GLOBAL LNG UNCERTAINTY

PLATTS - 26 May 2022 - The LNG and gas markets globally are dealing with numerous challenges including underinvestment, volatile prices amid massive supply uncertainty while demand stays supported, and risk management is gaining even more traction in the last few months to tackle this unpredictable environment, Steve Hill, executive vice president Shell Energy said at an industry event.

"From a decarbonization perspective, from an energy security perspective, from an affordability perspective, we are in unchartered territory today and we have many challenges but change also brings opportunities and opportunities often require investments," Hill said during a panel discussion on May 25 at the World Gas Conference 2022 in Daegu, South Korea.

"As always, we should start with the customers and we have to recognize the pain that's caused by the high prices and the uncertainty that customers face in the market today, but some people are well positioned," he said.

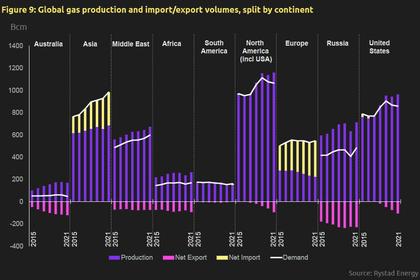

Some key questions include how much gas or LNG will move from North America to Europe and how much gas demand will move in the opposite direction and when it comes to Europe, the size of the challenge today is massive, he said.

"If we convert the Russian pipeline gas volume into Europe in 2021 into LNG equivalent and add all the LNG volumes delivered into Europe in 2021, that's [about] 200 million mt of LNG equivalent. That's half the size of the current LNG industry," he said.

The market today is challenged but is experiencing shoulder months when LNG demand is typically the lowest, most of the Russian gas is still flowing and LNG demand in China is down significantly, he said, adding that there was significant uncertainty over what will happen next.

However, supply risks stay heightened as Russian LNG has its challenges, Hill said, adding that North America is a big source of new LNG but there are not many others.

US will develop lots of new LNG capacity to supply for European demand but there are infrastructure hurdles, Hill said.

"Since the crisis started, we've seen about 30 million mt of new contracts signed in the US but only two European buyers have signed long-term contracts with the US," Hill said.

Most of that 30 million mt has been either signed by buyers in Asia or by portfolio players, and there is some variability attached to how that situation will develop as well, Hill said.

"Moving to LNG liquefaction, the message should be [that] we need more LNG, we need another 200 million mt of LNG over and above what is already committed to meet 2040 demand projections and the LNG we develop in the future needs to be competitive."

"It needs to be particularly coming from projects which have a shorter payback period given the long term regulatory uncertainty we face but not only do the projects in the future have to be at the low end of the cost curve, they also need to be at the low end of the emissions curve," Hill said.

According to the Global Gas Report 2022, numerous liquefaction projects were delayed due to the global pandemic, with only one project being sanctioned in 2020 and three liquefaction projects sanctioned in 2021.

Risk mitigation

Long-term contracts provide price stability and a mature buyer that has a portfolio of long-term contracts and spot purchases can combine flexibility and price management, Hill said.

Customers want different things and customers that have had a strategy to get price diversity and hedging have really benefitted, he said.

Given the volatile prices and the uncertainty, the industry has learnt a "tremendous" amount about risk management in the last six months, Hill said.

"There was quite an immature mindset in the past that price risk management was an option. You either did it or didn't do it... What the industry has learnt is actually that risk is like energy. You can't create it or destroy it , you can just divert it," he said.

-----

Earlier: