U.S. ENERGY, GDP GROWTH 2021

By KENT KNUTSON Energy Market Specialist Hitachi Energy USA Inc.

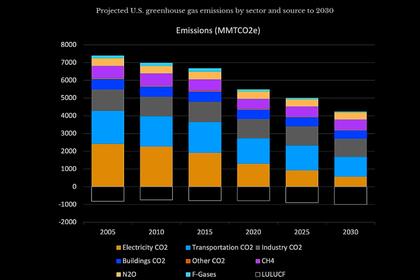

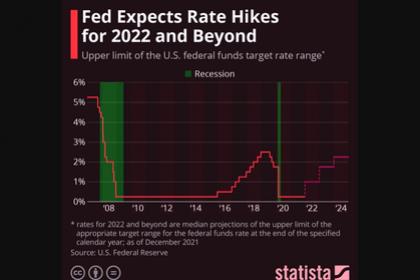

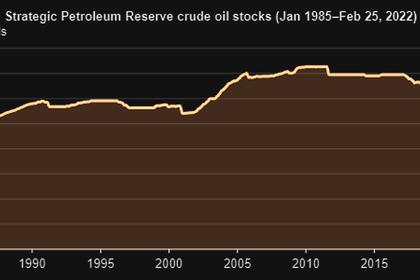

ENERGYCENTRAL - Mar 28, 2022 - Higher energy and commodity prices, persistent inflation, and rising interest rates are expected to dampen growth in electricity demand and investment this year. According to data compiled by the U.S. Bureau of Economic Analysis, the Consumer Price Index (CPI) for ‘Energy’ in February 2022 was 25.6% higher than in February 2021, which is more than triple the increase of the CPI for ‘All Items,’ which was 7.9% higher over the same period. To combat inflation that could result from the rising prices, the Federal Reserve has begun tightening the money supply by increasing the federal funds rate which typically drives overall lending interest rates higher. Even with these economic developments, electricity demand and consumption of coal, natural gas, wind, and solar are expected to increase in the short term. Colder than normal temperatures drove an increase in demand for the first two months of the year.

2021 recovery

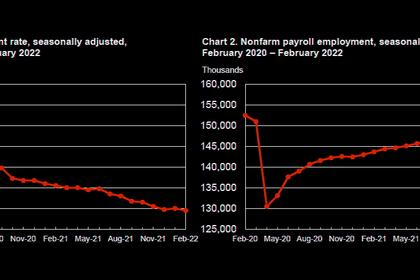

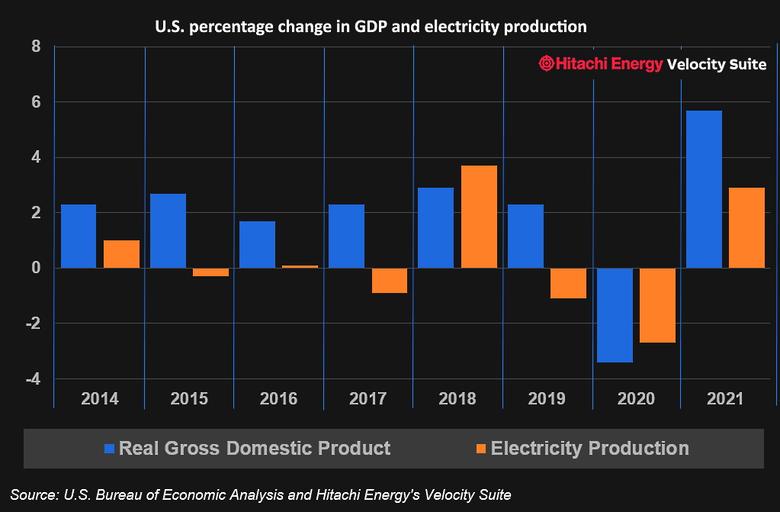

Driven by an increase in consumer spending and business investment as the economy rebounded from the pandemic, Gross Domestic Product (GDP), the most comprehensive measure of the nation’s production of goods and services, increased by 5.7% in 2021 – the largest increase since 1984. The recovery drove the highest annual GDP ever at nearly $23 trillion.

Coal, wind, and solar bounce back in 2021

The growing economy in 2021 drove overall electricity production higher for the first time in three years – up 2.9% (116 million MWh) year on year. Higher prices led to a 3.0% (-48.9 million MWh) decline in generation from natural gas which drove coal up by 16.2% (125.3 million MWh) over 2020. Wind and solar were also big winners, increasing output by 12.4% (41.8 million MWh) and 25.2% (33.0 million MWh), respectively. These generation statistics do not include the contribution of small-scale solar (SCS) like residential solar PV, which has grown rapidly in recent years. In 2021, SCS reached nearly 50 million MWh – up 18.1% from 2020.

High natural gas prices drive coal demand

The average price of natural gas delivered to power plants more than doubled, growing from around $2.4/mmBtu in 2020 to nearly $5/mmBtu in 2021, while coal prices remained relatively flat. The dramatic increase in natural gas prices can be traced to the slowdown in drilling during the pandemic, increased global demand for U.S. liquified natural gas (LNG), and increased demand associated with extreme weather at various times throughout the year. The disparity in coal and natural gas prices resulted in an increase in coal purchases (receipts) and a slight decline in gas purchases during the year. Wind and solar contributed more to the overall fuel mix throughout the year, but coal performed well, continuing to demonstrate the need for dispatchable resources during extreme weather events and during some hours of the day.

Electricity demand and prices rise

Overall electricity demand grew by 2.1% in 2021, driven mostly by commercial (up 2.9%) and industrial demand (up 2.9%) while power sales to residential electricity customers grew by a modest 0.8% – likely reflecting the higher electricity usage from work at home orders during the pandemic in 2020. Overall electricity rates grew by 5.5%, driven mostly by the industrial (8.8%) and commercial (6.4%) sectors, while residential rates rose 4.3%.

Coal plants continue to shutter, and renewables continue to grow

In 2021, 7.3 GW of coal capacity was shuttered. But even with recent coal plant closures, the existing operating fleet generated nearly 900 million MWh in 2021. That’s almost certain to fall in 2022, as more coal capacity is retired. Hitachi Energy’s Velocity Suite research team has identified nearly 30 GW of coal capacity that is scheduled to close over the next two years.

Recent and planned coal plant closures combined with reduced plant utilization rates have impacted overall coal inventories, requiring less coal to be stored and ready for use. At the end of January 2022, the nation’s coal inventories totaled 87.4 million tons – only slightly higher than the nearly fifty-year low that occurred when inventories dipped to 80.4 million tons in September of last year.

The nation added just over 34 gigawatts (GW) of new generating capacity in 2021. Most of the additions were solar PV (15.1 GW) and wind (12.6), while natural gas (6.2) accounted for most of the rest.

Solar, wind, and gas capacity set to continue expansion in 2022

Based on Velocity Suite’s ‘New Entrant’ research, there are 48.1 GW of new solar, wind, and natural gas facilities in various stages of site development, construction, or testing expected online in the next two years alone. During the same time frame, 28.1 GW of coal capacity is expected to shutter, and an additional 49.9 GW will be taken offline by 2030 – that is 78 GW of coal generation that is expected to close between now and the end of the decade. In addition to the closure of coal power plants, 20.8 GW of older natural gas generators are scheduled for retirement by 2030. New solar, wind, natural gas, and energy storage resources are expected to fill the 98.8 GW gap created by the fossil fuel plant closures by 2030.

The top-5 largest projects in terms of capacity to enter service during 2021 include:

- Advanced Power’s South Field Energy (1,182 MW) natural gas combined cycle (CC) facility in Columbiana County, Ohio

- Ares Management LP’s Hill Top Energy Center (665 MW) natural gas combined cycle (CC) power plant in Greene County, Pennsylvania

- NextEra Energy’s White Mesa Wind I & II (501 MW) in Crockett County, Texas

- Algonquin Power & Utilities Corporation’s Maverick Creek Wind Farm (492 MW) in Concho County, Texas

- Fortress Investment Group’s Lone Ridge Energy Terminal (485 MW) natural gas combined cycle (CC) facility in Monroe County, Ohio

The Top-5 largest generation projects expected to come online in 2022 include:

- DTE Energy’s Blue Water Energy Center (1,267 MW) natural gas combined cycle (CC) plant in Saint Clair County, Michigan

- Seminole Electric Cooperative’s Seminole (1,183 MW) natural gas combined cycle (CC) plant in Putnam County, Florida

- NextEra Energy’s Lauderdale (1,163 MW) natural gas combined cycle (CC) facility in Broward County, Florida

- The Southern Company (45.7% ownership), Oglethorpe Power Corp. (30%), Municipal Electric Authority of Georgia (22.7%), and Dalton City (1.6%) owned Vogtle Unit 3 nuclear reactor (1,100 MW) in Burke County, Georgia

- Indeck Energy Service’s Niles Energy Center (1,000 MW) natural gas combined cycle (CC) plant in Cass County, Michigan

The post-pandemic economic recovery in 2021 drove electricity production and demand upward for the first time since 2018. However, inflation and higher interest rates will likely slow demand and investment in 2022. Expect the continued closure of aging and uneconomic coal resources, the continued expansion of wind, solar, and battery storage, and new and upgraded power grid projects to garner most of the attention from investors as the year unwinds.

-----

This thought leadership article was originally shared with Energy Central's Generation Professionals Group. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join the Generation Professionals Community today and learn from others who work in the industry.

-----

Earlier: