RUSSIA'S OIL PRODUCTION WILL DOWN

PLATTS- 07 Apr 2022 - Russian oil output could fall 4%-5% on month in April: Novak

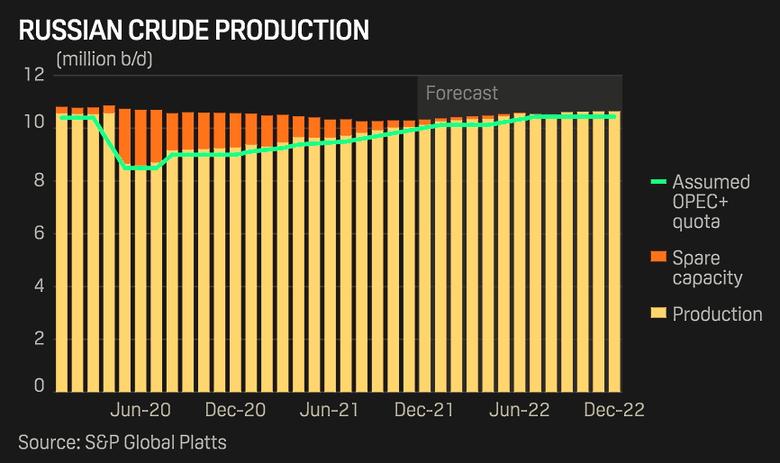

Russian Deputy Prime Minister Alexander Novak said April 7 that Russia's April oil output could fall 4%-5% on the month due to financial and logistical difficulties.

Russia has not published output data for March -- the first full month since Russia invaded Ukraine Feb. 24. The invasion triggered sanctions that complicate purchase of Russian oil and led some countries to announce import bans on Russian energy.

The conflict also raises the risk of damage to key energy export infrastructure, including oil and gas pipelines running through Ukraine, as well as ports on the Black Sea.

"Logistics, as well as financial problems associated with insurance and the use of ships are changing," Novak told reporters, according to the Prime news agency.

"Therefore, we will have an adjustment in April. I think that we may see a decline in April by 4-5% compared to March," Novak said.

"There will also be adjustments to refining, there will also be a decrease in refining volumes," he said, adding that he does not expect this to affect domestic supplies, and exports will continue.

Novak is Russia's key negotiator in the OPEC+ group, which has resisted calls from consumers to increase production. On March 31, OPEC+ approved an output boost of 432,000 b/d in May. S&P Global Commodity Insights forecast 2.8 million b/d of Russian crude shut-ins from late April through to the end of 2022.

IEA member countries have also announced plans to release oil from storage in an attempt to mitigate the impact of a drop in Russian oil exports.

Growing demand

"Today we see that demand for oil and oil products is growing on the market, because the pre-pandemic level is recovering, especially summer demand," Novak said in an interview with the Russia 24 TV channel.

"In my opinion, the situation is now stable, and prices reflect the current situation," he said.

Since the conflict began, oil prices have seen significant volatility. S&P Global Commodity Insights assessed Dated Brent at $100.485/b Feb. 23. This rose to $137.64/b March 8.

S&P Global Commodity Insights last assessed Brent at $104.52/b April 6.

Novak said that predicting oil prices up to the end of 2022 is difficult due to sanctions and uncertainty about the impact of changes to supply chains and sanctions remains.

"But these issues are being resolved, therefore, in my opinion, today we do not see any particular problems," Novak said.

He added that the oil, gas and power sectors in Russia are operating normally.

Ruble payments

Novak also said that he is sure that European consumers will pay for Russian gas in rubles.

"Now European countries and companies that are consumers of Russian gas are studying this issue," he said.

"We are hearing different statements. There are those that have already agreed with this approach, and there are countries that are studying it. But I am sure that payments will be made as set out by the President [Russian President Vladimir Putin]," Novak said.

Putin ordered state-owned gas exporter Gazprom to develop a mechanism to switch payments for Russian gas delivered to countries that have sanctioned Russia to rubles. The move came in response to EU member states freezing the foreign exchange reserves of the Russian Central Bank.

Under the new rules, European buyers are required to transfer funds in euros or dollars to a new Russian account, from which payments would be made to state-controlled Gazprom in rubles after conversion.

Many EU officials have spoken out against the switch and the G7 - Germany, Italy, France, Japan, Canada, the US and the UK - rejected the move in a joint statement released March 28.

Others including Hungary and Slovakia have indicated that they may pay for Russian gas in rubles.

Russia is looking to increase trade in currencies other than the US dollar and euro for other commodities. Novak said that there are already some agreements for yuan payments for Russian oil and coal supplies.

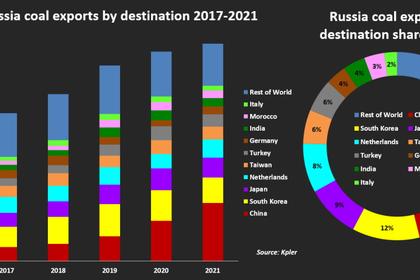

Coal impact

Novak also said that Russia can redirect coal exports from Europe to Asia, following the EU including a ban on importing Russian coal in its fifth packet of sanctions.

"There are such opportunities, everything just depends on logistics, on cost. It is possible to supply coal to the Asia-Pacific Region through ports that we have underloaded. Coal companies are now working on all these issues," Novak said.

Novak said that it will be hard for some European countries to immediately halt Russian coal supplies.

This includes ports on the Black and Baltic seas.

-----

Earlier: