RUSSIAN LNG FOR CHINA

PLATTS - 30 Mar 2022 - China's state-run offshore giant CNOOC said the under-construction Arctic LNG 2 project in Russia was running relatively stable, but the company will rigorously assess risks related to sweeping technological and financial sanctions against Moscow.

CNOOC will continue to take a close look at the development of the Russia-Ukraine conflict before making any decision of pulling out investment from the country or acquiring more assets.

"It is too early to make a decision while the Russia-Ukraine situation changes all the time; too many uncertainties," Chairman Wang Dongjin said March 30 during CNOOC's 2021 results call.

CNOOC has a 10% stake in the 19.8 million mt/year Arctic LNG 2 project, which is also its solo asset in Russia.

One of its partners, France's TotalEnergies, said March 22 it had opted not to provide any more capital to the Novatek-operated project in northern Russia, while China's CNPC and a Japanese consortium are more likely to stick to the project.

CNOOC, CNPC, TotalEnergies, and the Japanese consortium each hold 10% stake in Arctic LNG 2, and Novatek holds the remaining 60% stake.

"We don't feel any difficulty in pushing forward the project, so far," Wang said.

The first train of Arctic LNG 2 is due to begin operations in 2023, but there have been reports western sanctions against Russian banks could make financing Arctic LNG 2 more difficult.

Novatek in February estimated the overall completion rate of the Arctic LNG 2 project at 59% at the end of 2021, with progress on the first train estimated at 78% complete.

The provisional startup schedule is 2023 for the first train, 2024 for the second and 2025 for the third.

High prices support output

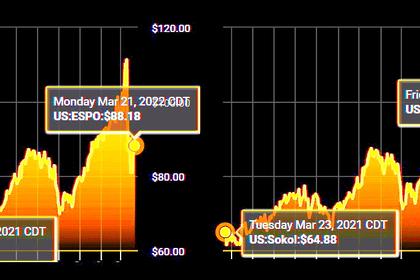

High crude and gas prices, pushed up by the conflict, supported CNOOC in boosting its output target and set a record-high budget for 2022, Wang said.

The company set its capital expenditure at Yuan 90 billion-100 billion ($14.19 billion-$15.75 billion) in 2022, compared with about Yuan 88.7 billion in 2021. The capex reflects CNOOC's efforts in oil and gas exploration and development to sustain the output growth in the coming years, CFO Xie Weizhi said.

"We're going to sustain the annual capex at about Yuan 100 billion to ensure 5%-6% annual growth in production and reach 2 million boe/d by 2025. We will keep this plan despite short term fluctuation in oil prices," Xie added.

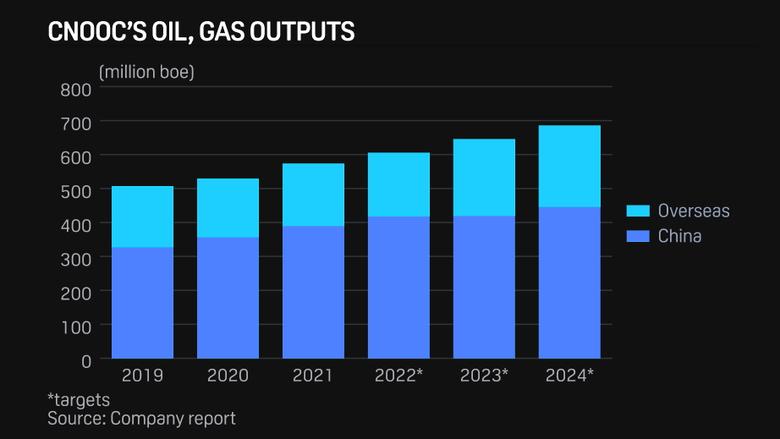

CNOOC targets to produce 1.64 million-1.67 million b/d of oil equivalent (600 million-610 million boe) in 2022, up 5.6% from the actual output of 1.57 million boe/d in 2021. Annual growth is targeted to exceed 6% in 2023 and 2024 to produce 640 million-650 million boe and 680 million-690 million boe, respectively, according to Xie.

CNOOC's 2021 output exceeded its original target of 1.49 million-1.52 million boe/d, which helped the company's net profit to jump 181.7% year on year and hit a record high Yuan 70.31 billion amid a well-controlled all-in cost, according to company results.

The company's all-in cost was $29.49/boe in 2021, 12% higher than $26.34/boe in 2020 but below $29.78/boe in 2019.

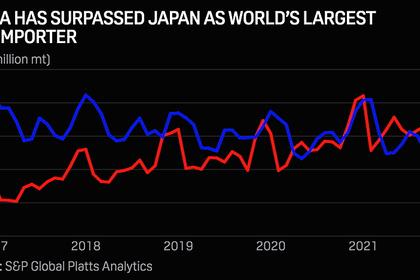

Domestic crude output rose 9.5%, or 27 million barrels, year on year in 2021, contributing to more than 79% of the country's output increment, showed company results and data from China's National Bureau of Statistics.

Gas output jumped 10.8% year on year to 700.6 Bcf from both domestic and overseas operations in 2021. Almost all of thecompany's gas is sold into the China market via term contracts, Xie said.

Some of the term supplies are priced against the Japan Crude Cocktail that are less impacted by spot LNG prices, he added.

Wang Dongjin, who is also the chairman of CNOOC Group, said the parent company's LNG imports are mainly from the Middle East, Australia and America, but seldom from Russia.

CNOOC's gas output accounts for about 25% of the group's gas sales. The company targets to lift the proportion to 30%-35% of the group's sales volume by end-2025, Wang said.

CBM, offshore wind power

In the onshore arena, company CEO Xu Keqiang said CNOOC sees a big opportunity for unconventional gas development.

CNOOC's coal bed methane output jumped 79.1% or 1.14 Bcm year on year and reached its production target of 3.59 Bcm in 2021 to become China's top onshore CBM producer, Xu said.

The company acquired China United CBM to have its onshore production resources.

"Based on the current exploration results and the [production] plan on proved reserve, our offshore gas output will reach 6-10 Bcm/year by end of the 14th Five Year Plan 2025."

Xu added that the good results from CBM exploration in Lin Xin and Shen Fu areas reflected sufficient reserves while the launch of the Shen'an pipeline will facilitate CBM sales prospects.

The 5 Bcm/year, 622.98 km Shen'an pipeline is the longest CBM pipeline in China to connect Shenmu city in Shaanxi province and Anping town in Hebei province via Shanxi province.

The part between Shanxi and Hebei provinces has been gradually launched since July 2021 to supply about 600 million cu m gas, according to local media.

To accelerate the company's energy transition, Xu said CNOOC newly acquired a 1.5 GW offshore wind power project in Hainan province's shoal waters.

"In addition to the offshore projects along the coastal provinces, we are also considering deepwater, far sea wind power generation demonstrative projects," Xu said.

CNOOC takes offshore wind power as its energy transition focus due to its strength in offshore fabrication, installation, maintenance and operation, and its fossil production platforms are the consumers of the power generated, Xu added.

The company targeted to spend 5%-10% of capex in energy transition during the 14th FYP.

-----

Earlier: