SAUDI ARAMCO $2.3 TLN

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

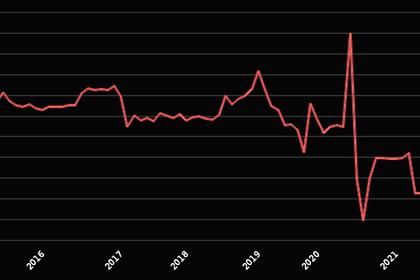

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

SAUDI ARAMCO $2.3 TLN

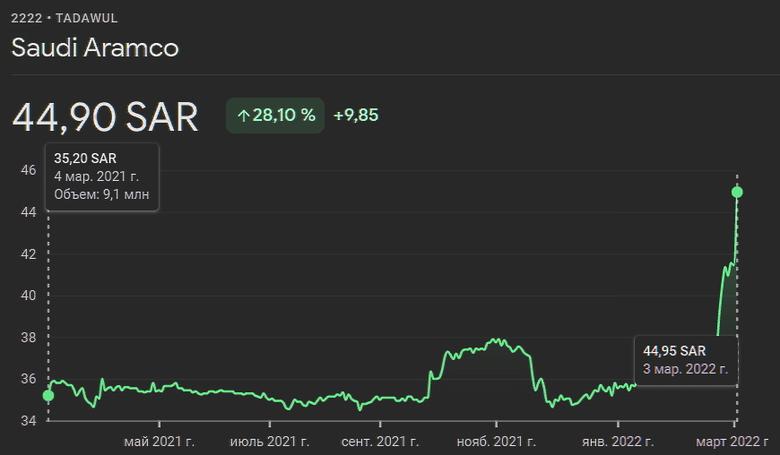

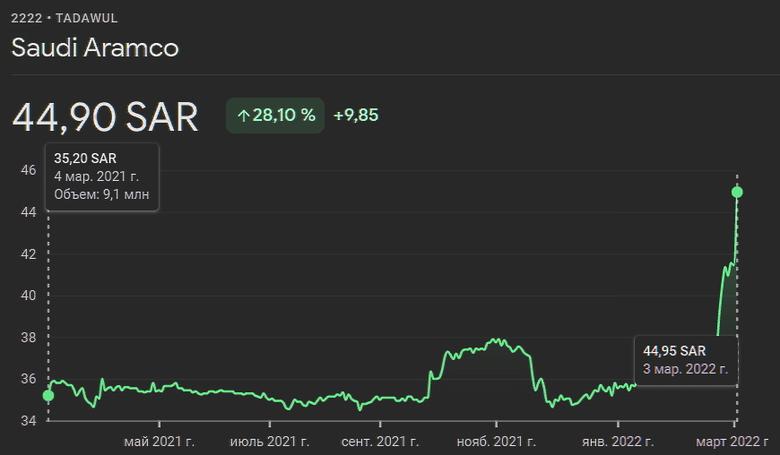

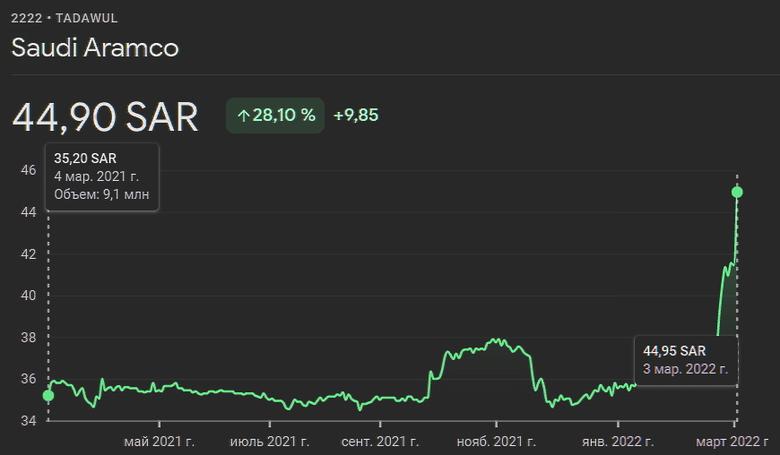

AN - March 02, 2022 - Shares in oil giant Aramco touched the highest level in its history of SR43.1 ($11.5) on Wednesday, propelled by a rally in the energy market.

This brought the oil giant’s market value to as much as $2.3 trillion, positioning it as the second-largest valued company worldwide after Apple Inc.

The shares have been trading at record levels for few times recently, breaking a new record every few days.

At 11:48 a.m., shares slightly retreated to SR42.85, having jumped 3.38 percent during the day.

Oil prices rose significantly ahead of the OPEC+ meeting –where the Organization of the Petroleum Exporting Countries members and its allies will convene to discuss oil output.

Brent crude topped $111 during Wednesday Trading, after settling at $105 a day earlier, and US benchmark WTI neared $110 per barrel as of 11:44 a.m. Saudi time.

-----

Earlier:

2022, February, 28, 13:00:00

ARAMCO INVESTMENT DEAL $15.5 BLN

The consortium has acquired 49% stake in Aramco Gas Pipelines Company, a subsidiary of Aramco, for $15.5 billion.

2022, February, 1, 14:25:00

SAUDI ARABIA'S NEOM $500 BLN

Neom, which will be built along Saudi Arabia's borders with Jordan and just across the narrow Strait of Aqaba from Egypt's Sinai Peninsula, is a linchpin of the world's largest oil exporter's plans to diversify its fossil fuels-dominated economy.

2022, January, 21, 10:45:00

SAUDI ARABIA'S HYDROGEN

Private sector firms in Saudi Arabia will be encouraged to import hydrogen-powered vehicles as part of the Kingdom's green iniative

2022, January, 13, 13:50:00

SAUDI ARABIA RENEWABLES 15 GW

Saudi Arabia plans to generate 15109 gigawatt hours of electricity from renewable sources by 2024, supplying 692,557 houses with energy, the Kingdom's Gastat said on its website.

2021, December, 13, 12:35:00

SAUDI ARABIA, KUWAIT OIL PRODUCTION RISE

The Neutral Zone fields, which lie in onshore and offshore territory shared by Saudi Arabia and Kuwait at their border, were offline for more than four years until 2020, due to a political dispute that was resolved with a signing of an agreement in December 2019.

2021, December, 7, 17:55:00

ARAMCO GAS PIPELINE DEAL $15.5 BLN

Aramco Gas Pipelines Co. will lease usage rights in its parent company's gas pipelines network and lease them back to Aramco for a 20-year period.

All Publications »

Tags:

SAUDI,

ARAMCO