S.KOREA'S LNG UPDOWN

PLATTS - 19 Apr 2022 - South Korea's state-owned Korea Gas Corp's LNG sales in March climbed 12.1% from a year earlier to 3.866 million mt on strong demand for power production despite higher import costs, a company official told S&P Global Commodity Insights April 19.

However, the March sales fell 7% from 4.156 million mt in February.

Kogas, which has a monopoly in domestic natural gas sales, did not disclose how much LNG it sold for the first quarter. However, S&P Global's calculations based on Kogas' previous report showed it sold a total of 12.655 million mt for the first three months, up 4.4% from 12.121 million mt in the same quarter last year.

Of the state utility's total LNG sales in March, purchases by power generators rose 15.9% year on year to 1.811 million mt, compared with 1.563 million mt a year earlier, rising for the second straight month.

Sales to retail gas companies for households and businesses also climbed 9% year on year to 2.055 million mt in March, from 1.885 million mt in the same month last year, rising for two months in a row.

Imports rise despite higher prices

The Kogas official attributed the rise in LNG sales in March to shutdown of several nuclear reactors for maintenance.

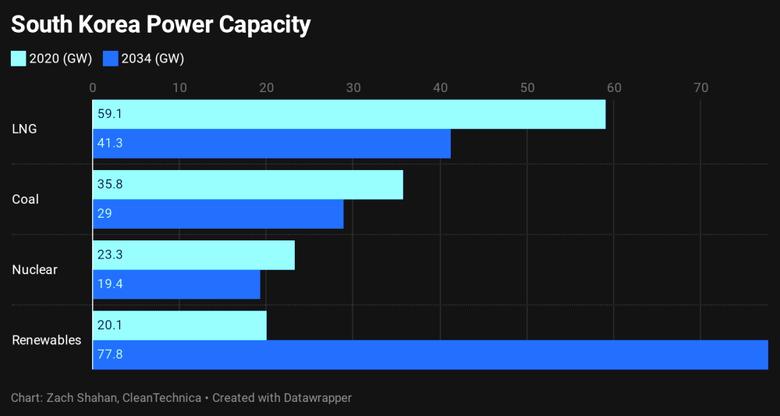

Six nuclear reactors with a combined capacity of 5.25 GW are currently offline for maintenance, accounting for 22.6% of the country's overall capacity of 23.25 GW across 24 nuclear reactors, according to an official from Korea Hydro & Nuclear Power Co.

To meet the strong domestic demand, South Korea's LNG imports led by Kogas jumped 18% year on year to 4.992 million mt in March despite higher imports prices, as part of efforts to build up stockpiles amid rising import prices due to the ongoing Ukraine-Russia crisis.

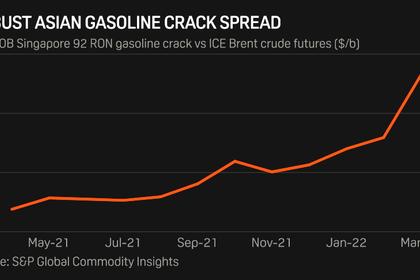

JKM and TTF saw a significant increase in volatility in March after Russia's invasion of Ukraine. The JKM assessment posted a fresh all-time high of $84.80/MMBtu on March 7, following a large swing in intraday pricing of TTF, S&P Global said in a report recently.

Persistent risks related to Russian supplies will likely support global gas prices -- TTF and JKM -- at more than three times their four-year averages through 2022, the report added.

Meanwhile, many South Korean companies are in the process of or have already inked sales and purchase agreements for reliable LNG deliveries.

Kogas in 2021 had inked a 20-year LNG agreement with Qatar Petroleum, now known as QatarEnergy, to buy two million mt of LNG per year. As part of the agreement, the LNG supplies to Kogas will start in January 2025 and will be delivered to its LNG receiving terminals.

-----

Earlier: