U.S. SOLAR POWER GROWTH

By JESS TAYLOR Co-founder Practically Green

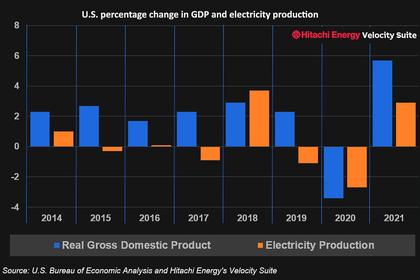

ENERGYCENTRAL - Apr 4, 2022 - Despite faltering global economics and fluctuating domestic energy policy, a decade of stable growth in the U.S. solar sector has been achieved. Although 2021 has been a strange year, expansion has continued.

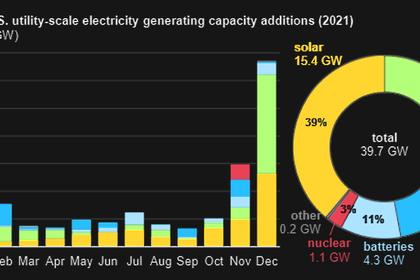

Based on data from the third quarter, analysts expect to see a record 19 gigawatts of utility-scale solar and about 4 gigawatts of distributed solar installed in the United States this year. The sector is booming despite high installation costs, personnel shortages, supply-chain issues, and import tariff complexities.

With new software and internet initiatives, American residential and distributed solar firms have weathered the Covid-19 storm and let the sector expand well during a turbulent 18 months.

Astonishing development

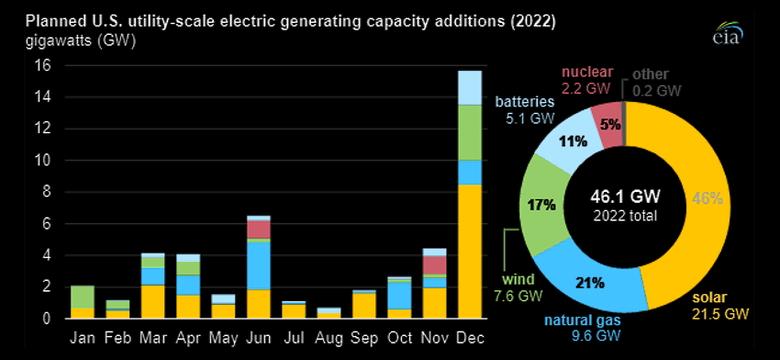

In the United States, solar power is booming at an incredible rate. Despite the planned deployment of 23 gigawatts in the U.S. this year, S&P Global Market Intelligence has estimated 44 gigawatts in 2022, which would be practically a doubling year over year.

According to the International Energy Agency, solar power is currently the “cheapest electricity in history.”

According to a midyear study from the Solar Energy Industries Association and Wood Mackenzie, solar capacity in the United States has surpassed 100 gigawatts. All around the country, the number of solar power plants with outputs of more than 100 megawatts is on the rise.

According to S&P analysts, the demand for electricity in the United States is high, with 17.4 gigawatts of new capacity built or planned.

The cost of solar energy production has risen across the board.

The prices of polysilicon, silver, copper, aluminium, and glass, all of which are utilized to produce solar modules, are on the rise.

Certain solar projects are in peril due to rising costs for polysilicon, a key component in crystalline-silicon photovoltaic (P.V.) cells. By 2020, the polysilicon spot price has risen from $6.30 per kilogramme to $37 per kilogramme, according to BloombergNEF’s solar team.

Trackers are becoming more expensive due to a rise in the cost of steel.

Global logistical issues exacerbate delivery delays and price increases for materials and components. According to some estimates, shipping prices have risen by as much as 500 per cent.

Power purchase agreements for solar are being renegotiated since margins are so small. Solar is still the most cost-effective generating option in many places. However, because of the high demand for solar power, it is more probable that projects would be postponed than cancelled. Increasing input costs and power-purchase agreements for solar electricity coincide with growing pricing for an all-new generation.

Somethings that may have been.

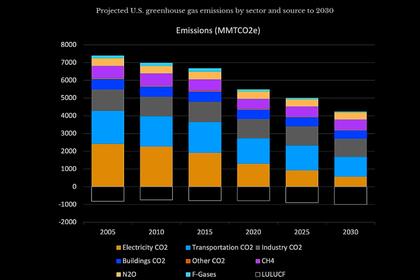

$555 billion in financing for climate change and sustainable energy was included in the Democrats’ Build Back Better proposal, which passed the House and was blocked in the Senate. Tax credits and production credits for renewable energy projects and credits for energy storage systems were included in the bill.

In contrast, the “direct-pay” provision in Build Back Better would allow renewable energy projects to be financed via the Investment Tax Credit in the form of a tax return rather than credit allocations.

A 10 per cent adder for projects that utilize local materials and pay prevailing wages would have been possible under the bill’s Investment Tax Credit and direct-payment provisions, which would have climbed from 26 to 30 per cent. I think it’s a huge shift in the way we fund renewable energy projects here in the U.S.

Insisting on domestic production of solar cells

Can the United States become a solar-powered nation without a local solar supply chain? The solar industry in the United States is struggling to get back on track, but is there hope for it?

American companies have mostly lost the war against Chinese solar producers. ACCORDING TO WOOD MACKENZIE, U.S. P.V. module production capacity currently stands at 7.5 gigawatts, compared to nearly 400 gigawatts in the global market.

American lawmakers are determined to push through legislation that includes subsidies and support for domestic solar manufacturing in the hopes that it would drive the sector’s growth and create employment.

In June, Senator Jon Ossoff of Georgia (D) presented the Solar Energy Manufacturing for America Act, which would offer a significant tax credit for domestic solar production at all stages of the solar module supply chain to bring part of that offshore manufacturing back to the United States.

Canary just released a list of U.S. solar producers and a summary of manufacturing-related press releases.

Residential solar gets a boost from software.

Finally, after the pandemic, solar and storage companies in the United States have found a cost-cutting strategy: employ software to shift the whole process online.

Using industry jargon for anything other than hardware, U.S. solar software businesses aim to optimize the design and cut-price by concentrating on “soft expenses.” In the typical home installation, soft expenses currently account for between 55 and 60 per cent of the total cost. These include client acquisition, design, overhead for installers, finance, contracts, inspection, permits, and connectivity.

This subsector of the software industry is dynamic and attracting investment. A software dynamo for solar power With an estimated $2 billion value and a $250 million fundraising round, Aurora Solar purchased Folsom Labs, a software business that designs commercial solar systems. Aurora uses remote imaging to design solar rooftop systems, to move a time-consuming and in-person design process to the internet. Enphase, a manufacturer of microinverters, purchased the residential solar software company Sofdesk earlier this year.

Startups in the software industry are working to make solar systems better for customers and better for investors.

The never-ending battles over net metering in California have enabled the state to solidify its position as the uncontested leader in U.S. rooftop solar installations because of its long-standing net metering legislation.

A surge in solar energy innovation and venture capital funding

However, investors are still hopeful and continue to support solar entrepreneurs with strong concepts, despite the scars of prior investments.

Earlier: