort out how exactly to apportion the higher quotas for the five countries but hope to finalize the figures at the meeting.

Non-OPEC supply

So far Saudi Arabia and the UAE have indicated that they will stand behind Russia, and stick to the agreement, despite the significant supply concerns.

Russia makes a "sizable contribution to energy markets," Saudi energy minister Prince Abdulaziz bin Salman told the World Government Summit on March 29. OPEC+ can "compartmentalize our political differences for the collective good of us all." He added that oil market volatility would be worse if OPEC+ did not exist.

Russia has not yet released details of production in March, but February data did not show a decline in output. Russia produced 10.11 million b/d in February, according to a monthly S&P Global survey. That was up 30,000 b/d month on month but below Russia's quota of 10.227 million b/d.

Russian and Ukrainian officials launched peace talks March 29. These talks could have a significant impact on prices if progress is made and concerns around Russia's ability to supply global markets eases.

Non-OPEC's second largest producer Kazakhstan expects a significant drop in production in April following storm damage to loading facilities at the port of Novorossiisk. The Kazakh energy ministry said March 29 that the incident could take 320,000 b/d of Kazakh production off the market in April, while maintenance work is carried out. It expects to compensate for lost volumes under the agreement by the end of June 2022. Kazakhstan produced 1.65 million b/d in February.

-----

Earlier: