INDIA REDUCES OIL PRICES

PLATTS - 25 May 2022 - From cutting taxes on retail oil products to scouting around for attractive term crude deals, India is stepping up efforts to ensure that surging world prices do not stand in the way of the fragile economic recovery as well as a revival in domestic oil product consumption.

Government officials in India said they believe that current oil prices were not sustainable over the longer term, but they were also unanimous in their view that it was crucial to implement fiscal measures now to ensure that inflation stays under control, instead of waiting for oil prices to cool.

"Oil prices are a big concern for the government and the economy now because of its cascading effect. Not only pump prices and transportation costs go up, but prices of various other goods and services are affected," Dharmakirti Joshi, chief economist at CRISIL, a unit of S&P Global, said.

According to Platts Analytics of S&P Global Commodity Insights, Dated Brent prices are expected to average $103/b in 2022, up from $71/b in 2021, before easing to $90/b in 2023.

"We estimate that every $10 per barrel rise in the price of Brent crude would raise the headline consumer price index by about 40 basis points. The weakening of the Indian rupee will also add to the imported cost of crude and commodities," Joshi added.

Inflation, based on CPI, has risen consistently for the past seven months, reaching an eight-year high of 7.8% in April.

Excise duty cuts

On May 21, India's federal government decided to cut the excise duty on petrol and diesel in an attempt to rein in high levels of inflation. It was the second duty cut in a little over six months. The duties on petrol and diesel were cut by Rupees 8/liter and Rupees 6/liter, respectively.

"The decisions along with steps to curb the price rise on key infrastructure material such as cement, steel and plastics will bring wide-scale relief to millions of Indian families and provide pivotal support to the Indian economy amid a challenging global inflationary environment," oil minister Hardeep Singh Puri said after the excise duty cuts were announced.

CRISIL's Joshi added that while the government's top priority was battling inflation, the excise duty cut on fuels would also mean revenue loss.

"But the space to address this issue is extremely limited. You either let fiscal deficit to go up or cut capital expenditure. The government may watch oil prices for some more time before taking additional measures."

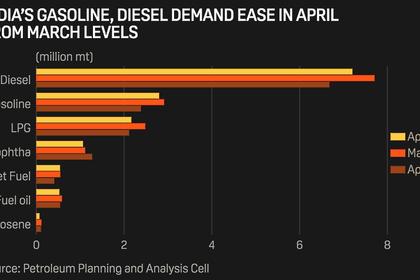

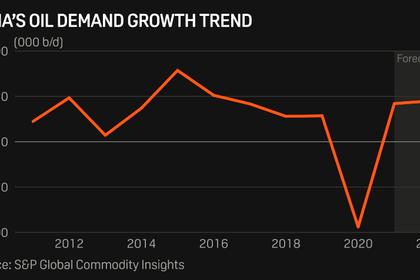

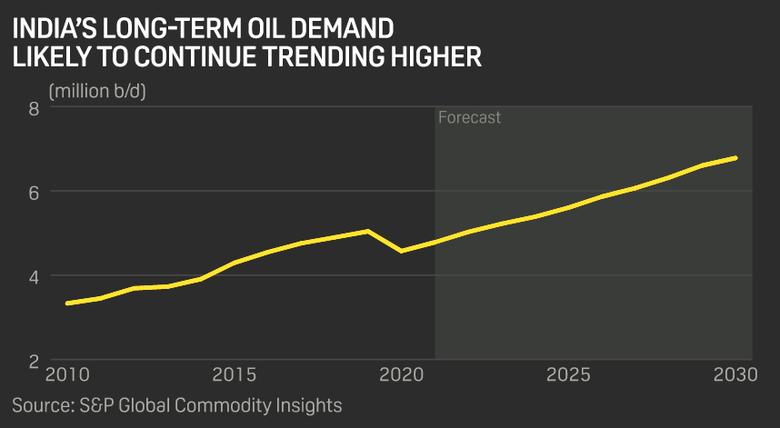

India's sustained uptrend in oil consumption came to a halt and slipped into the red in April from March levels as rising domestic retail fuel prices on the back of surging crude took a toll on gasoline, diesel and LPG demand.

Domestic oil product demand fell 4% month on month to 18.64 million mt, or 4.9 million b/d, in April, recent data from the Petroleum Planning and Analysis Cell showed.

"I am not convinced international crude prices would continue above $110 a barrel. Global crude prices should come down in the near to medium term. High oil prices will lead to recession. Our job is to insulate the country against the expected recession," a top official at the petroleum ministry said.

The official added that it was difficult to believe that the recent high crude prices were due to lack of investment in the exploration and production segment worldwide. "The current high crude prices reflect the mismatch between demand and supply of crude in global markets."

New crude term deals

The Indian government and refinery officials said India was looking for new term crude deals that would make commercial sense.

"There are discussions on a government-to-government (G-to-G) level. We are open to any kind of opportunity and if something is done on a G-to-G level, we would obviously be a part of that," P.K. Joshi, chairman of state-run Hindustan Petroleum Corp. Ltd., said.

"Any opportunity coming in the future of utilizing Russian crude, definitely we will be utilizing that depending on technical and economical requirements."

"It should make sense in terms of freight, insurance, and various factors," he added.

India is also eyeing term crude deals with Brazil, but analysts said high shipment costs, the long sailing period and limited bandwidth with the South American producer to commit plentiful volumes beyond its traditional Asian customers will keep the size of any new term deals relatively small.

While it currently costs less than $4/mt and takes about four to six days to ship crude oil from the Middle East, it costs $15-$20/mt and takes more than 25 days to ship from Brazil to Asian destinations, market sources said.

HPCL officials said they expect crude prices to hover in the range of $105-$115/b in June, and $103-$111/b in the July-September quarter.

-----

Earlier: