OPEC+ OIL PRODUCTION DOWN

PLATTS - 07 Apr 2022 - OPEC+ crude production falls as sanctions take bite out of Russia: S&P Global survey

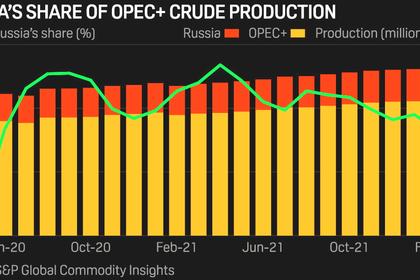

Crude oil production by OPEC and its allies fell in March from February for the first time in more than a year, the latest S&P Global Commodity Insights survey found, contributing to a tightening market thrown in flux by the Russia-Ukraine war.

Western sanctions began biting into primary non-OPEC partner Russia's oil flows, and sizable disruptions in Kazakhstan and Libya also led the coalition's production lower, the survey found.

OPEC's 13 members raised output by 60,000 b/d to 28.73 million b/d, but that was more than offset by a 160,000 b/d decline by the bloc's nine allies, who pumped 13.91 million b/d.

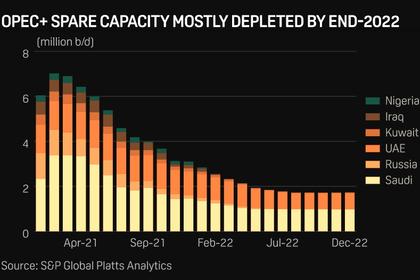

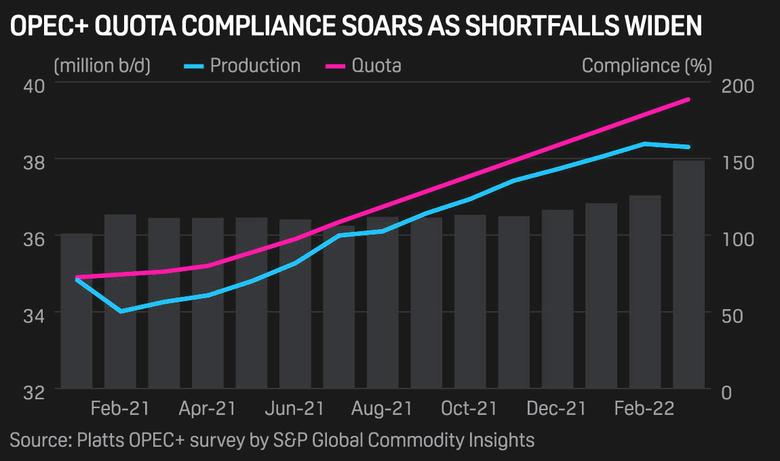

With the net decline of 100,000 b/d, the widening gap between the OPEC+ production and quotas jumped to a record-high 1.24 million b/d—casting further doubt on the group's ability to meet growing global oil demand, which many analysts expect to return to pre-pandemic levels in 2022.

The drop was the first since February 2021, when Saudi Arabia instituted a unilateral voluntary 1 million b/d cut to help prop up the market that at the time was still wobbly from resurgent coronavirus cases.

Since August, with the global economy on firmer footing, the producer group has stuck to a plan of gradually raising quotas by 400,000 b/d each month but has faced mounting pressure from the US, India, Japan, and other major oil-consuming nations for accelerated supplies to cool off rising energy prices.

But several countries have not hit their output targets in months, and March's shortfall resulted in a compliance figure of 148% for the 19 members with quotas, according to S&P Global calculations. Iran, Libya, and Venezuela are exempt from quotas under the OPEC+ agreement.

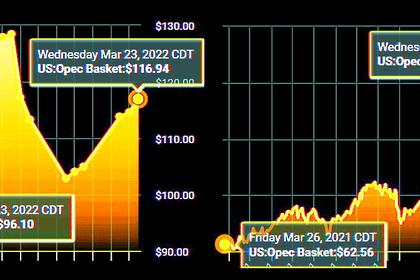

Concerns over OPEC+ production capabilities, in combination with the Russia-Ukraine war and recovering oil demand, have helped lift the Platts Dated Brent benchmark to nearly $140/b in recent weeks, although it dropped to $98.28/b April 7 as the International Energy Agency announced a 120 million barrel stock release from strategic petroleum reserves, led by the US. OPEC+ officials have attributed the volatility to geopolitics, and not market fundamentals.

Production woes

OPEC kingpin Saudi Arabia, one of just a handful of countries that appears to hold significant spare capacity, kept its production steady in March at 10.25 million b/d, the survey found. Ship-tracking data indicated its exports fell during the month, but several analysts surveyed cited increased refinery runs and said storage volumes may have also increased.

Non-OPEC leader Russia, hit by western sanctions targeting its financial sector, saw its crude production fall to 10.04 million b/d, the survey found. Many traders have stopped transacting with Russian commodities, and analysts expect production shut-ins to build up in April and May, though some flows are shifting to Asian customers.

Both Saudi Arabia and Russia had quotas of 10.33 million b/d for the month.

Neighboring Kazakhstan saw the biggest fall in production, with storm damage to the loading terminal of the CPC pipeline causing major disruptions. Kazakh output was 1.55 million b/d in March, and officials have warned of further impacts in April from the outage.

Libyan output fell 50,000 b/d in March, with the country's largest oil field, Sharara, shut from March 3-8 due to civil unrest. The Elephant, or El Feel, field remains offline due to sabotage, officials have said.

Iraq, Venezuela up

Among the gainers, Iraq saw the largest rise, pumping 4.34 million b/d, slightly under its quota of 4.37 million b/d.

The country brought back its giant West Qurna 2 field from maintenance about two weeks early in early March and also saw its Nassiriya field disrupted for a few days at the start of the month because of protests. Sources and satellite data indicated considerable inventory builds.

Venezuela posted a 40,000 b/d gain in March, the survey found, benefitting from the arrival of two cargoes of Iranian condensate that enabled a production rebound in the Orinoco Belt. Extracting the region's extra-heavy crude requires diluent, which US sanctions have made it difficult for Venezuela to obtain, although Iran has been sending cargoes under a bilateral agreement.

The survey figures, which measure wellhead production, are compiled using information from oil industry officials, traders, and analysts, as well as reviewing proprietary shipping, satellite, and inventory data.

-----

Earlier: