CHINA NEED RUSSIAN OIL

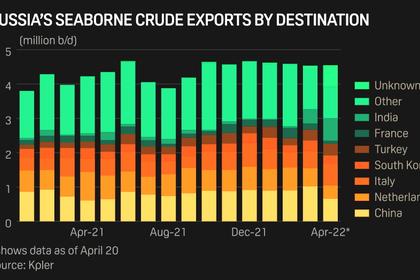

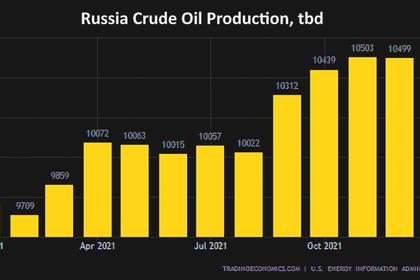

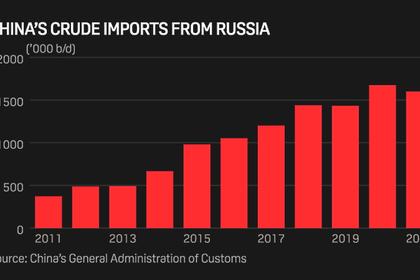

PLATTS - 11 May 2022 - After an initial period of caution, China's independent refiners are becoming increasingly confident in snapping up attractively-priced Russian crude amid growing clarity that the conflict in Ukraine will not create major disruptions to shipment flows or financial transactions, unless sanctions are imposed.

With Shandong's pandemic-related restrictions easing and signs of improving refining margins, independent refiners are buying cargoes from the non-OPEC supplier as they do not want to miss the boat in making up for the losses suffered over the past few months.

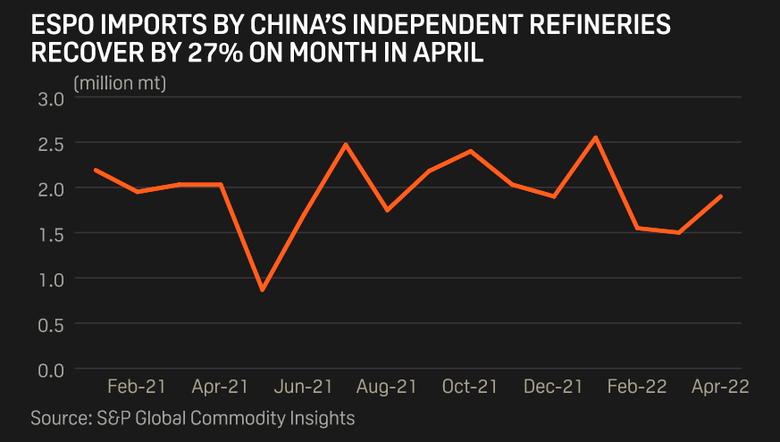

Thus, after the slump in March inflows, Russian crude imports by China's independent refiners recovered 35.7% year on year to 2 million mt in April, S&P Global Commodity Insights' data showed on May 9.

While state-owned refineries are cautiously buying Russian cargoes amid payment and shipping uncertainties, industry sources said independent refineries were willing to take the risk in securing discounted spot crude imports from Russia, including ESPO and Urals.

"A few independent refineries have bought May and June ESPO cargoes, as well as Urals," said an analyst in Shandong, home to most of the country's independent refiners.

According to market sources, these cargoes are mainly on a DES basis, which minimizes the risks as compared with FOB deals.

Although details of such deals are not known, independent refineries have always wanted to purchase these discounted cargoes and had hoped that trading companies would bring them to China, sources said.

In April, independent refineries imported around 2.04 million mt barrels of feedstock from Russia, which included mostly ESPO and fuel oil. Among these were 19 ESPO cargoes that had already arrived in Shandong, up 26.7% from 15 cargoes in March. The buyers included ChemChina, Lijin Petrochemical and Dongming Petrochemical.

ChemChina received slightly higher volumes of ESPO crude in April compared with March, as its Huaxing Petrochemical restarted after scheduled maintenance. Its Changyi Petrochemical, however, is still undergoing scheduled maintenance, which will likely cap its ESPO demand for May.

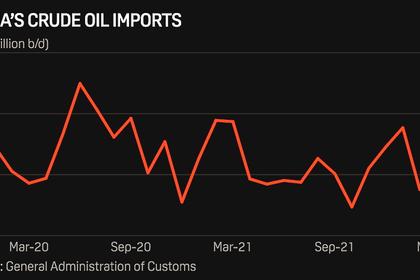

Despite the rebound in Russian imports last month, independent refineries' cumulative imports from Russia during the first four months of this year fell 23.6% year on year to 7.89 million mt.

The drop in Russian inflow to the independent refining sector was in line with the overall 15.9% year-on-year drop in inflows from all suppliers to 54.4 million mt during the same period, according to S&P Global data.

May feedstock demand outlook

According to industry analysts, dark clouds were starting to clear as COVID-19 related restrictions have started to ease in Shandong, while refining margins had improved and returned to positive territory, boosting expectations that feedstock demand would continue to rise in the near term.

"Average run rates in Shandong are likely to be slightly higher in May, with more refineries scheduled to restart after maintenance towards the end of the month, as margins improve," said an analyst with JLC, a local energy information provider.

The monthly average run rate at 40 independent refineries stood at around 51.4% in April, down three percentage points from March, according to JLC, which compares with average run rates of 74.3% in April 2021.

Malaysia in pole position

Malaysia continued to top the suppliers' list in April, surpassing Russia and Saudi Arabia, despite flows from the Southeast Asian supplier falling 31.9% month on month to around 2.14 million mt. But imports from Malaysia rose 4.1% year on year to 9.7 million mt over January-April.

Imports from Malaysia included blended crudes Mal Blend, Nemina -- an Iranian crude -- as well as bitumen blend.

Iran-origin cargoes, marked as cargoes from other origins, continue to flow to independent refiners. These crudes totaled 2.26 million mt in April, 24.8% lower from 3 million mt imported in March, according to S&P Global data.

"The margins for processing Iranian crudes are a bit better than those for processing regular grades," a market source said.

Bitumen blend imports, together with Iranian crudes, amounted to 3.23 million mt, almost half the feedstock imported by China's independent sector in Shandong in April, according to S&P Global data.

Saudi Arabia slipped from second position to become the third-largest supplier to China's independent refineries in April, sending 1.6 million mt.

Imports from Saudi Arabia also fell 23.5% month on month and 30.6% year on year, mainly due to lesser imports by Hengli Petrochemical (Dalian) Refinery, which slashed imports in April due to weak margins.

A drop in Hengli Petrochemical's imports had weighed down inflows from Saudi Arabia, which fell 8% year on year to 7.56 million mt, only slightly lower than that from Russia, which was the second largest supplier in April.

S&P Global collects information on feedstocks imported by independent refineries in Shandong province, Tianjin, Zhoushan and Dalian, Lianyungang, including 32 crude import quota holders, and other non-quota holders.

These 32 refiners were awarded a combined 99.7 million mt of crude quotas in the first batch for 2022, accounting for 93% of this year's total allocations to the independent refining sector.

-----

Earlier: