RUSSIA'S, GERMANY'S GAS DEPENDENCE

By SIMON GOESS Co-founder cr.hub

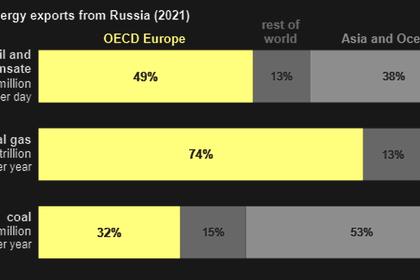

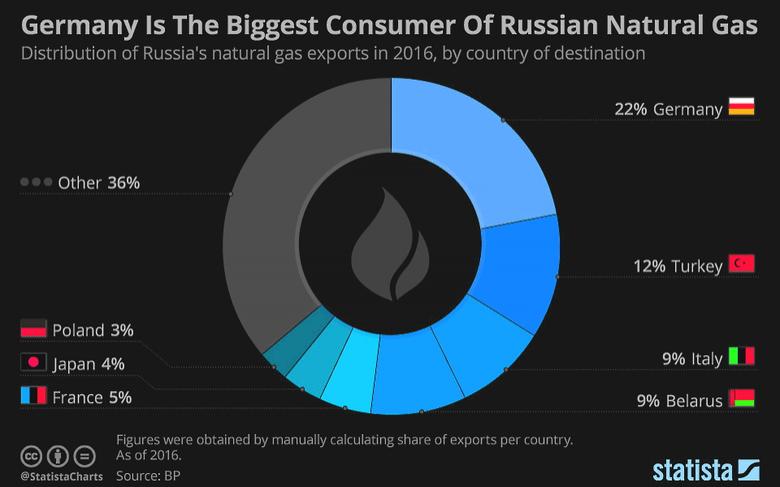

ENERGYCENTRAL - Mar 23, 2022 - The current discussion in Germany and Europe regarding a possible delivery stop of natural gas & Co. from Russia in the course of the Ukraine war is moving many. Part of the debate is not based on factual information. This blog article examines the topic of security of supply in a data-driven manner.

In this analysis, we assume two phases to ensure security of supply in Europe. In the first phase, two paths are conceivable: One path includes a delivery stop from Russia. On the other hand, there is the second path, in which Russia will continue to deliver a minimum of natural gas in accordance with its commitments. Both paths have the same goal: to establish a secure supply of oil, natural gas and coal. And at the same time to realize a long-term transfer towards a regenerative energy world with synthetic fuels. This is the second phase.

What is the initial situation like?

In 2020, Europeans consumed 5,000 TWh of natural gas. In addition, the natural gas storage tanks with a total capacity of 1,000 TWh had to be filled. These are currently about 30 percent full. Therefore, in a worst-case scenario - the rest of March 2022 will remain cold - we assume that we will need an additional 850 TWh in the first year to fill the storage facilities.

The following graphic shows the current gas import quantities using LNG from Algeria and Norway, extrapolated for the year 2022, the current import from Russia and domestic production within the EU, as well as the natural gas demand just mentioned for the year 2020.

In the event of a total failure of the supply of natural gas from Russia, another 640 TWh of LNG imports could be used. However, it can be seen that about 500 TWh of natural gas would then be missing in Europe. This corresponds to about 10 percent of the total amount. The bottleneck here is mainly due to regasification capacities in Europe. Far less relevant are the exporting countries (USA or Qatar) or the LNG fleet, which is significantly expanded every year.

What happens if Russia stops delivering?

The loss of Russia as a supplier would not immediately affect natural gas consumption. The failure will only be felt when peak consumption occurs in January, February and March 2023 – usually the coldest months of winter.

Because these quantities usually come from the natural gas storage facilities. Without Russia's supplies, however, natural gas storage in Europe remains at 30 percent. This amount would be used up in the first few months of the heating season. As a result, there can be significant bottlenecks in the second phase of winter. This can be seen in the graphic below.

As the figure clearly shows: Due to the seasonal nature of natural gas consumption, the heat use of natural gas in Europe can be seen either directly or to a small extent through the use of natural gas power plants with district heating extraction.

How can the supply gap be closed?

In the short term, the supply gap can only be closed by reducing natural gas consumption. Because the other energy sources (oil, coal) would also be affected by a supply failure by Russia. In the medium term, Europe needs at least six more LNG regasification terminals, each capable of bringing around 100 TWh of natural gas into the system. However, this will not be feasible before 2026.

Until then, we will have to reckon with a natural gas price level in Europe that is characterized by panic, cold spells in Asia and LNG export costs. From our point of view, this state of affairs will only change significantly when regenerative hydrogen prices, the only alternative to natural gas, determine the price level. The figure below shows the expected price levels.

Significant investments will be made in the panic phase until 2026 to compensate for the loss of Russian imports and to find alternatives for the use of natural gas. A significant problem is that a large proportion of natural gas is used to provide heat.

Replacing this with fluctuating renewable energies will not be possible in the short term. Alternatives to the provision of heat in residential construction will be implemented (heat pumps, etc.). But this will not significantly lead to consumers consuming much less natural gas.

Chart 4 uses the example of Germany to see which measures could be implemented in the short term. On the one hand, there is the much-discussed extension of the lifetime of nuclear power plants and a postponement of the coal phase-out in 2022.

What does the analysis show in detail?

In a scenario run based on the Power2Sim fundamental model , the analysts from Energy Brainpool compared the following: How will the planned phase-out of nuclear energy and the phase-out of coal affect natural gas consumption, also with the perspective of a possible life extension of nuclear power plants? This results in savings of 17 TWh of natural gas per year with around 1,000 TWh of natural gas consumption. The reason for the small reduction lies in the district heating decoupling of the natural gas power plants. This cannot be replaced by the existing nuclear or coal power plants. The second measure is the planned temperature reduction in households under the motto "Freeze for peace".

Our conclusion: Reducing the room temperatures in the household actually has a greater impact on natural gas consumption than extending the running times of the power plants. Initial estimates assume 21 TWh per year. The graphic below shows these effects.

The savings are offset by the increased consumption of natural gas, especially heating gas, during a cold winter. The historical fluctuation ranges were 67 TWh in a winter season.

Summary

In summary, it can be stated: We have established that the dependence on Russian natural gas in Germany is so great that if supplies from Russia were to be stopped and the remaining quantities of natural gas distributed to Europe, Germany would have to reduce its natural gas consumption in the heating gas sector or in the industrial sector by 100 TWh per year . From today's perspective, this does not appear to be possible and can only be adequately compensated for by the rapid construction of LNG terminals.

-----

This thought leadership article was originally shared with Energy Central's Energy Collective Group. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join the Energy Collective Group today and learn from others who work in the industry.

-----

Earlier: