RUSSIAN OIL FOR TURKEY

DS - MAR 09, 2022 - Sanctions on Russia will have a "terrifying" effect on the global energy market, Turkey warned on Wednesday, saying it will continue to buy Russian oil, while also expressing hopes sanctions on Iran are lifted, a move that would bring additional supplies to meet global demand.

Separately, the World Bank warned oil price hikes driven by the Russia-Ukraine war would slash growth for big importers.

Turkey relies on Russia for 45% of its natural gas demand, 17% of oil and 40% of its gasoline, Deputy Energy and Natural Resources Minister Alparslan Bayraktar said in remarks on the sidelines of the CERAWeek energy conference.

"The world needs more oil," Bayraktar said. "It needs to come from somewhere, from the United States, from Venezuela, from Iran, Saudi Arabia, or wherever we need it to be," he added.

Bayraktar stressed Turkey could not easily replace its Russian oil supply from elsewhere and added, "they have been old, reliable suppliers."

The West’s moves to isolate Russia economically for attacking Ukraine have hit hard global commodity and energy markets, sending prices spiraling out and threatening to derail the nascent recovery from the COVID-19 pandemic.

The U.S. on Tuesday stepped up its campaign to punish Moscow by banning Russian oil and energy imports. Britain too said it would ban imports of Russian oil but only by gradually phasing them out during 2022 to give businesses time to find alternative sources of supply.

The sanctions will have a "terrifying" effect on the global oil market, Bayraktar separately told Sputnik on the sidelines of the energy event in Houston, the U.S.

"It will be very difficult to replace Russia, the world’s largest oil producer, in the global market," the official said, noting that countries are in a position where they should increase oil production as the coronavirus pandemic is easing and the global economy is recovering.

"Actually, I don’t know what effect this decision will have. But the previous U.S. sanctions, including those on Iran, affected other markets and regions, including Turkey," Bayraktar said.

"These sanctions will also have some spillover effect on other countries and the region," he added.

War-driven price hikes to affect big importers

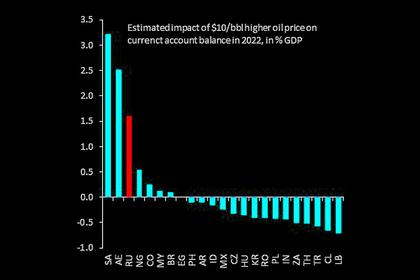

Persistent high-oil prices prompted by Russia’s invasion of Ukraine could cut a full percentage point off the growth of large oil-importing developing economies like China, Turkey, Indonesia and South Africa, a World Bank official said on Tuesday.

Indermit Gill, the bank’s vice president for Equitable Growth, Finance and Institutions, said in a blog posting that the war will deal further setbacks to growth for emerging markets already lagging in recovery from the COVID-19 pandemic and struggling with a range of uncertainties from debt to inflation.

"The war has aggravated those uncertainties in ways that will reverberate across the world, harming the most vulnerable people in the most fragile places," Gill said.

"It’s too soon to tell the degree to which the conflict will alter the global economic outlook," he cautioned.

Some countries in the Middle East, Central Asia, Africa and Europe are heavily reliant on Russia and Ukraine for food, as the countries together make up more than 20% of global wheat exports.

Gill said estimates from a forthcoming World Bank publication suggest that a 10% oil price increase that persists for several years can cut growth in commodity-importing developing economies by a tenth of a percentage point.

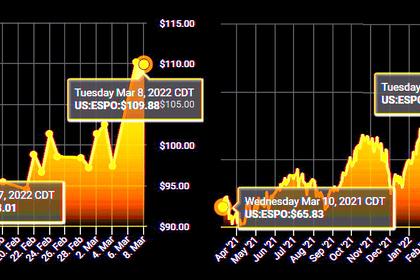

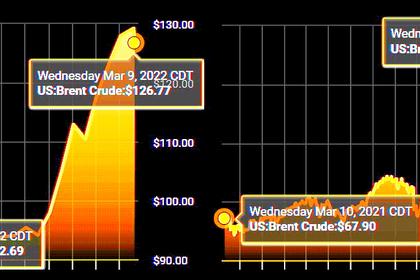

Oil prices have more than doubled over the last six months.

"If this lasts, oil could shave a full percentage point of growth from oil importers like China, Indonesia, South Africa and Turkey," Gill warned.

"Before the war broke out, South Africa was expected to grow by about 2% annually in 2022 and 2023, Turkey by 2%-3%, and China and Indonesia by 5%," he said.

Inflation, current account risks

The war has raised inflation and current account risks for Turkey amid a slide in the Turkish lira.

The rise in commodity prices from oil to wheat due to the conflict are likely to lead to a larger deficit, while also further stoking inflation – already at 54%.

The lira declined for a seventh straight day on Wednesday, bringing its losses to more than 5% since Russia launched its attack on Ukraine.

The lira was down around 1.3% to stand at 14.65 against the U.S. dollar by 8:44 a.m. GMT, its weakest since Dec. 20, when the government announced a plan to protect lira deposits against currency depreciation.

The currency was broadly stable in the first two months of the year mainly thanks to the protection scheme following a 44% decline in 2021 and was hovering just below 14 against the dollar.

The currency topped 14 against when volatility returned in late February as the tensions between Moscow and Kyiv rose, before rebounding.

The government has been embracing a new economic plan that aims to turn Turkey’s chronic current account deficits into a surplus, raise growth, employment and exports while keeping low rates.

The drive was supported by the central bank’s easing cycle, which saw its benchmark policy rate reduced 500 basis points to 14% since September.

‘Cannot have another disruption’

Turkey previously imported about 200,000 barrels per day (bpd) of Iranian crude before Washington decided in 2018 it would pull out of the 2015 Iran nuclear deal and reinstate sanctions.

"All of a sudden we went down to zero," Bayraktar said. "And now we cannot have another supply disruption, this time in Russia," he warned.

Turkey is hoping Washington and Tehran will reach a deal soon that will bring Iran back into compliance with the 2015 nuclear accord.

The two countries have been in talks for almost a year to restore the deal which lifted sanctions on Iran.

"I hope this Iran issue will be sorted out soon," Bayraktar said and added, "It will be much easier for us to cope with (supply)."

He stressed Turkey wants a stable energy market. "We need our economies to grow. I do not think that this decision (sanctions on Russia) will in any way contribute to achieving this goal," he said.

The oil prices, which spiked even before the events in Ukraine, are expected to continue to rise due to Western sanctions on Russia, Bayraktar said.

"There is simple math here. If the supply decreases, prices rise."

-----

Earlier: