RUSSIAN OIL TO CHINA DOWN

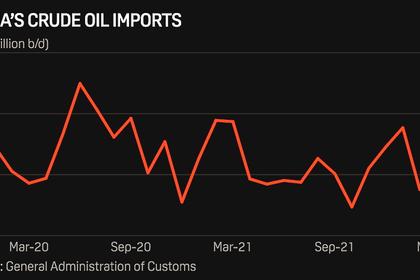

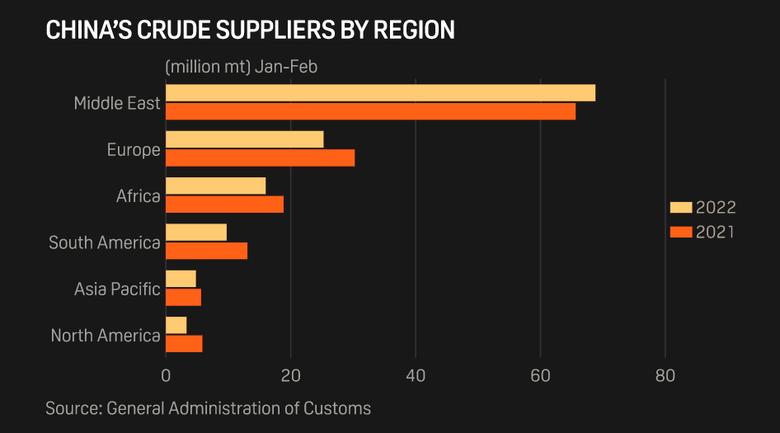

PLATTS- 20 Apr 2022 - China's reliance on Middle Eastern crudes grew sharply in the first quarter of 2022, as the country reduced inflows from Russia, Brazil and the US, data from the General Administration of Customs showed April 20.

The Middle Eastern crude deliveries rose 4.8% to 5.6 million b/d in Q1, taking a 53.8% market share in the January-March period, the data showed.

Compared to an year ago, China's imports from the Middle East was 5.35 million b/d, accounting for 47.1% of market share.

Despite inflows from Saudi Arabia, the top crude supplier, dropping 6.2% on the year in Q1, Iraq, Oman, UAE and Kuwait increased their shipments in the range of 4.7% to 30.1% in the three-month period.

Zhejiang Petroleum & Chemical drove the Kuwaiti crudes imports, which were up 30% in Q1, to meet the feedstock requirement from its new 400,000 b/d phase 2 facilities. The private complex imported about 103,000 b/d Kuwaiti crude in the January-March period, S&P Global Commodity Insights data showed.

Meanwhile, some Iranian cargoes were delivered into China and reported as crudes from the UAE or Oman, also supporting the rise in Middle Eastern crude imports.

China is likely to continue its reliance on Middle Eastern crude in Q2 despite waning appetite amid sluggish refining margins, analysts reckoned.

"The rise in volumes from the Middle East are supported by the term contracts with the producers. China is more likely to cut spot buying when domestic demand is bad," a Beijing-based analyst said.

Russian inflows drop in Q1

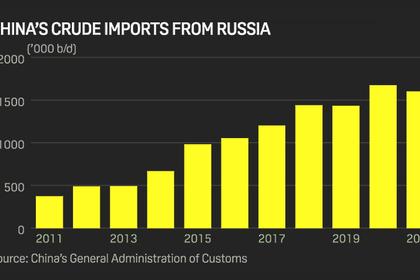

March imports from Russia, the second-largest supplier, were down 14.1% from a year ago, leading to a near 11% drop in Russian deliveries to 1.55 million b/d in Q1.

The decline in Russian crude inflows exceeded the 8.1% year-on-year reduction in China's total crude imports during the same period. The trend is likely to persist amid trade uncertainty in the wake of the Russia-Ukraine war, coupled with weak domestic demand and lower margins.

"Cheap Russian crudes are very attractive, but we prefer to take the barrels on a DES basis due to lower shipping risk," a source with an independent refinery, which has recently taken an ESPO cargo, said.

On a monthly basis, China's crude imports from Russia stood at 1.51 million b/d in March, recovering 6.6% from a nine-month low of 1.42 million b/d in February, GAC data showed.

The increase was driven by state-run buyers as independent refineries reduced their Russian crude imports by 14.3% from February to 355,000 b/d in March, S&P Global data showed.

Brazil, US supplies

Over the first three months of 2022, China's imports of Brazilian crude fell 28.6% on the year to 517,000 b/d, while inflows from the US dropped 30.3% to 271,000 b/d, according to the GAC data.

The sharp decline in Brazilian crude imports was due to weak demand from independent refineries, as they trimmed inflows by 48.5% on the year to 199,780 b/d in Q1, S&P Global data showed.

The drop in imports resulted in Latin America losing 1.8 percentage points market share to 7.6% in Q1, while North America's market share fell 1.6 percentage points to 2.6% over the same period.

GAC releases data in metric tons, which S&P Global converts to barrels using a 7.33 conversion factor.

-----

Earlier: