SAUDI ARAMCO NET INCOME $110 BLN

ARAMCO - March 20, 2022 - Aramco announces full-year 2021 results

Company outlines growth ambitions, net income and free cash flow more than double year-on-year

• Aramco invests for growth, expanding its focus on blue hydrogen and carbon capture as it targets role as critical supplier of secure, affordable energy with lower emissions

• Net income: $110.0 billion (2020: $49.0 billion)

• Cash flow from operating activities: $139.4 billion (2020: $76.1 billion)

• Free cash flow*: $107.5 billion (2020: $49.1 billion)

• Gearing ratio*: 14.2% as at December 31 (end of 2020: 23.0%)

• Full-year cash dividend of $75 billion declared, including $18.8 billion for Q4. Board recommends $4 billion in retained earnings to be capitalized and bonus shares to be distributed to shareholders, reflecting strong 2021 earnings performance

• Increased capital expenditure guidance of $40-50 billion in 2022, with further growth expected until around the middle of the decade

The Saudi Arabian Oil Company (“Aramco” or “the Company”) today announced its full-year 2021 financial results, reporting that net income more than doubled year-on-year to $110.0 billion. Aramco declared a fourth quarter dividend of $18.8 billion, to be paid in the first quarter of 2022.

The Company also announced its growth strategy, which in its Upstream business includes continuing to raise crude oil Maximum Sustainable Capacity (MSC) to 13 million barrels per day (mmbpd) by 2027, and potentially increasing gas production by more than 50% by 2030. In its Downstream business, the Company plans to expand its liquids to chemicals capacity to up to 4 mmbpd. Aramco also intends to develop a significant hydrogen export capability and become a global leader in Carbon Capture and Storage (CCS).

In addition, the Company is targeting investment in renewable energy and nature-based solutions, as it pursues its ambition of achieving net-zero Scope 1 and Scope 2 greenhouse gas emissions across its wholly-owned operated assets by 2050. This includes an aim to reach nearzero Upstream methane emissions by 2030.

Commenting on the results, Aramco President & CEO Amin H. Nasser, said: “Our strong results are a testament to our financial discipline, flexibility through evolving market conditions and steadfast focus on our long-term growth strategy, which targets value growth for our shareholders.

“Although economic conditions have improved considerably, the outlook remains uncertain due to various macro-economic and geopolitical factors. But our investment plan aims to tap into rising long-term demand for reliable, affordable and ever more secure and sustainable energy.

“We recognize that energy security is paramount for billions of people around the world, which is why we continue to make progress on increasing our crude oil production capacity, executing our gas expansion program and increasing our liquids to chemicals capacity.

“We are also investing in CCS, renewables and low-carbon hydrogen production - supporting the global energy transition and advancing our net-zero ambition.”

Financial Highlights

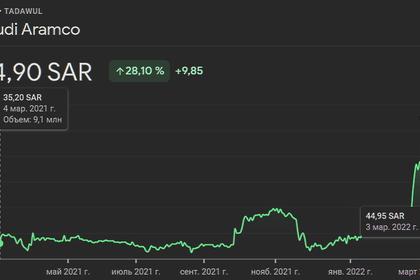

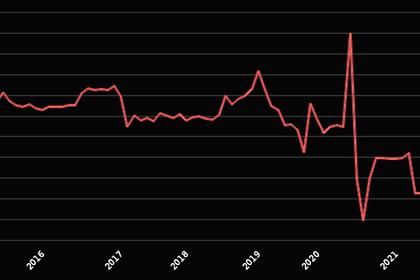

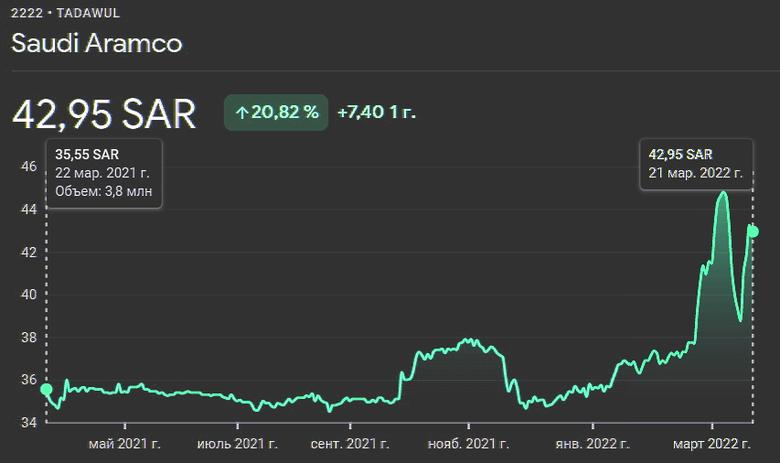

Aramco’s net income increased by 124% to $110.0 billion in 2021, compared to $49.0 billion in 2020. The increase in net income reflects higher crude oil prices, stronger refining and chemicals margins, and the consolidation of SABIC’s full-year results.

Free cash flow* was $107.5 billion in 2021, compared to $49.1 billion in 2020. Aramco continues to prioritize a strong balance sheet and its gearing ratio at the end of 2021 was 14.2%, compared to 23.0% at the end of 2020.

Aramco declared a dividend of $18.8 billion for the fourth quarter, to be paid in Q1 2022. The Board of Directors also recommended that $4 billion in retained earnings be capitalized and bonus shares be distributed to shareholders, subject to required Extraordinary General Assembly and regulatory approvals. Under the recommendation, shareholders would be granted one bonus share for every ten shares owned. As a result, the total dividend for 2021 is $75 billion in cash, in addition to bonus shares. The Company aims to maintain a sustainable and progressive dividend, in line with future prospects, underlying growth in free cash flow, and long-term value creation through investments in available opportunities.

Capital expenditure in 2021 was $31.9 billion, an increase of 18% from 2020, primarily driven by increased activities in relation to crude oil increments, Tanajib Gas Plant and development drilling programs. Aramco expects 2022 capital expenditure to be approximately $40-50 billion, with further growth expected until around the middle of the decade. This is in line with the Company’s belief that substantial new investment is required to meet demand growth, against a broader decline in upstream investment across the industry globally.

Reflecting progress in its portfolio optimization program, in December the Company signed a lease and leaseback deal involving its gas pipeline network with a consortium of investors led by BlackRock Real Assets and Hassana Investment Company. The deal closed in February 2022 and the consortium acquired a 49% stake in a newly-formed Aramco subsidiary, Aramco Gas Pipelines Company, with Aramco receiving upfront proceeds of $15.5 billion.

Earlier in 2021, Aramco closed a similar deal for its oil pipeline network with another international investor consortium, including EIG Global Energy Partners and Mubadala. The consortium acquired a 49% stake in Aramco Oil Pipelines Company, a subsidiary of Aramco, for $12.4 billion.

In addition, Jazan Integrated Gasification and Power Company, a joint venture consisting of Saudi Aramco Power Company (SAPCO), Air Products, ACWA Power and Air Products Qudra, signed agreements for the asset acquisition and project financing of $11.8 billion relating to the Jazan Integrated Gasification Combined-Cycle power plant, an Air Separation Unit and certain ancillary assets from Aramco located in Jazan Economic City.

Aramco also raised $6 billion in the second quarter of 2021, as it expanded and diversified access to capital through the issuance of three tranches of US dollar-denominated Shari’a-compliant Sukuk trust certificates. The issuance was the world’s largest order book of US-dollar denominated Sukuk.

Press release full PDF version

Consolidated financial statements full PDF version

-----

Earlier: