GAZPROM GERMANIA UNDER TRUSTEESHIP

By SIMON GOESS Co-founder cr.hub

ENERGYCENTRAL - Apr 6, 2022 - Ruble decree, early warning stage, raid, Gazprom's parent company withdrawing, imminent default and now trusteeship: Since last week, reports on the subject of Gazprom and the natural gas supply stop have been escalating. The danger of a Russian natural gas supply freeze to Germany and Europe seems more present than ever.

Beyond a possible delivery stop, however, one question increasingly came to mind: What happens if Gazprom's European subsidiaries fail? How would that affect German energy suppliers? This blog post puts the events in perspective and explains the background to the step taken by the federal government on April 4, 2022 to place Gazprom Germania under trusteeship.

Initial situation: What leverage does Russia have when it comes to natural gas deliveries?

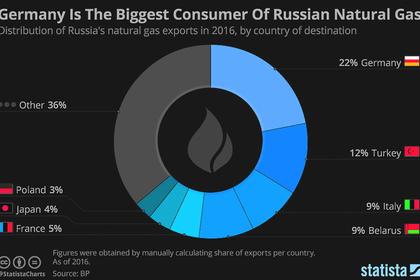

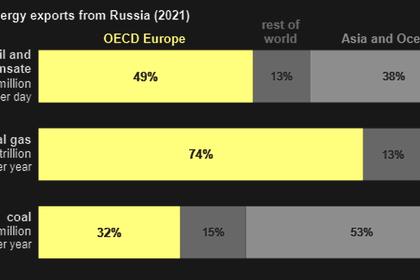

Since the outbreak of the Ukraine war, it has become increasingly clear that Germany and Europe's dependence on Russian natural gas supplies cannot be eliminated in the short term without considerable economic damage (cf. blog post Erdgas & Co.: Will next winter be cold? ). According to the current status, Germany must expect a lack of natural gas quantities for at least one, in all probability two winters (progress report BMWK from 25.03.22: goal of independence by summer 2024). [1]

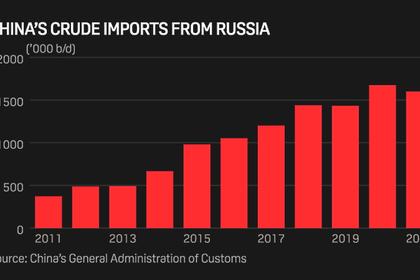

Of course, an immediate stop to pipeline-bound natural gas sales to Europe would also result in considerable economic losses for the Russian government. There are no alternative pipeline routes with a similarly large transport capacity for the natural gas in question from the natural gas fields near Europe to “friendly countries” such as China or India.

Nevertheless, control over natural gas supply volumes harbors the potential for Russia to use this as a geopolitical lever to further its own interests. A reduction in the delivery quantities within the quantity structure defined in the inventory contracts can already contribute to natural gas quantities not being stored in the summer. These will then be missing next winter in a delivery stop scenario.

In addition, in such a tense geopolitical situation, small changes in import volumes are relevant to the market price. Because they increase the price volatility on the natural gas trading venues.

Gazprom's natural gas sales to Europe: the role of Gazprom's subsidiaries

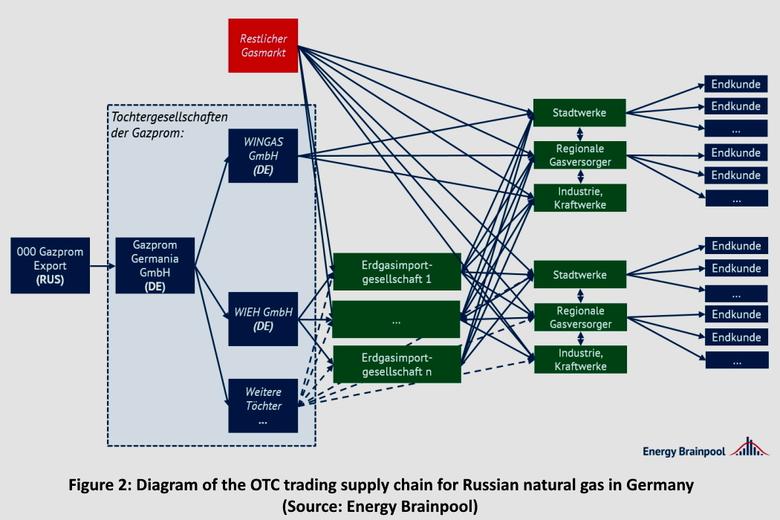

On the trading side, Gazprom's natural gas reaches Europe via long-term supply contracts. However, European suppliers have not concluded natural gas sales contracts directly through the Russian Gazprom export company “OOO Gazprom Export”. Specifically, this was realized by the Germany-based, 100% subsidiary Gazprom Germania GmbH. Gazprom Germania distributes the natural gas quantities on the trading side in Europe via its own subsidiaries.

According to the annual reports of the companies concerned, WIEH GmbH and Wingas GmbH are particularly relevant for the German natural gas supply. There are also other subsidiaries of Gazprom-Germania that are important for the European natural gas supply and infrastructure. These include London-based Gazprom Marketing & Trading Ltd and storage operator Astora GmbH, as shown in the figure below.

Ruble decree, raid, withdrawal of the Gazprom mother: the risk of insolvency of the Gazprom subsidiaries has increased

In the past week, events have increased that have significantly increased the risk of insolvency for Gazprom's subsidiaries. Although these events did not appear to be directly related at first glance, they always affected Gazprom Germania.

Ruble Decree

After a week-long confusion of partly contradictory public announcements, the Russian government decreed new methods of payment on March 31, 2022. Specifically, they demanded that western countries pay for gas deliveries at least in part in rubles instead of in the contractually defined euros or dollars. Western customers are to make payments in EUR to Gazprom Bank, which will then exchange them for rubles. [3]

Gazprom Bank is explicitly not affected by the EU sanctions regarding the Ukraine war and continues to be part of the SWIFT system. However, according to the Handelsblatt [4] , the Russian government ordered Gazprom PAO in mid-March to convert 80 percent of the income from energy transactions into rubles to support the national currency. This is only possible through Gazprom Bank.

Among other things, the German federal government decided in the course of these public statements on March 30, 2022 to proclaim the early warning level of the gas emergency plan. The aim is to intensify the precautionary measures with regard to an imminent gas supply stop.

raid

On March 30, 2022, the EU competition authorities raided several European Gazprom subsidiaries. This was due to investigations by the EU Commission into possible anti-competitive behavior by Gazprom. [5]

withdrawal of the Gazprom parent company

On March 31, 2022, the Russian Gazprom parent company announced that it was withdrawing its 100% stake in the subsidiary Gazprom Germania GmbH, which is central to European gas supplies. [6] At the time of writing, one can only speculate about the reasons.

This step is conceivable both as a reaction to the raid and as a strategic element of uncertainty. Furthermore, the goal of redesigning existing contract structures seems conceivable in order to get more leeway in the volume and price structure for future gas sales contracts to Europe. In addition, even more weight could be given to the "delivery stop" as a means of pressure.

It is also possible to get a clear signal in the direction of the ruble decree. Nothing has changed for Gazprom Germania's European business partners. Neither because of the ruble decree nor, for the time being, because of the withdrawal of Gazprom's parent company. With a view to the Gazprom subsidiaries, however, in view of these events it can be said that their contractual and financial situation became completely unclear as a result of this step, and their risk of default has increased significantly in view of this uncertainty.

Which companies would be directly affected by a Gazprom subsidiary default?

Russian natural gas currently accounts for around 40% of German natural gas consumption. According to its own statements, Wingas GmbH alone already covers around 20% of German natural gas sales [source: Annual Report of Wingas GmbH, as of April 4th, 2022] [7] . It acts as a contractual partner for a large number of German energy suppliers and municipal utilities.

WIEH GmbH , on the other hand, primarily supplies two large German natural gas import companies, but could also have other large trading partners. It can be assumed that Wingas focuses on small and medium-sized customers, whereas WIEH GmbH only serves large customers.

A leak from the Tagesspiegel Background dated March 29, 2022 indicates that the three German companies Uniper Global Commodities, Wintershall Dea and VNG held long-term contracts for Russian natural gas from Gazprom in 2020. Although it seems conceivable that at least two of these companies get their Russian gas from WIEH GmbH. At the given time, it is unclear whether a major German natural gas buyer has a direct contract with 000 Gazprom-Export.

What effects would be expected on the natural gas trading chain and supply if Gazprom Germania were to fail?

Most of the direct contractual partners of the Gazprom subsidiaries act as intermediaries. In the event of a loss in natural gas purchase quantities, these would first have to meet their delivery obligations from the resale transactions by procuring replacement quantities.

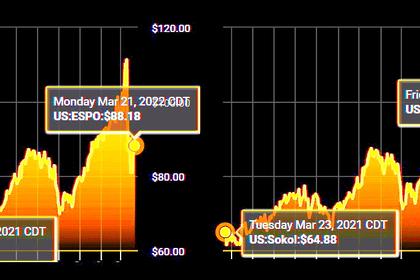

These replacement quantities would be procured at today's market prices. The so-called replacement risk is a problem for intermediaries if the market price at the time of replacement is higher than at the time the contract was concluded. In most cases, this should be the case given the current maximum prices.

It is also conceivable that if the Gazprom subsidiaries default, the prices for natural gas on the spot and futures markets will rise significantly. This can also be the case if the Russian Gazprom parent company offers the natural gas volumes released by the default of the Gazprom subsidiaries – which were previously tied up in the subsidiaries' contracts – for sale on European markets.

Today's natural gas price level can pose significant financial problems for intermediaries when it comes to replacing and fulfilling existing delivery obligations. In some cases, this can endanger the continued existence of the company. This raises the question of “economic reasonableness” for the intermediaries.

In principle, delivery obligations may only be adjusted if the replacement costs for the middleman, who is also often the supplier, are "economically unreasonable". Should this be the case, however, the prices of the end customer contracts would be adjusted accordingly. And the problem of high natural gas prices is transmitted to the next link in the trading chain, all the way to the end customer. This would then be all household and commercial customers, power plants and industrial customers.

Analogously to the Russian share of German natural gas consumption, around 40% of German natural gas sales volumes could be affected. However, these natural gas quantities cannot be distributed among 40% of end customers. Instead, it is quite possible that almost all natural gas end customers are affected by this one contract termination. As can be seen in Figure 2, the natural gas traders and suppliers deliver the natural gas to end consumers via several intermediate trade levels and also trade with each other.

One megawatt hour of natural gas is now sold and repurchased at least once on German trading venues before it is ultimately consumed by end customers. In 2020, for example, the ratio of gas trading volume and consumption volume ("turnover ratio") was around 2.8. This means that one megawatt hour of natural gas consumed in Germany in the year in question was previously traded 2.8 times on average. [8th]

In addition, it cannot be assumed that a natural gas intermediary would distribute its own natural gas procurement contract directly to one or more customers. Instead, it is common practice to mix up all procurement contracts and then resell this portfolio mix to all of its customers, end customers as well as other intermediaries. This procedure is called portfolio hedging and is shown in Figure 3 in comparison to a possible direct delivery, which is traceable.

In the case of portfolio hedges, which are customary in the industry, the origin of the natural gas import volumes is no longer traceable after the first intermediate trading stage in the retail chain. From the turnover ratio of the German gas trade of 2.8 it can be deduced that on average there are almost two intermediate trade levels up to the end consumer.

In short: an end user cannot ask his supplier about the origin of the natural gas because he does not know himself.

Trust management instead of wave of bankruptcies – the only logical step?

In view of the market structures described, it should now be clear that a failure of Gazprom Germania would subject the energy trading system to an enormous stress test with an uncertain outcome. In this respect, the announcement by the federal government on April 4, 2022 that the Federal Network Agency would be appointed as trustee of Gazprom Germania GmbH until the end of September 2022 appears to be a sensible step towards reducing market uncertainty. As a result, the authority to manage and dispose of the company's assets is limited and is subject to the approval of the Federal Network Agency.

The trustee is also fully authorized to give instructions and receives all voting rights of the GmbH. [9] This means that German and European natural gas traders and suppliers are at least a little less exposed to the arbitrariness of Russian politics. But would there have been other ways to mitigate the threat of a collapse in energy trading?

Why the federal load distributor alone is not enough

The Schmidt cabinet in Germany at the time of the oil crisis in the 1970s already regulated how to proceed in the event of a threat to the security of supply in Germany: with the 1975 Energy Security Act and the 1982 Gas and Electricity Security Ordinance (last updated in 2005). The implementation of EU regulations also resulted in a gas emergency plan for the Federal Republic of Germany in 2019 (three warning levels are provided for in this plan. On March 30th, 2022, the federal government activated the first early warning level in order to intensify precautionary measures.

A further increased risk of a Russian delivery stop would result in the activation of the highest emergency level. In this case, it is intended that the Federal Network Agency, as the federal load distributor, will carry out official load flow distribution measures.

Particularly protected customer groups (e.g. social institutions, private households) who are not affected by a load shedding are clearly defined in this case. For the remaining customer groups, corresponding physical switch-off plans for prioritizing the remaining natural gas consumers in Germany either exist or are currently being developed.

The central load distributor allocates natural gas purchases. In addition, in accordance with the Energy Security Act, he can also issue rulings for affected companies that relate to the cancellation or adjustment of contracts or the conclusion of new contracts. “Reasonable” prices should be set here. Beyond that, however, there are hardly any further instructions on how to deal with the commercial contracts.

Since replacement and default risks arise primarily from the difference between currently high market prices and "old", lower contract prices, it is particularly important to clearly regulate who takes on the financing of this delta. Without such a regulation, it is quite conceivable that all contracts would become obsolete in an emergency. Accordingly, the existing regulations on the federal load distributor do not offer a completely reliable safeguard for the trading system in the event of a Gazprom subsidiary defaulting.

What steps can now be expected from the trustee? A look at the UK

With regard to defaulting counterparties, the British government already enshrined a possible problem-solving strategy in law in 2009, which is very similar to the trust administration in Germany - the so-called Special Administration Regime (SAR). In the event of an impending failure of an energy trader, an administrator appointed by the state government takes over its management.

The admin also carries out the procurement at expensive wholesale market prices without passing them on to the final customer. The financing of the delta of high market and low retail prices is thus provided by the government. Should Gazprom Germania no longer be supplied with natural gas by its ex-parent company in the course of the next few months, such a step can also be expected from the trustee, the Federal Network Agency. In contrast to the UK, however, the financing of this step has yet to be clarified.

The Administrator's role in UK SAR is to ensure deliveries to customers provided that costs are kept to the lowest practicable level. Apart from that, the end result of the SAR is open and can result in:

- A rescue of the failing company,

- The sale of this very company, right

- The transfer of the company's customers to other distributors/suppliers.

Since a possible expropriation and nationalization of the German subsidiaries of Gazprom and Rosneft has been discussed in Germany in the meantime [10] , no path seems to be ruled out in this country either.

Figure 4 summarizes the market role of an SAR or trustee regime, should the trade relationship between 000 Gazprom Export and Gazprom Germania end and a state takeover of all trade relationships, including the procurement of replacement quantities, become necessary.

Conclusion: What can we expect now?

The risk of a collapse in energy trading relationships in Germany is at least partially reduced by the trusteeship. In the event of a break in the trading relationship between Gazprom Germania and its ex-parent company, questions regarding the financing of the procurement of replacement quantities must now be clarified quickly in order to adequately protect the market against default risks.

From a political point of view, this case seems quite conceivable, because it would play into the hands of the Russian government due to the upcoming renegotiation of natural gas supply contracts. After all, not only the delivery quantity structure, but also the currency specifications for the payments could be redefined.

The financial effort of an expensive replacement is associated with very high costs based on the current market prices. In view of the threatening economic damage in the event of a collapse in energy trading, this financial expense seems reasonable from today's perspective and could be financed either through a levy or through the state budget.

Authors: Tobias Federico, Michael Claussner

Swell:

[1] https://www.bmwi.de/Redaktion/DE/Downloads/Energie/0325_fortstufenbericht_energieSicherheit.pdf?__blob=publicationFile&v=10

[2] https://www.gazprom-germania.de/company/structure.html

[3] https://www.handelsblatt.com/politik/international/russia-putin-unterzeicht-gas-dekret-westliche-kunden-musessen-kauf-ueber-russian-bank-absolve/28217422.html

[5] https://www.sueddeutsche.de/wirtschaft/eu-kommission-razzia-bei-gazprom-1.5557938

[6] https://www.reuters.com/business/energy/russias-gazprom-exits-german-business-amid-row-over-pricing-2022-04-01/

[7] https://www.wingas.com/fileadmin/Wingas/content/04_UNTERNEHMEN/2020-01-31-Factsheet_DE_WEB-1seiten-RZ-vro.pdf

[9] https://www.bmwi.de/Redaktion/DE/Pressemitteilungen/2022/04/20220404-bmwk-setz-bundesnetzagentur-als-treuhanderin-fur-gazprom-germania-ein-zugang-der-gazprom-germania -gmbh-by-jsc-palmary-pending-ineffective.html

-----

Earlier: