US SELLS OIL 90 MB

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

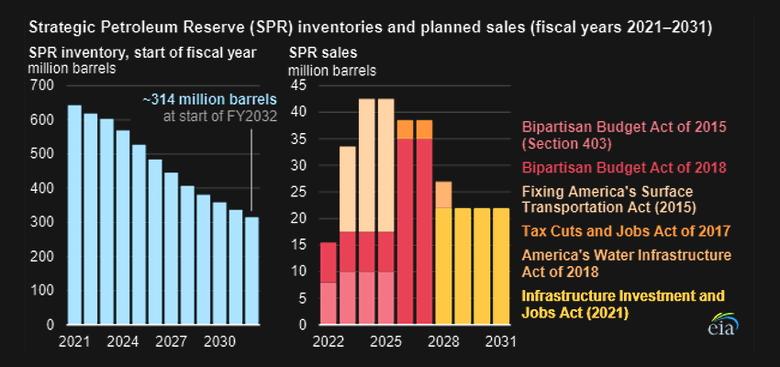

US SELLS OIL 90 MB

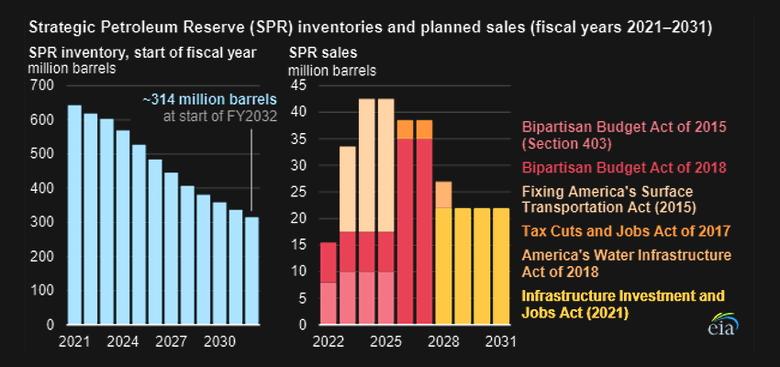

U.S. DOE - APRIL 1, 2022 - DOE Announces Second Emergency Notice of Sale of Crude Oil From The Strategic Petroleum Reserve to Address Putin’s Energy Price Hike

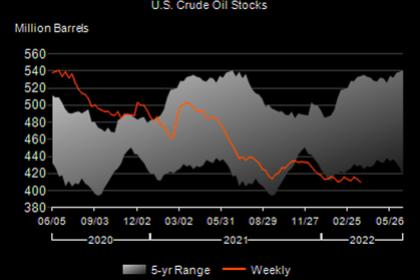

The U.S. Department of Energy’s (DOE) Office of Fossil Energy and Carbon Management (FECM) today announced a Notice of Sale of crude oil from the Strategic Petroleum Reserve (SPR). This Notice of Sale follows President Biden’s announcement yesterday authorizing the sale of crude oil from the SPR to address the significant market supply disruption caused by Putin’s war on Ukraine and aid in lowering energy costs for American families.

The SPR will release approximately one million barrels of crude oil per day over the next six months. Crude oil in this emergency sale will enter the market in two releases.

The first 90 million barrels will be released between May and July, through two notices of sale totaling 70 million barrels, and 20 million barrels already scheduled to be released in May 2022. The remaining 90 million barrels will be released between August and October 2022. DOE must receive bids for the first notice of sale no later than 10:00 a.m. Central Time on April 12, 2022, and will award contracts to successful offerors no later than April 21, 2022.

The May through July sales will be conducted with crude oil from the following four SPR sites:

- Up to 20.5 million barrels from Big Hill

- Up to 21.5 million barrels from West Hackberry

- Up to 18 million barrels from Bryan Mound

- Up to 10 million barrels from Bayou Choctaw

The SPR is the world's largest supply of emergency crude oil, and the federally owned oil stocks are stored in underground salt caverns at four storage sites in Texas and Louisiana. The SPR has a long history of protecting the economy and American livelihoods in times of emergency oil shortages.

Any company registered in the SPR’s Crude Oil Sales Offer Program is eligible to participate in this and other SPR crude oil sales. Other interested companies may register through the SPR’s website: Crude Oil Sales Offer Program.

For more information on the SPR please visit Infographic: Strategic Petroleum Reserve and Fact Sheet: Strategic Petroleum Reserve . Sign up to receive future FECM news alerts here.

-----

Earlier:

2022, April, 1, 11:40:00

OPEC+ 432 TBD

Reconfirm the baseline adjustment, the production adjustment plan and the monthly production adjustment mechanism approved at the 19th OPEC and non-OPEC Ministerial Meeting and the decision to adjust upward the monthly overall production by 0.432 mb/d for the month of May 2022, as per the attached schedule.

2022, April, 1, 11:35:00

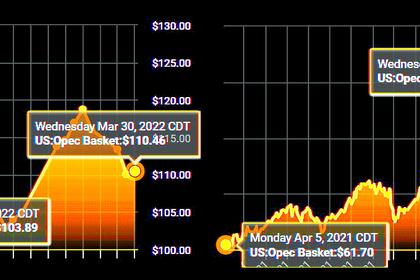

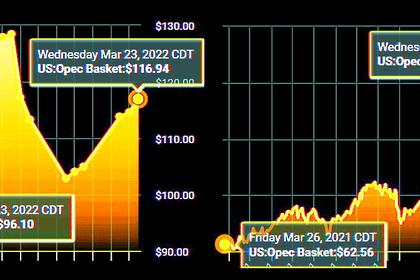

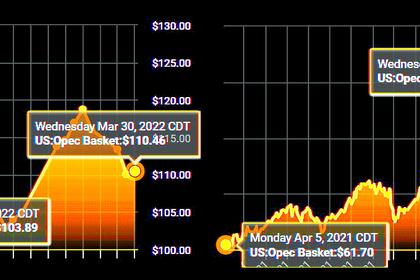

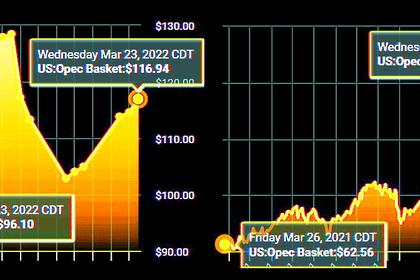

OPEC OIL PRICE: $110.46

The price of OPEC basket of thirteen crudes stood at $110.46 a barrel on Wednesday,

2022, April, 1, 11:20:00

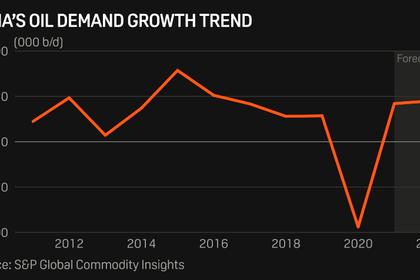

INDIA NEED MORE OIL

We imported from Russia just 0.419 million mt in the April-December period of the current fiscal year 2021-22 (April-March). That is just 0.2% of the total requirement.

2022, March, 25, 11:20:00

OPEC+ IS IMPORTANT

In a circular carried by state-run Saudi Press Agency, the cabinet stressed "the importance of the essential role of the OPEC+ agreement in the balance and stability of oil markets."

2022, March, 22, 12:45:00

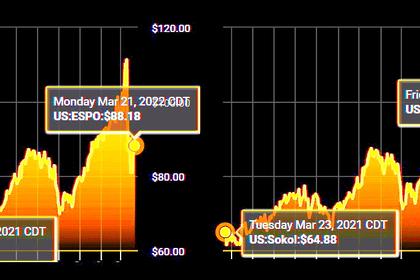

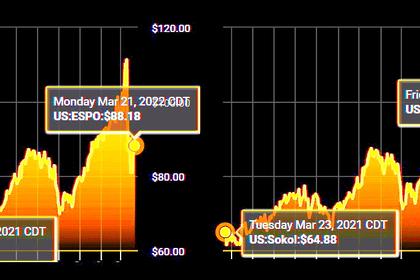

RUSSIA BYPASSES SANCTIONS

"If oil is sold at a discount, then [consumers] will be happy to buy it. We will earn less, but we will be able to place oil," Novak said.

All Publications »

Tags:

USA,

OIL,

PRICE