GLOBAL CHAOTIC ENERGY TRANSITION

By PATRICK MCGARRY Senior Director PCI

ENERGYCENTRAL - May 11, 2022 - According to a recent whitepaper by Epoch Investment Partners, the transformation to net zero emissions requires a fundamental shift in the structure of our economy. And it will not come easy or cheap or as quickly as some want.

Thanks to a polarized political climate and a global economy reeling from the pandemic, the transition will be chaotic, littered with periodic supply shortages and extremely volatile energy prices.

Due mainly to the 2009 fracking revolution, the U.S. enjoyed a sustained period of relatively low fuel prices until very recently. Low inflation, largely a result of the technology boom’s deflationary impact, kept interest rates near zero for over a decade.

Those days are history.

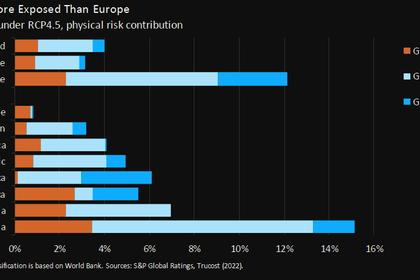

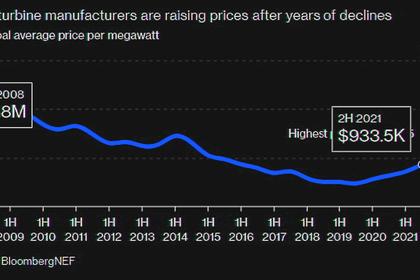

The pandemic and geopolitical turbulence in Europe have contributed to greenflation, the sharp rise in the prices and minerals used to create renewable technologies. Those factors, plus inflation, will introduce an investment environment remarkably different in terms of turbulence and volatility for the next two decades.

This blog post summarizes the findings by Epoch Investment Partners and shares some thoughts on organized wholesale energy markets and the impact on long-term planning for utilities and RTOs/ISOs.

Time to return to your seats and buckle up. The captain has turned on the seat belt sign as severe turbulence awaits ahead.

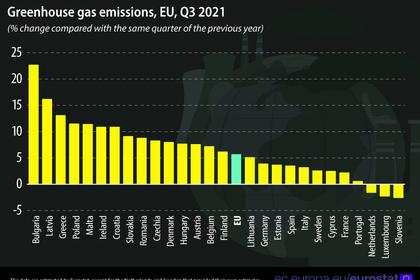

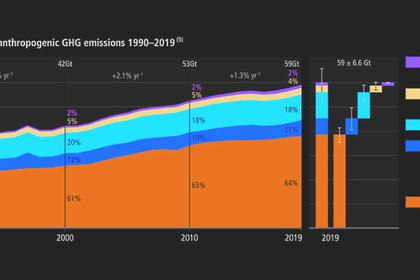

Net Zero Emissions = Moderately Higher Inflation

Authors Kevin Hebner (Ph.D.), William Priest (CFA), and Ravi Varghese provide four reasons to expect moderately higher inflation as a result of the transition to net zero emissions (NZE):

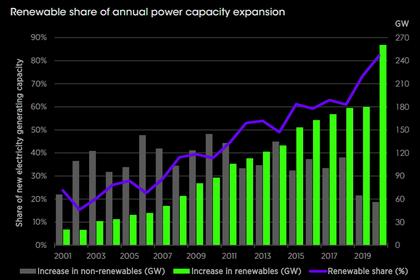

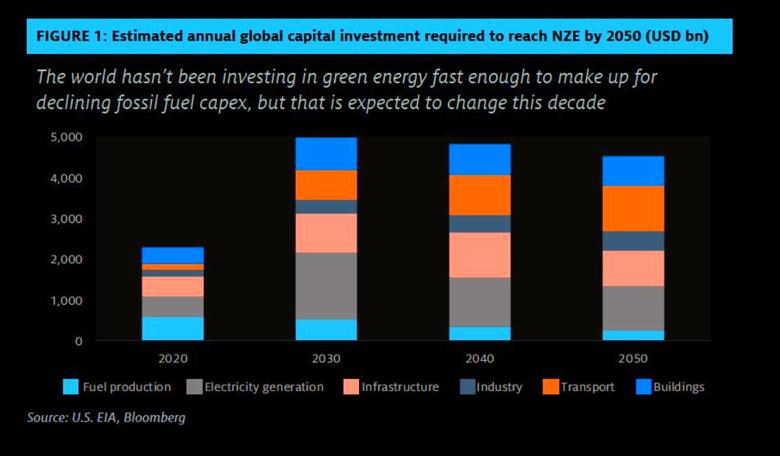

- Global capital investment in energy is expected to double by 2030.

- The transition involves tremendous increases in demand for commodities such as lithium carbonate, cobalt, and nickel.

- Green Premiums represent the cost of choosing a clean technology over a traditional one.

- Lack of Carbon Pricing: This implies a greater role for command and control regulation, which is much less efficient and will result in consumers facing markedly higher energy prices.

Lack of carbon pricing implies a greater role for command-and-control regulation, which is much less efficient and will result in consumers facing markedly higher energy prices.

These factors, according to Epoch, will raise trend inflation by 25 to 50 basis points (bps) over the next decade. The combination of greenflation and the reflationary effect of deglobalization is likely to outweigh the deflationary impact of technology. As a result, inflation and nominal interest rates are likely to be higher and more volatile, especially compared to levels seen over the last two decades.

Green Premiums must be eliminated to achieve NZE, which can be accomplished by either making green technologies cheaper (through innovation and scale) or making fossil fuels more expensive (through carbon taxes or regulations).

Net Zero Emissions = Turbulence

The Epoch white paper offers four main reasons why the energy transition will be extremely messy:

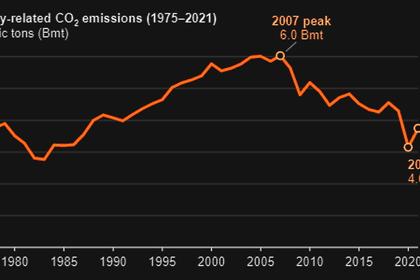

- Green energy investment is not ramping up nearly quickly enough.

- Half the technologies needed to achieve NZE by 2050 don’t yet exist commercially.

- Energy is a highly regulated industry, and our laws and regulations are enormously outdated.

- Energy transitions always take a very long time. Digital business models are built on bits and can rise to prominence in just a few years. Energy, though, lives in a world of atoms, where scale is built much more slowly.

The tumultuous transition is significant because it implies periodic supply shortages, disorderly markets, and periods of high price volatility.

The transition will simply take more time than forecasted, and the bill will be higher than advertised.

RTO/ISO Model Challenges

For more than two decades, supporters of the fully restructured RTO/ISO model have pushed it as the one-size-fits-all policy solution to the electricity industry’s problems. The model, according to supporters, is cleaner, more dependable, and saves customers money. However, events over the last decade have cast doubt on this assumption.

The model is becoming increasingly deficient, particularly in investment signals that support reliability, resilience, fuel source diversity, price stability, and clean energy.

RTOs have been struggling to keep up with changes in the electricity industry since they were created more than two decades ago. Particularly troubling are issues with price formation, which are misaligned with many of the public policies aimed at advancing grid decarbonization under the RTO model.

Last May, former FERC Commissioner Tony Clark noted, “It strikes us as a bad, perhaps even dangerous idea, to rule out all other regimes (both existing and potential new or hybrid models) to instead insist on pursuing all efforts to decarbonize the electricity grid through a universally imposed RTO model.”

Tony Clark believes emergent markets ensure stability and a state policy-dedicated path to reduce carbon emissions from the electric sector. The upcoming SEEM (Southeast Energy Exchange Market) represents a great example of an emergent market.

While most people recognize and understand the role of price formation in the current RTO/ISO model design, very few people seem to understand or appreciate the most important role of RTO/ISO – reliability.

ERCOT & MISO just announced concerns regarding power supply going forward. As flawed as they may be, the capacity markets recognize the danger ahead of the continued retirements of thermal generation being replaced by intermittent renewables.

The current RTO market design model cannot handle the transition to net zero emission, and evolving resource adequacy concerns are just the tip of the iceberg.

Long-Term Planning

The extremely messy transition to net zero emissions presents new and significant challenges for Integrated Resource Planning for utilities. Consequently, long-term planning for RTO/ISO markets is becoming near impossible.

Due to the reasons cited above, renewable energy projects, especially solar and battery storage, are delayed. The Department of Commerce’s investigation into potential solar tariff circumvention is also causing uncertainty and delays.

Meanwhile, due to political pressure, utilities continue to retire thermal generation. When you retire existing thermal generation, and there is no replacement, you quickly understand why MISO & ERCOT are expressing concerns about the power supply. Especially when we are at the top of the first inning of “the electrification of everything.”

As the Epoch paper notes, “While ‘Electrify everything, decarbonize everything’ makes for a great slogan, the actual implementation is mind-bogglingly complex.” We are changing the underlying structure, the foundations of a hugely complicated and labyrinthine economy.

We need pragmatic long-term planning to prepare for this highly challenging energy transition.

Regarding carbon emission reduction, there is a significant difference between “do something” and “do something responsible.”

Coordinated regional planning with a sound and consistent federal policy would be the best solution.

Regrettably, we will likely see more “command and control.” Regulations based on command and control are inefficient and will require massive bureaucracies at all levels of government to implement and enforce.

The Challenges Ahead

The Epoch Investment Partners whitepaper presents a straightforward summary of the challenges ahead based on plenty of supporting data. I believe all policy and regulation people in the energy industry should take 20 minutes to read and digest the findings.

Crisis situations often accelerate prior trends. For example, the global pandemic certainly elevated teleworking. The geopolitical crisis present in Ukraine is both a global tragedy and perhaps a turning point in the energy transition.

The meteoric rise in oil and natural gas may have some long-term legs. As a result, the lack of carbon pricing could become less impactful due to sustained high prices. When supply chain challenges dissipate, renewable energy and storage may become more attractive financially and from public policy.

On the other hand, the crisis shines a light on resource adequacy. Electricity does not come from a wall. Policy and long-term planners may need to take a second look at nuclear power and the role of natural gas generation to help smooth the volatility of intermittent solar and wind generation.

The energy transmission to net zero emissions will likely take longer than planned, and the cost will be much higher than most realize.

As Ringo Starr once famously sang, “It don’t come easy.”

-----

This thought leadership article was originally shared with Energy Central's Clean Power Community Group. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join the Clean Power Community today and learn from others who work in the industry.

-----

Earlier: