S.KOREA'S OIL IMPORTS UP

PLATTS - 18 Mar 2022 - South Korea's crude oil imports in February rose 3.3% from a year earlier, latest customs data showed, as local refiners raised their crude throughput and overall run rates to capture healthy Asian middle distillate cracks, while the companies will continue to favor competitive US crude to minimize feedstock cost burden, market and trading participants in Seoul said March 18.

The world's fourth-biggest crude importer received 10.565 million mt, or 77.44 million barrels, of crude oil in February, compared with 74.97 million barrels imported a year earlier, marking a fifth consecutive month of year-on-year increase, data from Korea Customs Service released March 16 showed.

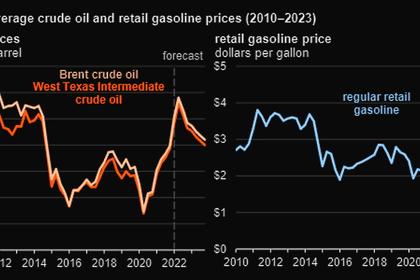

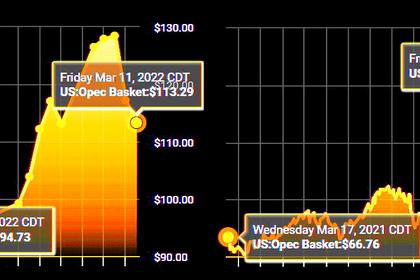

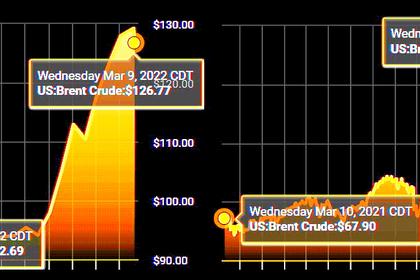

Despite the rise in energy import bills due to surging benchmark oil prices, South Korea's crude imports are likely to maintain the strong momentum as major refiners including SK Innovation and Hyundai Oilbank have been raising their crude throughput to capture strong refining margins amid tight middle distillate supply across Asia.

Hyundai Oilbank indicated that it plans to shut its No. 1 crude distillation unit for several weeks over April-May for seasonal turnaround, but the refiner aims to maintain high crude throughput to take advantage of strong cracking margins, a company official said.

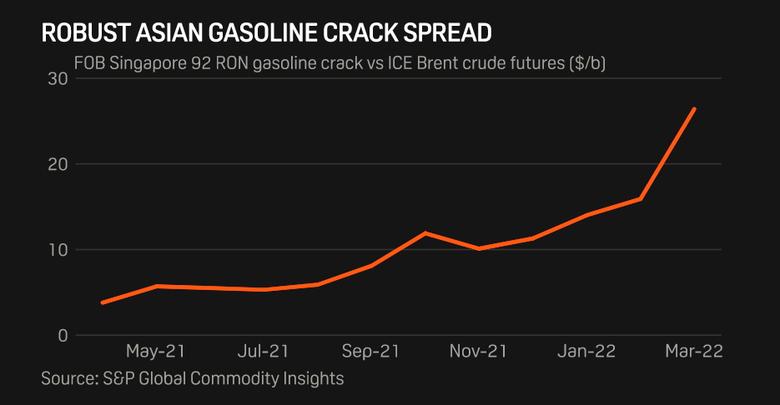

"Cracks for gasoline and diesel are forecast to further climb this year to average at $11-$12/b and $14-$15/b, respectively," the official told S&P Global Commodity Insights previously.

China's strong focus on securing oil products and transportation fuels for domestic market and domestic consumers so far this year has limited the country's middle distillate exports, while Vietnam's faltering refined products output due to financial struggles at the country's biggest refining complex Nghi Son refinery and petrochemical could mean more sales opportunity for South Korean fuel suppliers across Asia, gasoline and diesel marketers at two South Korean refiners said.

Reflecting the overall tight supply condition in East Asia, The FOB Singapore 92 RON gasoline crack against front month ICE Brent crude futures has averaged $17.6/b to date in first quarter, up from the $11.1/b average in Q4 2021 and sharply higher than 2021 yearly average of $6.9/b Platts data showed.

South Korea's domestic consumer transportation fuel demand is under pressure as surging retail gasoline prices dampen consumer sentiment, but tight supply and healthy margins in the broader Asian market would support middle distillate exports, a sales manager at S-Oil said.

Competitive US crude

The customs data showed South Korea's imports of US crude, mostly light sweet grades, jumped 30.1% year on year to 1.551 million mt, or 11.37 million barrels, in February.

The February shipments marked the eleventh consecutive month of year-on-year increase, reflecting local refiners' strong preference for competitive US crude grades in times of surging benchmark oil prices.

With lower taxes and tariffs on US crude purchases due to the US-South Korea free trade agreement, higher quality light sweet US crude comes anywhere between $1-$10/b cheaper than Middle Eastern cargoes, feedstock managers at two South Korean refiners told S&P Global.

In addition, South Korean traders said they typically purchase spot US crude cargoes on Dubai pricing basis, unlike some other refiners across Asia that buy North American grades on Dated Brent basis.

"Considering the record high Brent-Dubai price spread, this is another big advantage... in times of ultra-high oil prices, every cents and dollars per barrel you can save means a lot," a feedstock trading manager at Hanwha Total said.

Brent/Dubai Exchange of Futures for Swaps was assessed at an average premium of $6.8/b to date in Q1, more than double the 2021 average premium of $3.2/b, S&P Global data showed.

A widening EFS spread makes crude priced against Dubai more economically attractive for Asian refiners compared to Brent-linked ones.

South Korean refiners paid on average of $78.88/b for shipments of US grades in January, lower than $82.98/b paid for Saudi Arabian crude imports and more than $7/b cheaper than $85.94/b paid for Kuwaiti barrels, according to data from state-run Korea National Oil Corp.

Elsewhere, South Korea's crude imports from its top supplier Saudi Arabia, excluding shipments from the Saudi-Kuwaiti Neutral Zone, climbed 8.6% year on year to 3.508 million mt, or 25.71 million barrels, in February, the customs data showed.

Meanwhile, South Korea's crude stockpiles rose 10.3% on the year to 44.39 million barrels as of end-January, as refiners aimed to replenish their inventories amid growing concerns over global supply disruptions, according to a KNOC official.

KNOC will release detailed oil trade data for January in the week of March 27.

-----

Earlier: